The energy efficiency classes of commercial real estate in Europe are only comparable to a limited extent. Savills points this out in a recent article as part of the Impacts publication series.

The international real estate consulting firm cites the major differences in national and regional regulations on energy performance certificates (EPCs) as the cause. Even between EU countries, this can mean that a commercial property that receives the top grade in one country can be rated up to four grades lower in another.

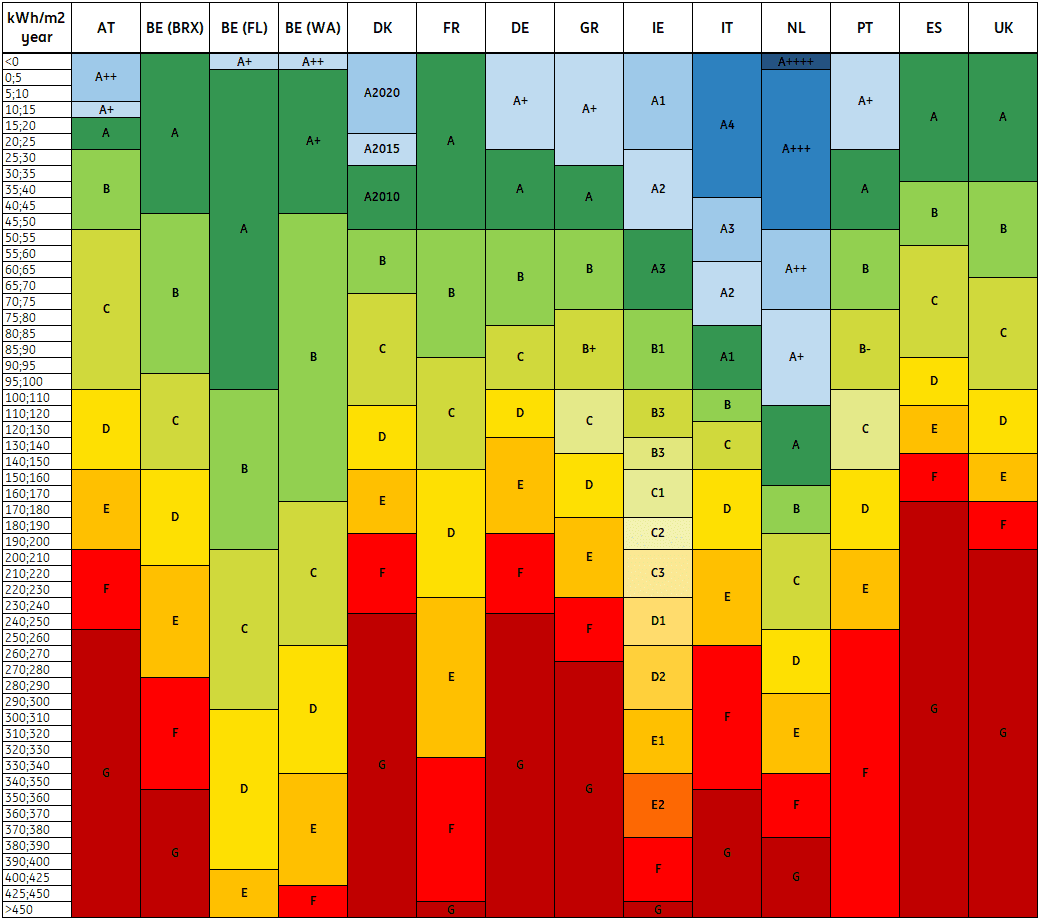

Savills explains that a deficiency in the standardisation of energy labelling can sometimes even occur within individual countries. In Belgium, for example, the same energy performance (in kWh/m²/year) would receive a “C” in the Flemish region, but a “D” or “F” in Brussels – due to stricter rating thresholds in the Brussels-Capital Region. The standards for the classification of primary energy consumption of commercial real estate also vary across Europe, making them difficult to compare with buildings in other countries. For example, a primary energy consumption of a commercial property rated “A” in the Netherlands would be classified as “D” or “E” in Germany.

Although the EU is implementing a revised Energy Performance of Buildings Directive (EPBD), which is intended to bring countries closer into line in their area of responsibility, deviations within individual states are likely to continue. The reasons for this are local political sensitivities, technical challenges, climate risks and the nature of the existing building stock, which mean that sustainability standards vary significantly from city to city.

Chris Cummings, Founding Director of Savills Earth, comments: “The lack of standardisation of energy efficiency classes within the EU and the UK, which also uses the EPC as the main measure of building performance, highlights a larger global problem: it is unclear to cross-border investors and tenants what constitutes a ‘good’ building. If there are already such differences within the same economic area, how can comparisons be made across even larger regions such as the Asia-Pacific region (APAC) or the USA? Ideally, investors and occupiers should look beyond the EPC classification to look at a building’s actual energy data to get a realistic picture of its relative performance. Otherwise, they risk excluding buildings in countries with ‘stricter’ EPC regimes because of a lower grade and thus missing their sustainability goals – only to subsequently choose a property with a higher grade in another country that ends up performing worse.”

Sarah Brooks, Associate Director, Savills World Research, says: “Differences in sustainability standards between real estate markets bring specific challenges and opportunities for occupiers and investors. In their strategies, they must take into account differences in local policies, market expectations and available incentives. Competitive advantage is often gained by exceeding national requirements while adapting to city-level expectations and long-term local sustainability plans. Differentiated due diligence is crucial here.”