· Decreased: annual result below previous year’s figure.

· Increase: Supply reserve grows.

· Quality remains in demand: Prime rents are rising again.

Challenging conditions are slowing down market dynamics.

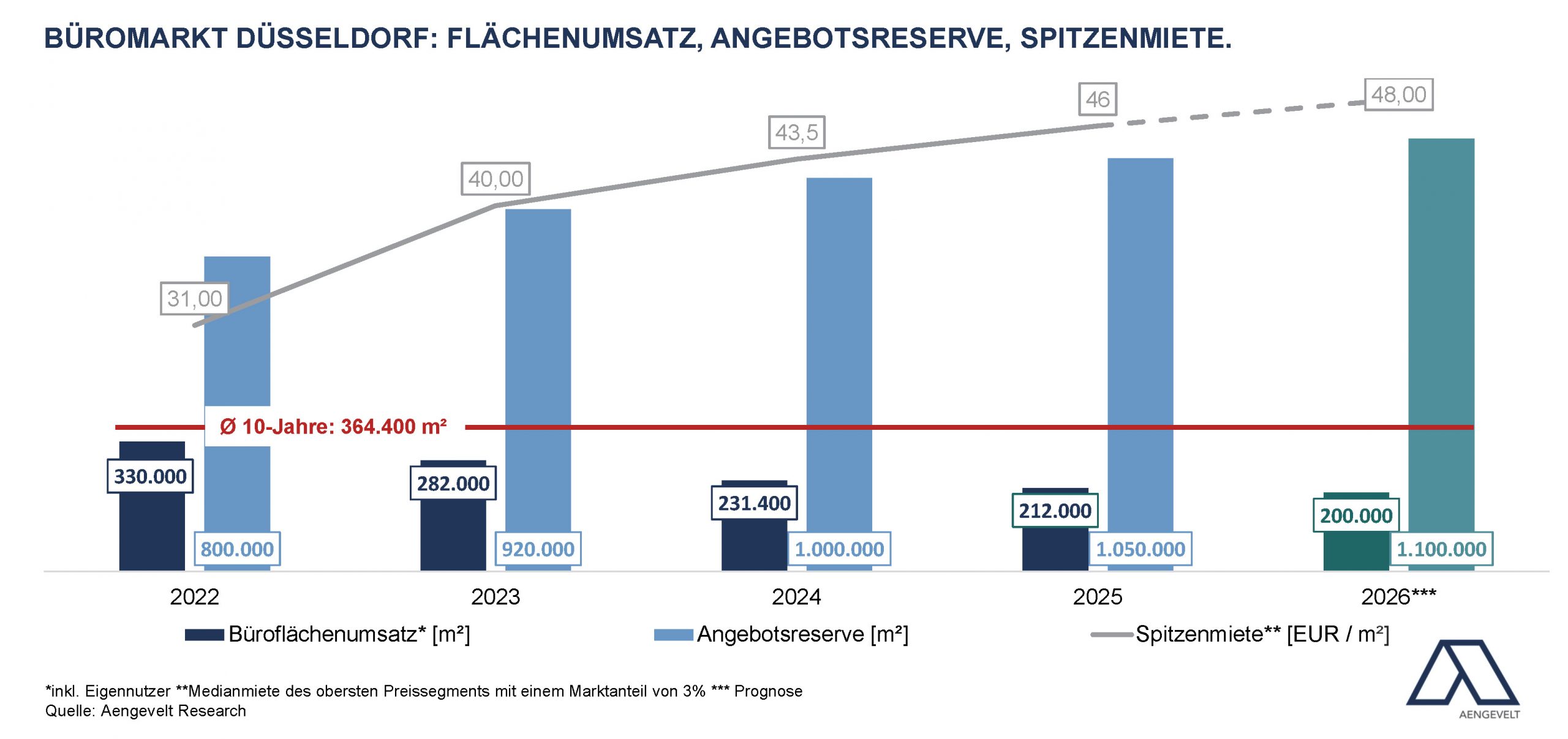

- According to analyses by Aengevelt Research, the office market in the Düsseldorf region (including Neuss, Ratingen, Erkrath, etc.) achieved office space take-up (including owner-occupiers) of around 212,000 m² in 2025 as a whole. Compared to the previous year (2024: 231,400 m²), this represents a decline of approx. 8 %. Compared to the decade average (Ø 2015 – 2024: 364,400 m² p.a.), it is around 42% less.

- Of the total take-up in 2025, around 201,000 m² will be accounted for by the Düsseldorf city area (2024: approx. 201,400 m²) and around 11,000 m² by the surrounding area (2023: approx. 32,000 m²).

- For 2026 , Aengevelt Research forecasts a further moderate decline in office space take-up of 200,000 m².

“In view of the difficult economic conditions, many companies are trying to save costs. Accordingly, they currently often prefer to remain at their previous location and try to negotiate lower rental costs with their landlords as part of lease extensions. Especially in the case of older existing properties, there is also a fundamental willingness on the part of landlords to do so, as the threat of vacancy is not easy to re-let in the current market phase,” explains Christoph Mooren, Head of the Commercial Leasing Team at Aengevelt in Düsseldorf, adding: “Against this background, there were lease extensions in the six-digit square metre range in Düsseldorf in 2025, which, however, are not counted as office space take-up.”

Supply reserve continues to rise.

- As many companies and office users have postponed or even downsized planned space expansions, the increase in the supply reserve available at short notice (ready for occupancy within three months) has continued and will amount to around 1.05 million m² at the beginning of 2026 (beginning of 2025: around 1 million m²).

- The vacancy rate increased accordingly from 10.5% to around 11.0% of the total stock of around 9.54 million m².

- For 2026 , Aengevelt Research forecasts a further moderate increase in the supply reserve to around 1.1 million m². The focus of vacancy continues to shift to older, energy-suboptimal existing properties.

Increasing office space completion.

- In Düsseldorf, new construction activity averaged around 79,500 m² p.a. between 2015 and 2024, and in 2024 it was only around 70,000 m².

- In 2025, the volume of new construction increased significantly to around 122,000 m² (2024: 70,000 m²) and in 2026 around 100,000 m² is possible according to the current status.

Significantly increased prime rent.

- After the significant jump in prime rents in 2023 from EUR 31/m² to EUR 40/m², the rental momentum in Düsseldorf continued and currently peaks at EUR 46/m², while the median rent in city locations remains stable at around EUR 25/m² .

- For 2026 , Aengevelt Research forecasts a further increase in prime rents to around EUR 48/m². Christoph Mooren comments: “The driver of this development is the continuing high demand for modern, ESG-compliant office space in premium locations. Here, the high-quality project developments in the vicinity of Königsallee have a particularly formative effect.”