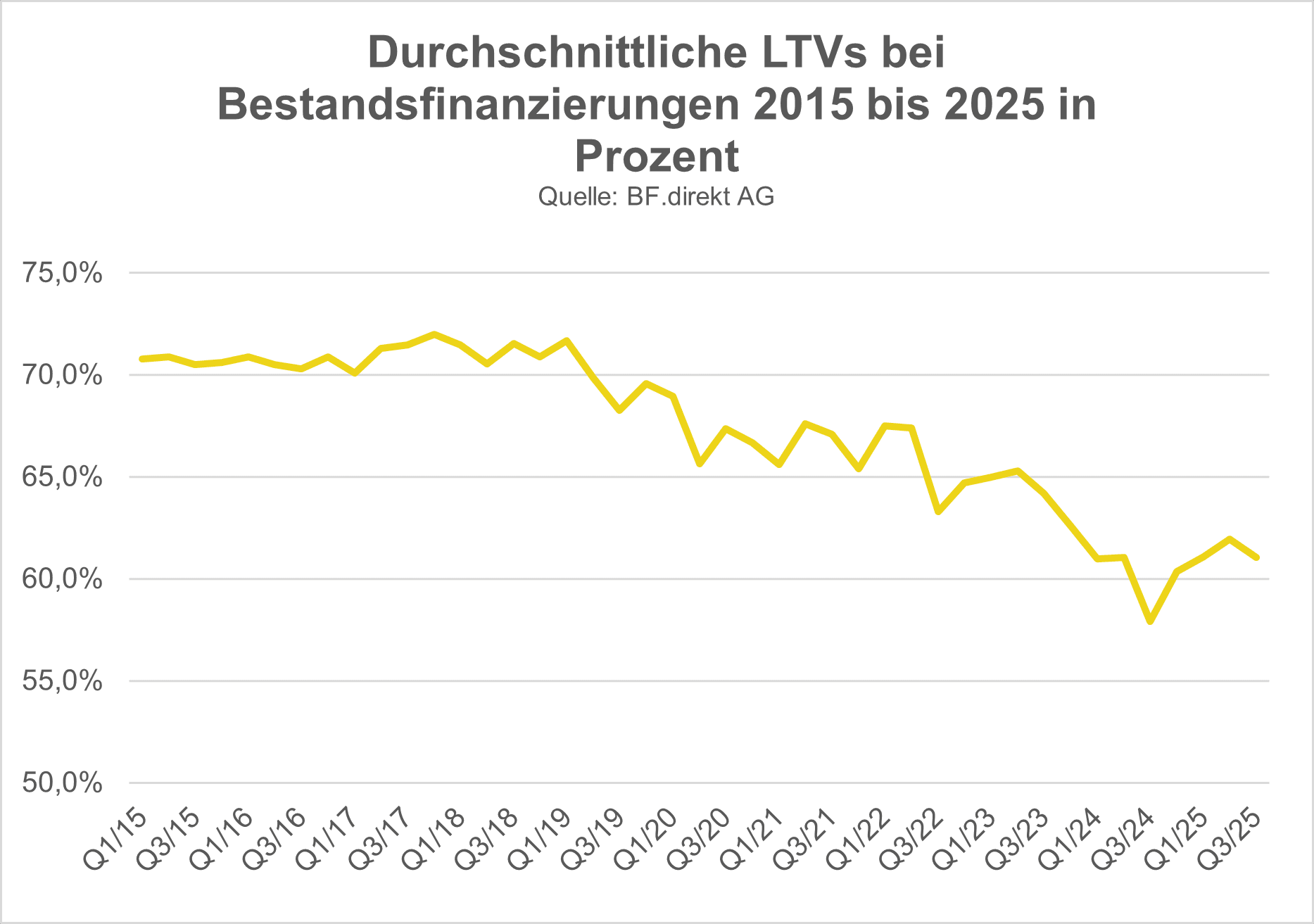

Loan-to-values (LTVs) in commercial real estate financing have fallen by around ten percentage points over the past ten years. While the average LTV in 2015 was 70.7 percent, it was 61.4 percent in the first three quarters of 2025. This was the result of a special evaluation by the BF. Quarterly Barometer. The loan-to-value ratio sets the loan amount in relation to the market value.

The decline in loan-to-value ratios did not occur selectively, but gradually over the entire ten-year period. It began back in 2019, when the values fell below the 70 percent mark for the first time. They then slowly fell further and further and sank below the 65 percent mark in the third quarter of 2022 and finally reached their lowest point in the third quarter of 2024 at 57.9 percent. Since then, the average LTV has fluctuated around 60 percent.

Francesco Fedele, CEO of BF.direkt AG, comments: “The fact that LTVs began to fall even before the interest rate turnaround was also due to the sharp rise in real estate prices. The financiers remained conservative and did not fully adjust the loan-to-value ratios to the rising prices. With the turnaround in interest rates, prices began to fall, and at the same time banks’ financing behaviour suddenly became very cautious and risk-averse. This explains the further decline in LTVs since 2022. Nevertheless, a new equilibrium seems to have been found at around 60 percent for several quarters. I expect us to continue at this level and see no signs of rising LTVs. The resulting gap will certainly not be completely filled with equity. This is where credit funds gain in importance. They will increasingly establish themselves as capital providers and play a more important role in the market than before.”

