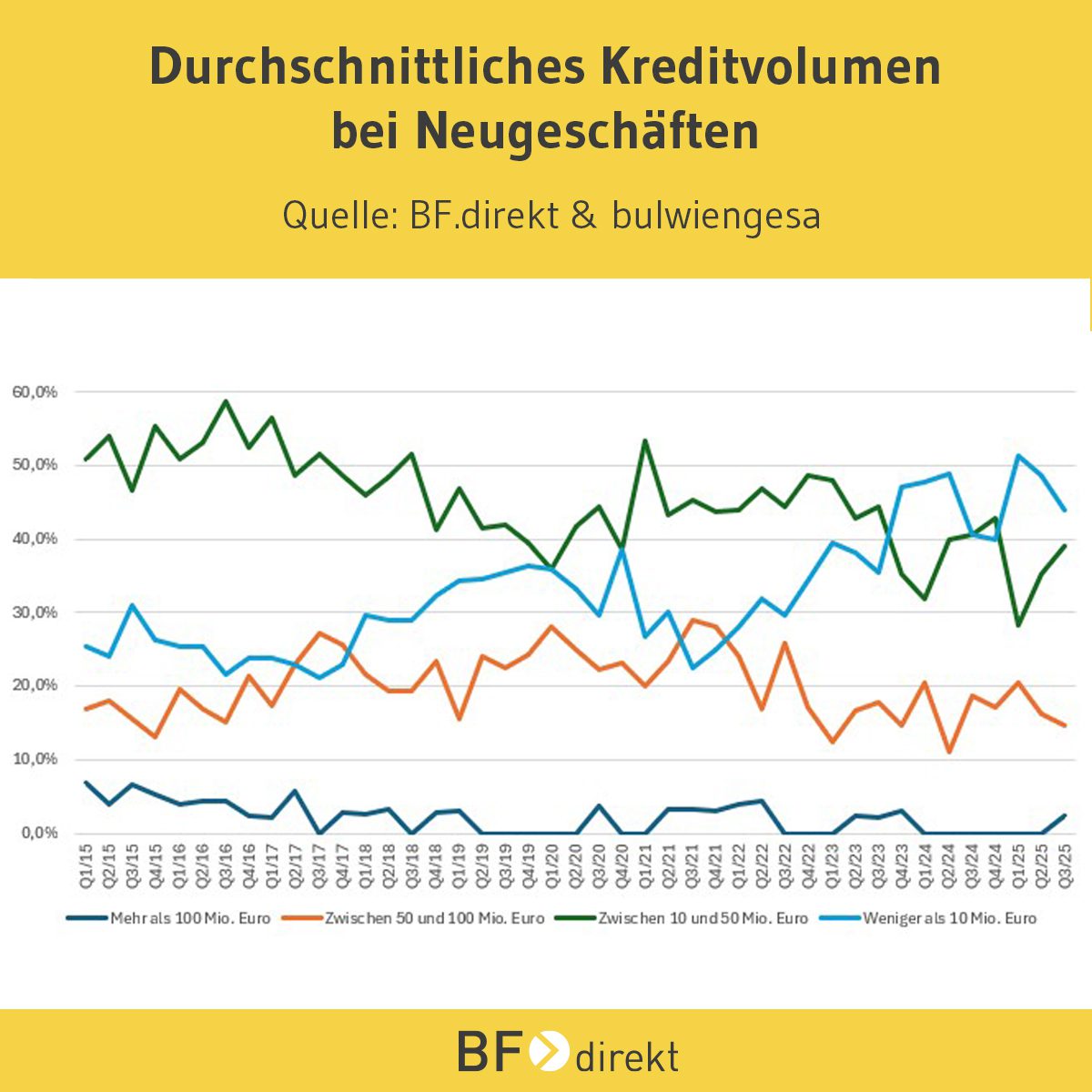

Loan volumes in commercial real estate financing have become smaller on average over the last ten years. In the first three quarters of 2025, almost half of those surveyed said that the average loan volume in new business was less than EUR 10 million. In contrast, major transactions of more than 100 million euros have almost completely disappeared from the statistics.

The results in detail: Respondents are asked to indicate the credit volume of the average individual business – in relation to new business – on a quarterly basis. The most striking development over the last ten years is the increase in small financing. In 2015 and 2016, for example, only around 25 percent of the panel stated that the average financing was less than 10 million. This figure rose to around 45 percent in 2024 and 2025 – an increase of around 20 percentage points.

In contrast, the next largest category – financing with a volume of EUR 10 million to EUR 50 million – declined. For example, while in 2015 and 2016 53 percent said that the average new business was in this area, in 2024 and 2025 it was only 37 percent. This corresponds to a decline of 16 percentage points.

In contrast, the size category of 50 to 100 million euros developed stably. The proportion of institutions that were active in this category on average was around 17 percent in 2015 and 2016 as well as in 2024 and 2025.

According to BF. Quarterly barometers have always been rare, but until the first quarter of 2019 they were regularly included in the evaluation in the single-digit percentage range. Since then, however, the value has increasingly been zero – this means that the average of new financing is no longer in the range of more than 100 million euros for almost any of the respondents.

Francesco Fedele, CEO of BF.direkt AG, comments: “The decline – especially since 2022 – naturally coincides with the more difficult market situation. Since then, we have seen a decline in transactions overall. An important issue in this context is cluster risks. Not only real estate companies shy away from them in their transactions, but also real estate financiers. This is reflected in the long-term evaluation of the BF. quarterly barometer.”

Prof. Dr. Steffen Sebastian, Professor of Real Estate Finance at the IREBS University of Regensburg and scientific advisor to the BF. Quarterly Barometer, adds: “One of the reasons for the increase in small-scale financing is the fact that large-volume financing has increasingly been provided by banking syndicates in recent years. Institutions have become more risk-averse and syndicated financing offers the opportunity to avoid large cluster risks on one’s own balance sheet.”

The BF. Quarterly Barometer is regularly compiled by bulwiengesa on behalf of BF.direkt AG. There, financiers are asked quarterly what loan volume the average individual business currently achieves. The question refers explicitly to new business and also includes extensions and – if syndicated financing is involved – the share of the surveyed institution in the financing.

Methodology

The BF. Quarterly barometer is compiled by the analysis company bulwiengesa AG on behalf of BF.direkt AG, a specialist in the financing of real estate projects. The index comprehensively reflects the mood and business climate of real estate financiers in Germany.