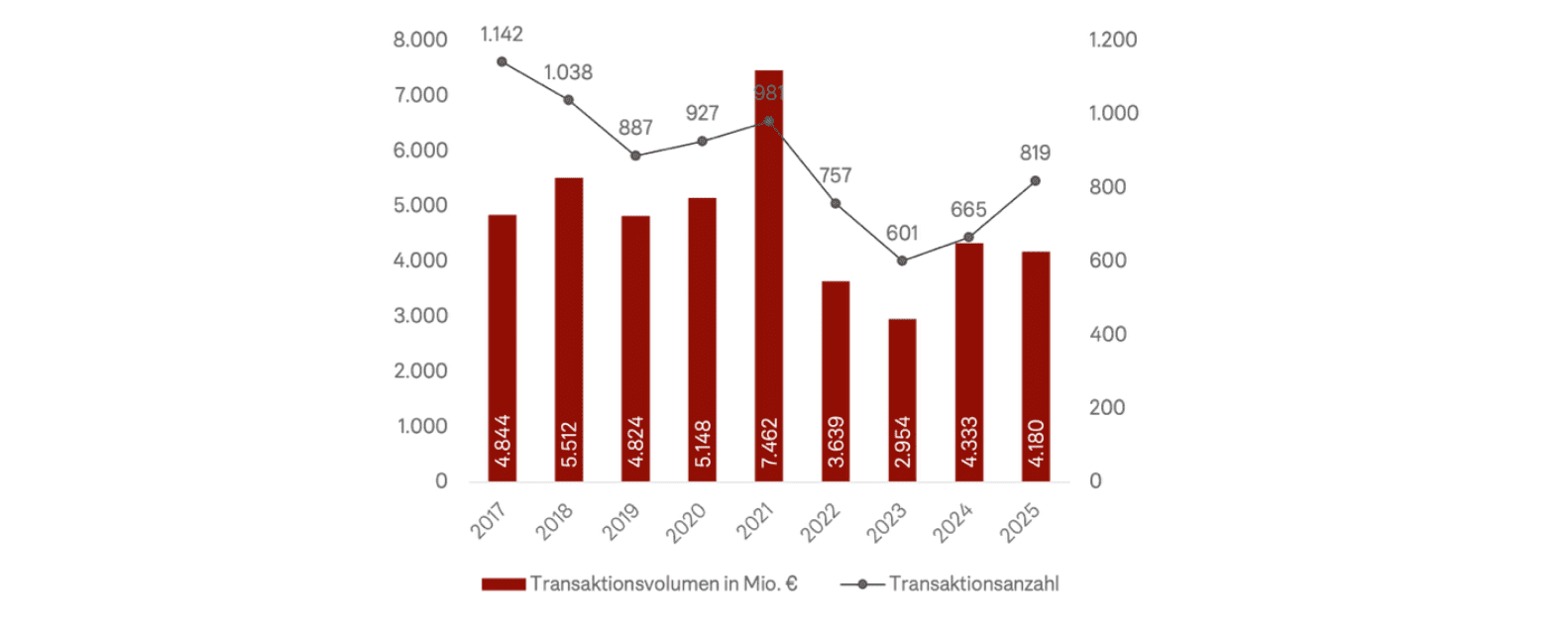

Berlin’s residential investment market was significantly revived in 2025. Although the transaction volume of 4.18 billion euros was almost at the previous year’s level (2024: 4.31 billion euros), market activity increased noticeably at the same time. A total of 819 transactions were registered, an increase of 23 percent compared to the 664 sales in 2024. 2025 marked another high point in the focus on the residential asset class. While office and retail properties continue to face structural challenges, residential real estate is gaining in importance across all sectors – even among market participants who have so far been primarily active in other segments.

Transaction volume and number of residential investment market 2017 – 2025

Portfolio market under scrutiny: Demand high, deals selective

Portfolio market under scrutiny: high demand, selective trades

The lesser importance of large-volume transactions in total volume is less an expression of a lack of demand than a result of structural shifts on the seller and buyer side. The majority of listed portfolio holders have already completed the necessary portfolio adjustments in 2024. At the same time, several extensive residential portfolios were being marketed in 2025, but most of them were not completed. The processes were characterized by intensive scrutiny, especially with regard to ESG risks, capex requirements and exit capability. In several cases, the deal failed at an advanced stage, often due to the withdrawal of equity partners. The result: fewer notarized major transactions, even though demand was high. A significant part of the portfolio processes initiated in 2025 are still in advanced phases and are expected to be notarized in the first half of 2026. Others will be continued in partial sales or individual marketing.