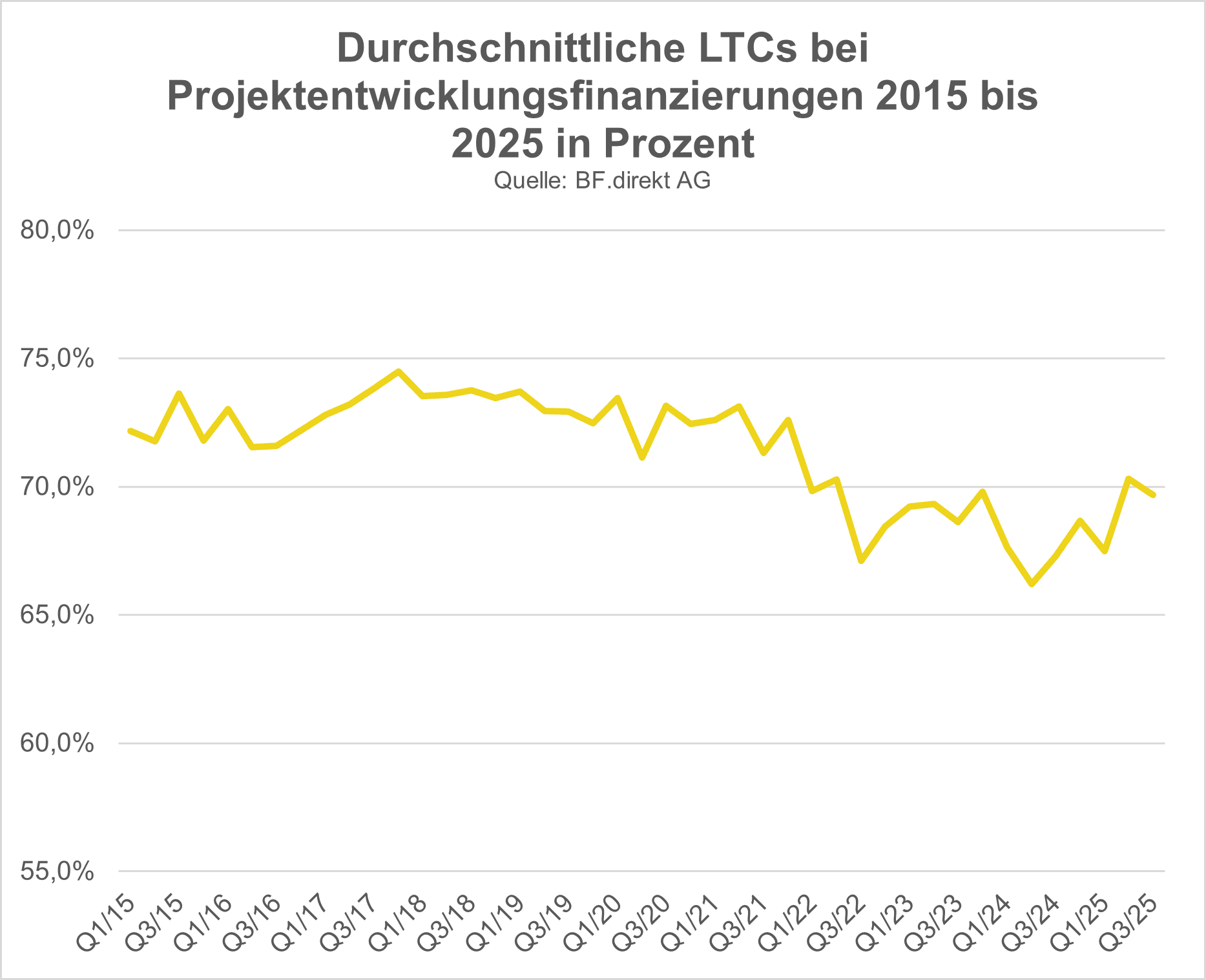

LTCs are also falling, but not as much

When it comes to financing project developments, loan-to-cost (LTC) is the analogous key figure. It sets the amount of debt financing in relation to the amount of the total costs. Here, too, there has been a downward movement over the last ten years – but less pronounced than with LTVs. For example, the average LTC between 2015 and the second quarter of 2022 ranged between 70 and 75 percent (average 72.6 percent). In the wake of the interest rate turnaround, LTCs fell and have been hovering between 67 and 70 percent since the third quarter of 2022 (average 68.5 percent).

Prof. Dr. Steffen Sebastian, Professor of Real Estate Finance at the IREBS University of Regensburg and scientific advisor to the BF. Quarterly Barometer, comments: “The decline in LTCs is surprisingly moderate. However, the pure LTC figures say nothing about the actual willingness to finance and the volume of project financing. Risky projects are rejected even if the LTC is actually sufficient. Overall, banks’ financing activities in the project development sector have declined significantly since the interest rate turnaround. Many banks have even withdrawn completely from financing developments.”

The BF. Quarterly Barometer is regularly compiled by bulwiengesa on behalf of BF.direkt AG. There, financiers are asked quarterly which LTVs and LTCs they grant for certain model financing in different types of real estate use. The time series goes back to 2015.