According to Colliers, real estate was traded for 23.7 billion euros in Germany in the first three quarters of 2025. Of this, 17.2 billion euros were accounted for by commercial real estate and 6.5 billion euros by the institutional residential segment of ten residential units or more. The residential sector contributed to the slight decline in transaction volume of 2 per cent compared to the same period last year with a contraction of 7 per cent, while the commercial sector was able to repeat its nine-month result of September 2024.

Commercial real estate achieved the strongest three-month result of the year in the third quarter at just under 6.3 billion euros. The number of transactions increased by 5 percent between January and September compared to the previous year, which indicates that there is still no significant shift towards larger ticket sizes in terms of the size structure of the deals. Unchanged from the previous year, 90 percent of all deals in the segment under 50 million euros take place. The volume-related market share in this segment increased by 6 percentage points to 48 percent.

Francesca Boucard, Head of Market Intelligence & Foresight at Colliers: “The investment market continues to be in a transformation phase in which institutional investors are faced with complex, sometimes rapidly changing geopolitical and economic developments. The ongoing uncertainty continues to be clearly reflected in the lack of large-volume transactions. However, confidence in real estate investments is gradually returning, as the latest results of the Real Estate Climate Index confirm, for example, across almost all types of use. The consolidation of the trend towards the 100-point mark, which stands for positive market sentiment, reinforces our belief that the way is paved for a gradual pick-up in market activity.”

Commercial segment with trend-setting transactions and market placements

Michael R. Baumann, Head of Capital Markets Germany at Colliers, adds: “Confirmation of a gradual market recovery can also be found in some trend-setting transactions that we have seen in the current quarter. After all, since the beginning of the year, more than half of the 25 deals with a minimum volume of 100 million euros or 42 percent of the transaction volume have been accounted for in the third quarter.”

The largest transaction of the quarter is the Helix portfolio from the German Logistics Fund, comprising twelve logistics properties, which was sold by Nuveen and Palmira to the US investment company Starwood Capital for around EUR 350 million. A remarkable single deal, which also changed hands after a lengthy transaction process, is the Gropius Passagen shopping centre in Berlin. It was transferred to the British investor Hayfin Capital for around a quarter of a billion euros. These major deals contributed to logistics real estate remaining in second place with a 23 percent market share and retail assets in third place with 22 percent among the most sought-after types of use.

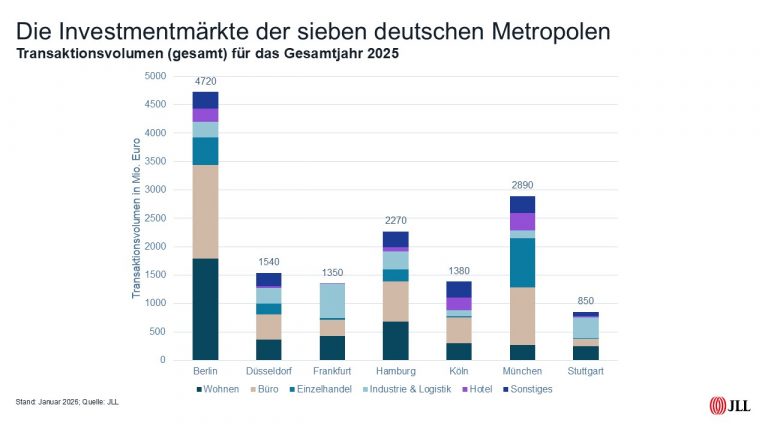

Office properties regained the top position with 24 percent of the transaction volume. With the sale of the Edison-Höfe in Berlin and the Atlantic Haus in Hamburg, at least some transactions in the low three-digit million euro range were registered in the TOP 7 markets. However, with the absence of major lighthouse transactions, the market volume of the seven major investment centres remained below average at 38 per cent in relation to the German market as a whole.

Baumann continues: “Investors are increasingly recognizing that the market phase in the core sector can hardly be more attractive than it is at the moment in terms of availability and pricing. A growing interest in current trophy objects such as the Opera Tower in Frankfurt testifies to this. Foreign investors in particular recognize the opportunities and assess the framework conditions on the German market much more positively than domestic investors. Foreign capital accounts for 44 percent of the transaction volume, and in the category above 100 million euros, the figure is as high as around two-thirds. There is also support for a return of core investments from the financing side. Although financing options and conditions remain limited overall, selective competition between banks can be observed in the financing of crisis-proof products.”

Operator properties in demand as investments

The high share values of healthcare real estate and hotels at 8 percent each in a long-term comparison are also striking. In the care segment, the consolidation of the operator landscape under increasing cost pressure is a driver for mergers and acquisitions. Meanwhile, in the hotel sector, the good fundamentals in Germany, in particular the record number of overnight stays and rising bed occupancy, are a decisive argument for the increasing number of transactions. With the takeover of 22 facilities of the insolvent Argentum Care Group and the Keystone hotel portfolio, two major deals of over 100 million euros were registered. Despite the package sales mentioned above, portfolio trading remains rather restrained with a market share of 24 percent.

Asset managers are once again intervening more strongly in the transaction process

Asset and fund managers are once again more active for professional real estate investors and, with a market share of 24 percent, have relegated corporates and owner-occupiers (18 percent) as well as private investors (16 percent) to the top spot as the most important buyer group. In addition to project developers (19 percent), the seller side is dominated by corporates and owner-occupiers (18 percent) as well as asset and fund managers (17 percent).

Prime yields remain stable, further yield increases expected in the non-core segment

The yield and interest rate environment, which has only changed gradually, has had no influence on prime real estate yields in the last three months. Prime yields in the German TOP 7 investment markets continue to range from 4.50 percent in Munich to 5.00 percent in Düsseldorf and Cologne in the office segment. The fall below the 5 percent mark in individual cases is usually linked to the acquisition by private investors with strong equity. Selective financing and higher financing costs will weigh on the financing of non-core assets in particular and lead to further price discounts. High construction and capex costs are also weighing on investment strategies in the portfolio.

Outlook: Transaction volume expected to be at previous year’s level without year-end rally

Baumann: “The real estate market is characterised by a consolidation of transaction activity at the previous year’s level, so that we are sticking to the June forecast in the region of EUR 25 billion in the commercial real estate segment at the end of the year. Even a stronger final quarter in terms of sales will not be able to do much about this, even if some transactions in the again quite well-filled pipeline in the TOP 7 should be completed before the end of the year. In view of lengthy sales negotiations, it remains difficult to predict the probability, timing and pricing of the deal.”

Boucard adds: “Moderate economic forecasts do not necessarily fuel long-term investment decisions. We see progress in market recovery into 2026, but not yet a pronounced cyclical upswing.”