Savills examines the real estate investment market in Berlin:

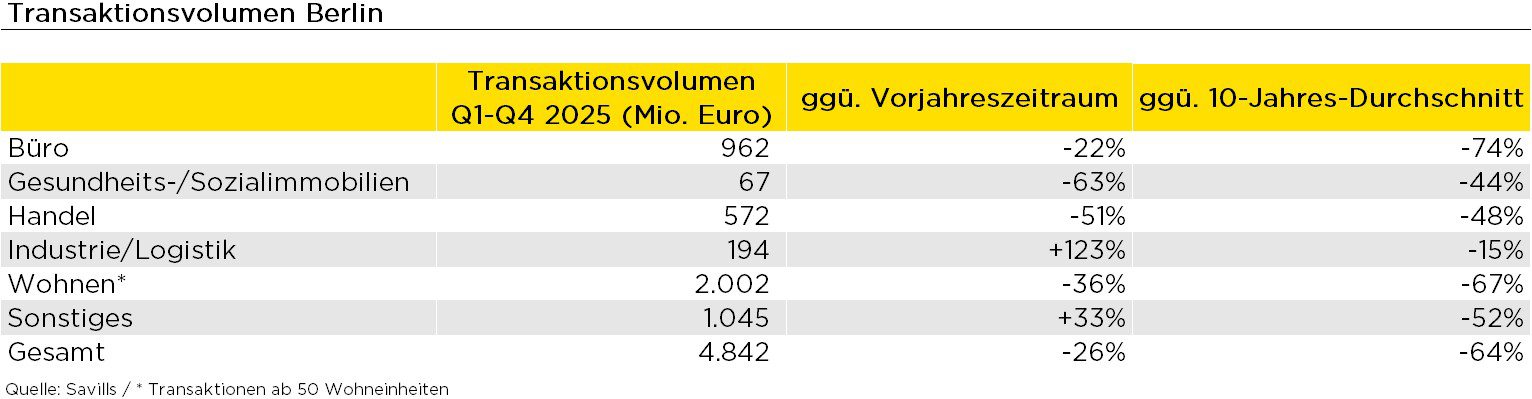

According to Savills, around 4.8 billion euros were turned over in the Berlin real estate investment market in 2025. Compared to the previous year, this corresponds to a decrease of 26%. Compared to the 10-year average, sales were even 64% lower. In the last twelve months, Savills has registered just under 80 transactions, an increase of 11% compared to the previous year. Prime yields for offices and commercial buildings were 4.4% each at the end of December. The prime yield on commercial buildings is thus unchanged from the previous quarter and also unchanged from the previous year’s figure, while the prime yield on offices fell 10 basis points compared to the same quarter last year.

Prof. Dr. Tayfun Erbil, Director Investment at Savills in Berlin, comments on the market as follows: “The environment on the Berlin real estate investment market has moved very slowly over the last year. Stabilized prime yields and increasing transaction evidence create trust and provide a revival in some areas, but many processes continue to drag on significantly. The main reason for this is ongoing uncertainties on the letting side, especially for office properties. Investors calculate their rental assumptions very defensively, so that the price expectations of some sellers are not met and some transactions fail. In contrast to the final phase of the zero interest rate period, in which rising purchase price factors overshadowed risks, the classic core real estate industry factors have once again come into focus. Location, building quality and rentability are intensively examined, which lengthens the decision-making processes. However, since numerous sales processes have not been concluded, there are indications of a comparatively strong first quarter in terms of sales for the current year.”

With a transaction volume of EUR 2.0 billion, residential real estate* has contributed the most to investment turnover in the last twelve months, followed by office properties (approx. EUR 0.96 billion) and retail properties (approx. EUR 0.57 billion).

* Only properties with at least 50 residential units

Additional graphics and data can be found in our online dashboard on the real estate investment market