Cologne real estate investment market

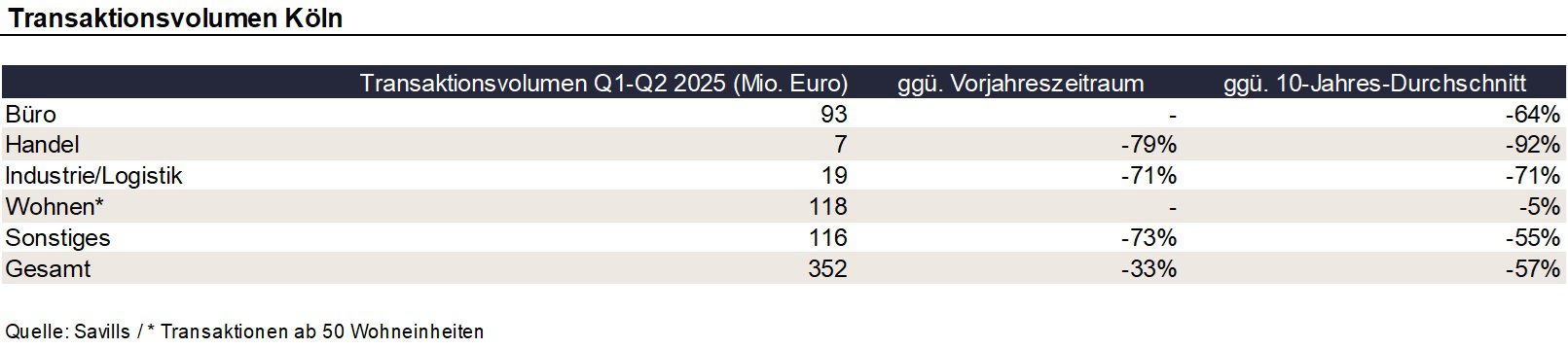

According to Savills, around 352 million euros were turned over on the Cologne real estate investment market in the 1st half of 2025. Compared to the same period last year, this corresponds to a decrease of 33%. Compared to the 10-year average, sales were even 57% lower. In the last twelve months, Savills has registered just under 30 transactions, which is a decrease of 26% compared to the same period last year. Prime yields for offices and commercial buildings were both 4.4% at the end of June, unchanged from the previous quarter and also unchanged from the previous year’s figure.

Tobias Schneider, Director Investment at Savills in Cologne, comments on the market as follows: “The number of properties for sale is increasing noticeably. Many potential sellers have now adjusted to the new price level and are willing to sell at adjusted conditions – even in the segment of top office properties, which was previously hardly represented on the market due to sharp price declines. With the increasing density of offers, the transaction volume is likely to increase in the second half of the year, even if not every property will find a buyer. Properties outside prime locations in particular are likely to have a hard time, as investors continue to focus on high-quality locations.”

With a transaction volume of EUR 400 million, office properties have contributed the most to investment turnover in the last twelve months, followed by residential properties* (approx. EUR 130 million) and industrial/logistics properties (approx. EUR 70 million).

Against the backdrop of increasing willingness to sell and more realistic price expectations of many owners as well as the growing number of active investors, Savills expects a gradual increase in transaction activity in the future.

* Only properties with at least 50 residential units