German clusters Berlin-Potsdam and Munich are well positioned in a European comparison

Artificial intelligence (AI) is fundamentally changing the design, function, and need for laboratory space in the life sciences, driving demand for next-generation facilities. The trend is to connect traditional wet labs with environments suitable for digital R, such as the ” EMEA Life Sciences Cluster Report 2025” by JLL.

The report highlights how AI is driving change in life science real estate. Laboratory spaces must evolve to enable hybrid research models. This, in turn, requires the presence of flexible units that seamlessly integrate wet laboratories (for biotechnological experiments) and dry laboratories (for mechanical experiments) and directly connected offices for data analysis and computational work. The development reflects the growing convergence of biotechnology and data science, as AI fuels hopes that medicine can be developed much faster and cheaper in the future.

Record investment volume at the start of 2025

This change is being driven by record investments. In 2024, there were 100 deals across Europe with more than 500 million US dollars invested by venture capital (VC) in life science companies specializing in AI. The momentum continues in 2025, with total investment in European life science VCs reaching €3.8 billion in the first quarter – the highest amount ever recorded in the first quarter for the entire life science sector.

Alexander Nuyken, EMEA Head of Life Sciences at JLL, says: “The life sciences real estate market is poised for significant, long-term expansion, driven by the increasing role of AI in laboratory efficiency and drug discovery. AI is no longer just a tool. It’s a catalyst for a new kind of lab – one that’s inherently more digital, collaborative, and adaptable.”

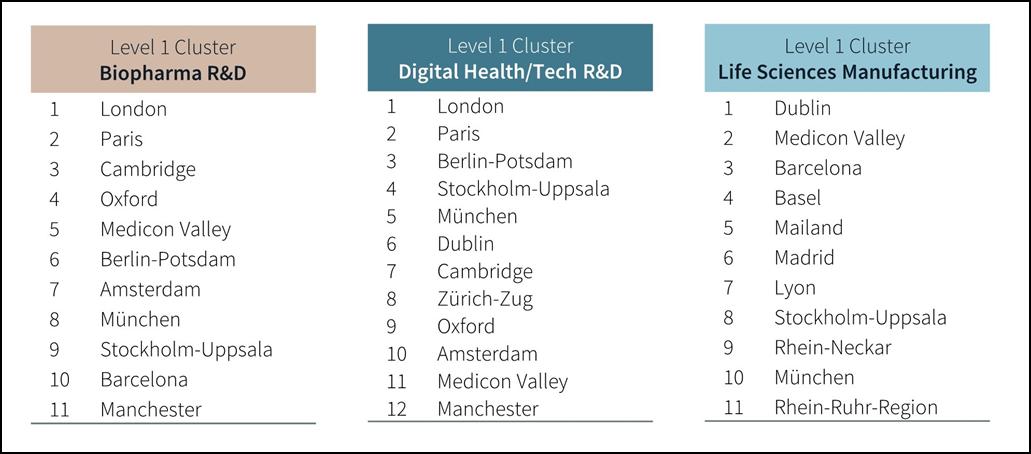

Life sciences companies are often grouped into geographic clusters to provide them with access to research institutions, talent, and other supporting companies. The report analyzes these clusters and finds that they can be broken down into three key areas:

• Biopharma RD (top cluster: Golden Triangle in the UK and Paris)

• Digital Health/Tech RD (top clusters: London and Berlin)

• Pharmaceutical manufacturing (top clusters: Dublin and Medicon Valley)

Stockholm-Uppsala, Medicon Valley and Munich are the only clusters that rank at the top in all categories and have completely balanced ecosystems. These findings show how real estate needs differ significantly by specialization – from lab-intensive biopharma spaces to technology-friendly digital health offices.

The increasing demand for modern, technology-enabled laboratories and the fact that demand is often concentrated in these clusters is leading to a shortage of suitable real estate across the EMEA region. Private laboratory stocks in Berlin, Paris and London are still scarce, although the pipelines could double the stock in the next five years. The projects under construction at six major European hubs account for over 27 percent of the existing supply.

“The VC upswing underscores investors’ confidence in life sciences, but the way of funding has changed,” Nuyken adds. “Capital is increasingly focused on more mature scale-ups rather than early-stage startups. This means that real estate demand is directed towards flexible laboratory real estate, which provides an attractive environment for the recruited talent and supports the perception of the company in the market. World-class locations with strong talent pools and existing laboratory infrastructure are set up to benefit them the most.”

Five German regions hold their own in European competition

The German market is represented in the study’s rankings by four clusters: In addition to those already mentioned in Berlin-Potsdam and Munich, these are the Rhine-Neckar and Rhine-Ruhr regions. While Munich presents the most balanced picture and is placed in all three categories Biopharma (8), Digital Health (5) and Life Sciences Manufacturing (10), Berlin-Potsdam ranks higher – Biopharma (6) and Digital Health (3) – but is not as strongly represented in Life Sciences Manufacturing. Only in this category are the Rhine-Neckar regions in ninth place and Rhine-Ruhr in eleventh place. Hamburg is part of the survey and is analysed in the three categories, but does not make it into the top group overall.

“Munich, with its historically grown ecosystem around the Innovation and Start-up Center Biotechnology (IZB) in Martinsried and Berlin with Bayer, the Charité and a high attraction for talents from the digital sector, offer the most attractive location conditions for life science companies in Germany in an international comparison,” says Alexander Nuyken , classifying the German clusters.