Individual properties up to 20 million euros as carriers of market revival

Individual properties up to 20 million euros as drivers of market recovery

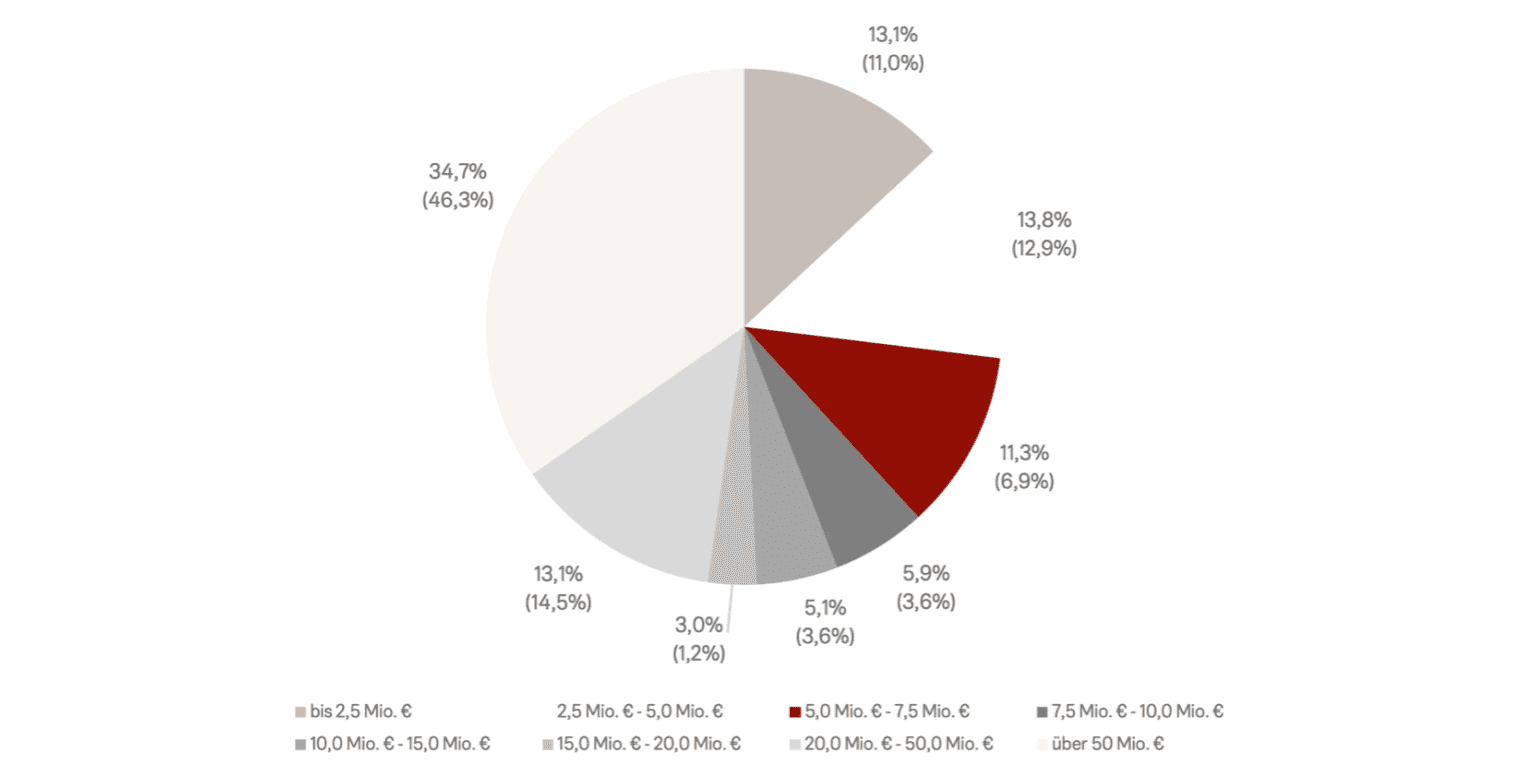

Individual transactions of up to 20 million euros – the classic Berlin apartment building market – showed a significant revival in 2025. The transaction volume in this segment amounted to around EUR 2.18 billion, which was about 28% higher than the previous year’s figure. The market confirmed a largely constant price level. After the correction of previous years, no further downward trends can be observed, while demand has picked up noticeably.

The increased activity continues to meet selective and demanding testing processes. Buyers act in a disciplined manner, financing is carefully structured, and investment decisions follow clear economic criteria. It is precisely this combination of higher demand and unchanged critical selection that speaks for an increasing stabilization of the market.

The development is supported by a broad diversification across small and medium-sized ticket sizes. The majority of transactions are for volumes of up to 7.5 million euros, while larger individual trades remain rarer. The market does not grow through individual outliers, but through functioning individual transactions with realistic prices.

“The Berlin apartment building market once again proved its resilience in 2025,” says Benjamin Rogmans, Managing Director and Head of the Residential and Commercial Buildings Division at Engel & Völkers Commercial Berlin. “Pricing, financing and demand are back in a healthy relationship.”

