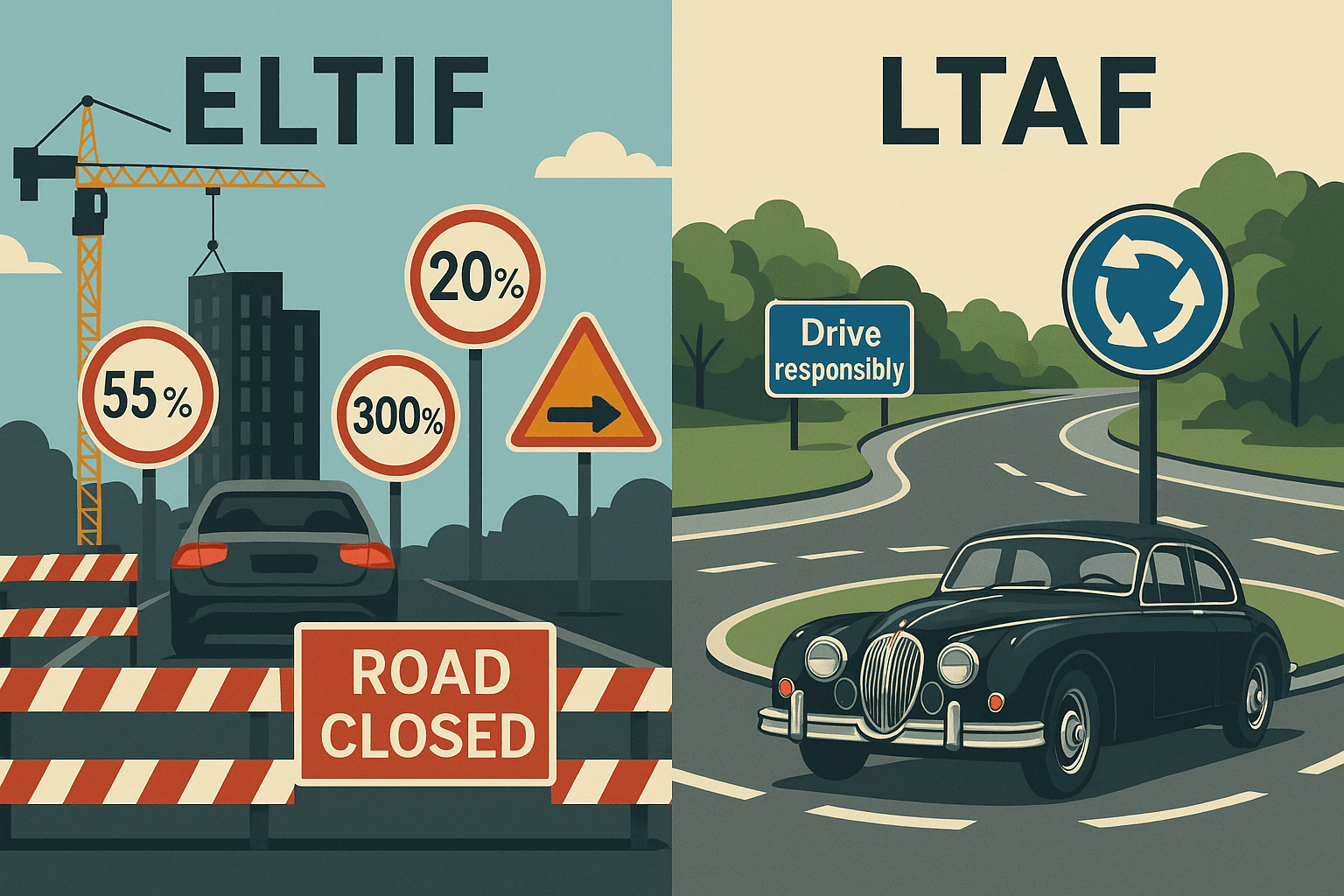

The sales apparatus in Europe has enthusiastically pounced on the ELTIF 2.0. This makes it all the more interesting to look over the fence: With the LTAF, London is showing that retail investors can organise access to illiquid investments in a completely different way.

Retail investors and private markets in Europe and the UK

If politicians want to activate the capital market for the real economy, new fund categories are created. Both Europe and the United Kingdom want to redirect not only institutional but also private capital to private markets. This includes particularly long-term and capital-intensive projects such as infrastructure, for example in the form of renewable energies or private equity. New fund categories have been created for this purpose. In Europe, ELTIF 2.0 is on everyone’s lips (which has already been reported in this column). The ELTIF 2.0 owes this to its reforms, which have made it more manageable. And the sales apparatus has now also pounced on him with full energy. Hardly any panel or specialist article can do without it at the moment. Therefore, apart from the media omnipresence of the ELTIF 2.0, the focus should be consciously on the United Kingdom.

Long-Term Asset Fund (LTAF) from the UK

With the LTAF, there is a fund vehicle in the UK that pursues the same overarching claim as ELTIF 2.0: to mobilise private capital for the real economy, especially for private markets (infrastructure, PE/VC and private debt), even if at second glance ELTIFs place even greater emphasis on European infrastructure and SME promotion. From a regulatory point of view, however, the LTAF is based on a completely different concept than the ELTIF 2.0: the product rules are (even) more flexible than those of ELTIF 2.0, but the sales channels are all the more closely linked to advice.

- Product flexibility LTAF: While ELTIFs also rely on proven product formalism in their 2.0 form, LTAFs are hardly subject to rigid quotas; for example, they do not have to invest at least 70% per se in qualifying assets; and there is more room for borrowing, as long as the LTAFs can justify this with their risk management; the portfolio composition of LTAF is not subject to strict diversification rules as is the case with ELTIFs, but the manager decides on the basis of his or her principle of responsibility.

- Consulting as a gatekeeper at LTAF: Originally, the LTAF issued by the Financial Conduct Authority (FCA) was created as a vehicle only within defined contribution pension plans in 2021 (so-called non-mass market investment). This means that retail investors did not initially have direct access to LTAF. However, due to a subsequent reform in 2023 , sales were opened up further. However, unlike ELTIF 2.0, whose sales specifications are only based on the MiFID II rules, no execution-only distribution is permitted; instead, LTAF must organise distribution to retail investors through regulated and licensed financial advisors.

This is where the difference in regulatory philosophies becomes apparent:

- ELTIF: Formally strictly regulated, but without a specific consultation process. If you click, you invest.

- LTAF: Flexible in product, but strict in access. No investment without specific advice. Retail investors must have the product explained to them in detail beforehand and also familiarize themselves with the illiquidity of the investment in this context.

Results

- Despite being more flexible, the European ELTIF 2.0 still embodies the European regulatory approach of the Detailed Regulation, and the British LTAF relies much more on British pragmatism and relies more on advisory responsibility in the sales channel.

- The real test for ELTIF 2.0 and LTAF has yet to come, as it does not lie in sales success, but in long-term investor satisfaction.

- LTAFs could benefit from investor satisfaction downstream of distribution by providing retail investors with a better understanding of the illiquidity of investments in the form of financial behavior, which could lead to fewer complaints later in the cycle.