Take-up exceeds previous year’s level by up to 30 per cent

The German industrial and logistics real estate market generated take-up of around 2.9 million square metres in the first half of 2025. This corresponds to an increase of 12 percent compared to the previous year. Around 56 per cent of take-up was achieved in the second quarter. The distribution of deals differs regionally, but in total, more than half of the deals took place in existing properties (57 percent). In particular, smaller areas of up to 3,000 square metres were rented in existing properties (72 per cent), while deals over 10,000 square metres were mainly in new-build areas (72 per cent).

Top 8 markets exceed previous year’s level

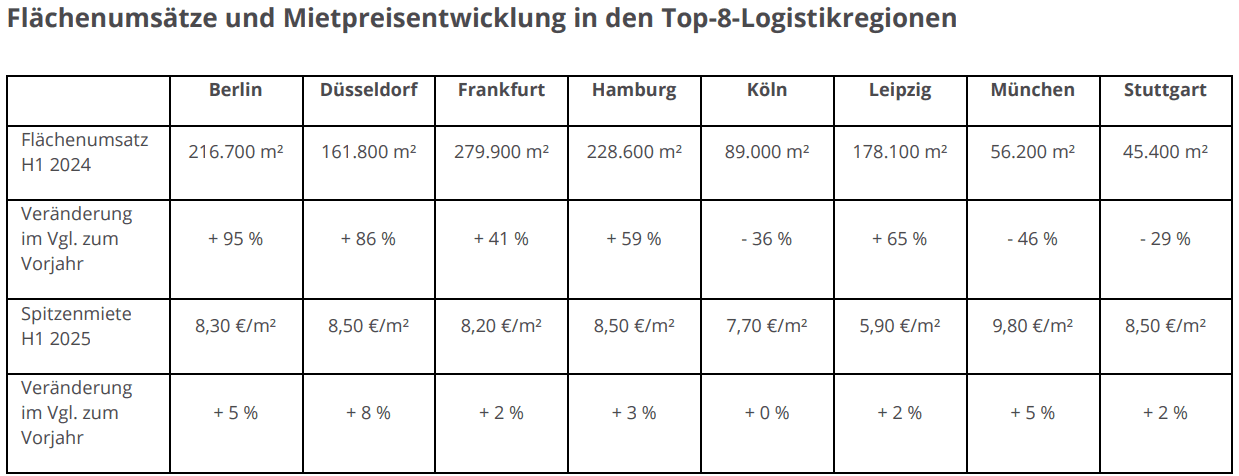

The top 8 industrial and logistics real estate markets accounted for 43 per cent of total take-up in Germany and achieved take-up of around 1.3 million square metres in the first half of 2025. The result corresponds to an increase of 31 percent compared to the same period last year and is only 3 percent below the five-year average.

Steffen Sauer, Head of Industrial & Logistics Letting at Colliers in Germany: “The overall positive result on the rental market is mainly due to the noticeably higher momentum in the second quarter. At the same time, the number of trades in the first half of 2025 remained almost the same at 256 compared to the same period last year (257). As a result, more deals have taken place in the large-scale area again, which has increased the average size per deal and currently stands at around 4,900 square meters. Even though demand and the willingness of entrepreneurs to make decisions are still somewhat subdued overall, we see that inquiries are rising slightly again in both the light industrial and big box sectors.”

Five of the top 8 regions recorded an increase in take-up compared to the previous year, thanks to a number of large-volume deals. Frankfurt achieved the highest take-up with 279,900 square metres and contributed 22 per cent to the overall result of the top 8 markets. Thanks to a large owner-occupier deal in the second quarter, the Berlin market recorded the strongest year-on-year increase in take-up (+95 percent). Although Munich showed the most noticeable decline in take-up (-46 per cent), letting take-up was exceeded by 26 per cent.

As in previous quarters, the focus of the users was primarily on the space segment of 1,000 to 3,000 square meters. Around a third of all deals were concluded in this area, but this accounted for only 12 percent of take-up. Although deals over 10,000 square metres accounted for only 11 per cent of the take-up, they were responsible for almost half of take-up. It is noteworthy that in Berlin and Leipzig, deals in the large-volume sector only took place in the new construction segment. This is mainly due to the good availability of space in the new-build segment in these regions. The largest deal took place in the logistics region of Berlin. This is Netto’s owner-occupier settlement in Kremmen, where a logistics facility of around 60,000 square metres is being built. The largest letting took place in the Leipzig logistics region. A logistics service provider rented 50,000 square meters there in a logistics hall under construction.

The strongest user group in the first half of 2025 was logistics service providers with a share of 40 percent of total take-up, followed by retail companies with 26 percent and the manufacturing industry with 19 percent.

“Every quarter, we observe the neck-and-neck race between retail companies and logistics service providers who demand similar properties. We are currently seeing attractive project developments in some regions that are interesting for both user groups. In recent months, logistics service providers in particular have been able to secure more large-volume contracts. By the end of the year, however, we expect retail companies to gain more shares again. We are currently registering a significant increase in demand from Asian companies, especially from the e-commerce sector. This will have a relevant impact on the letting activity until the end of the year,” adds Sauer.

Average rents are growing faster than prime rents

The top 8 logistics regions recorded an average year-on-year rental growth of 3 percent for prime rents and 5 percent for average rents. At 9.80 euros per square metre, Munich continues to have the highest prime rent. In second place are the locations Düsseldorf, Hamburg and Stuttgart, which are among the second most expensive locations at 8.50 euros per square metre each. The rent growth of 8 percent in Düsseldorf indicates that it will overtake the other locations by the end of the year.

“Rental growth across all top 8 locations has slowed down in the last two years. Since the fourth quarter of 2024, however, we have seen a stabilization of rental growth at an average of 3 percent for prime rents and 5 percent for average rents. However, due to attractive incentive packages of up to one month rent-free per lease year, the rents are effectively lower overall. The economic uncertainties have led to less predictability for orders from logistics service providers and manufacturing companies, so we are seeing an increase in demand for leases in the short to medium term. In locations such as Düsseldorf and Frankfurt, we will continue to see rental growth potential in the coming months, triggered by the continued high asking rents. In the Berlin and Leipzig regions, it is first necessary to absorb part of the large supply of space in order to enable further rent growth. This shows that the regional view is particularly important,” Sauer concluded.

We are currently registering a significant increase in demand from Asian companies, especially from the e-commerce sector. This will have a relevant impact on leasing activity until the end of the year