Transaction volume by purchase price cluster residential and commercial buildings in Berlin

Results from the transactions advised by Engel & Völkers Commercial

Results from the transactions

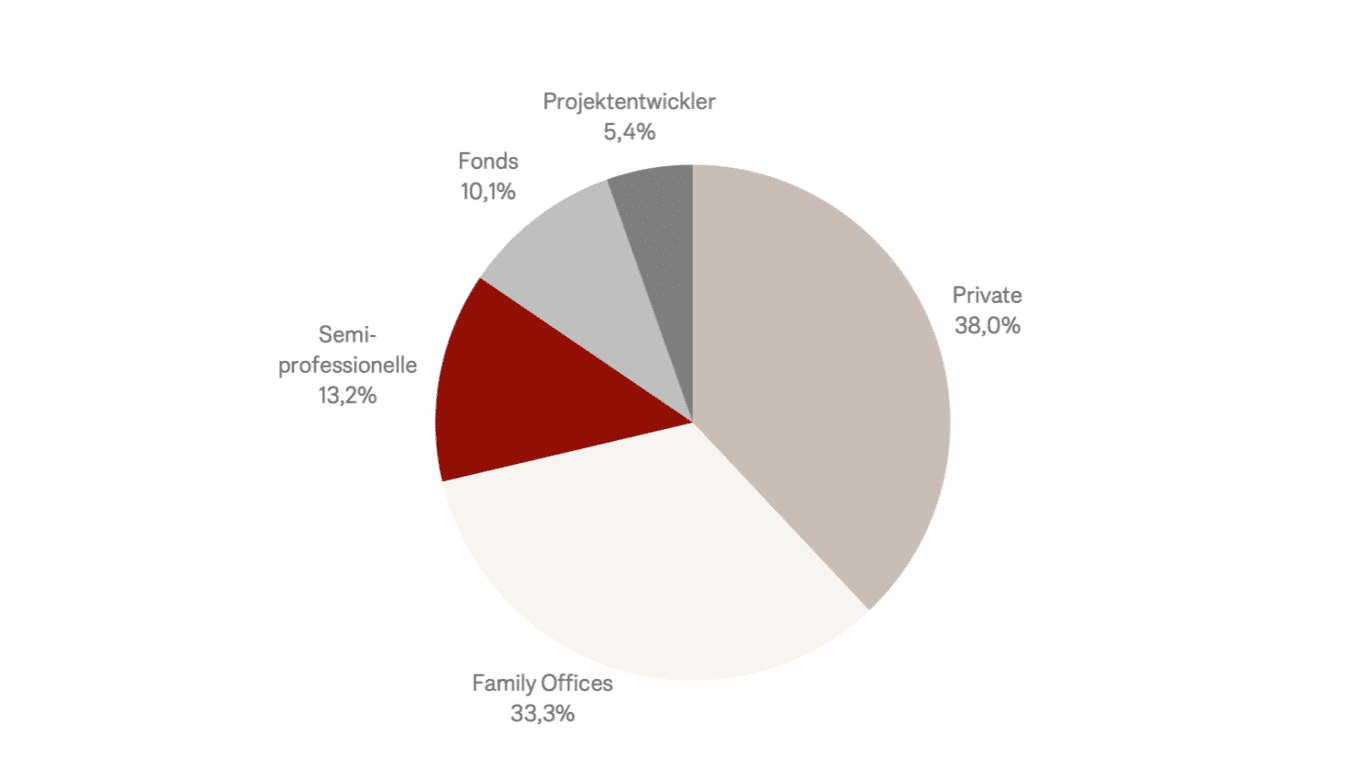

supported by Engel & Völkers Commercial In addition to the official market data, the transactions supported by Engel & Völkers Commercial Berlin provide a glimpse of specific market developments. The basis is 128 residential and commercial building sales completed in 2025, from which statements on buyer and seller structures can be derived.

Shift in the buyer structure

Shift in the buyer structure

While the price level was largely stable in 2025, the buyer structure changed significantly. The market was increasingly dominated by professional and semi-professional investors. Family offices and institutional buyers have noticeably expanded their market shares, so that around half of all buyers can now be assigned to this segment.

At the same time, international demand also increased significantly. The share of foreign buyers doubled compared to the previous year. Overall, this development speaks for a return of experienced investors who are working on the Berlin market selectively, strategically and with clear investment theses.

Buyer structure WGH Markt Berlin

Seller structure and holding period

Seller structure and holding period

On the seller side, private owners continued to shape market activity and accounted for around 70% of the deals. The long holding period of the sold properties is striking. Almost 80% of residential and commercial buildings had been owned by the sellers for more than ten years, almost half for more than 20 years. The sales motives were predominantly strategic in nature. The focus was on portfolio adjustments and age-related decisions by long-standing owners. In addition, there was the dissolution of communities of heirs and targeted liquidity procurement, and in some cases also tax reasons in connection with inheritances. On the other hand, there were hardly any indications of emergency-driven sales or structural selling pressure.

Looking ahead to 2026

Looking ahead to 2026

There are signs of a further revival of Berlin’s residential investment market in 2026, albeit under unchanged auspices. Market activity is likely to increase above all where realistic prices, resilient properties and viable financing concepts come together. While small and medium-sized units continue to form the core of transactions, the large-volume segment is expected to see increasing movement, especially in structured portfolio approaches. “The market continues to normalize,” says Rogmans. “Deals are concluded where economic logic and market price are congruent again.”