Frankfurt and London expand capacities – demand significantly exceeds supply

The market for data centers in Europe has recorded a comparatively subdued first quarter of 2025. Although the demand for technologies such as 5G, cloud services and, above all, artificial intelligence (AI) is enormous, limiting factors such as electricity availability and supply chain delays for new developments are causing slightly weaker growth: In the first quarter, sales amounted to around 45 megawatts (MW) in Europe’s most important locations for data centers, the so-called FLAP-D markets (Frankfurt, London, Amsterdam, Paris, Dublin). According to the “JLL EMEA Data Centre Report Q1 2025”, this is the weakest start to the year since 2021.

Regardless of this, the outlook remains positive: Pre-lettings, which give a picture of actual demand, were around 702 MW in 2024 alone – almost twice as high as in 2023. Accordingly, expectations are also high that sales will increase in the course of the year. Total revenue is forecast to be around 276 MW, after around 343 MW in 2024, about three percent less than 2023, the strongest year for data centers in Europe to date.

Growth in the total capacity of the core markets is also expected to weaken slightly in 2025, falling to ten percent, while it was still 13.2 percent in 2024. A new capacity of 31 MW was connected in the current year – slightly less than in the first quarters of the past two years, but more than at the start of 2022 with 18 MW.

“The high demand for data centers in Europe significantly exceeds supply and has a direct impact on the market. New project developments are being taken over in full and capacities that have already been connected are being absorbed more and more. For the fifth quarter in a row, we are recording falling vacancy rates,” says Martina Williams, Head of Work Dynamics Northern Europe at JLL. Work Dynamics provides specialized outsourcing services to companies. These include real estate consulting and services in corporate real estate and integrated facility management, portfolio and technology management as well as project and development services.

“The digital transformation and now critical importance of data for modern economic business processes is contributing to the increasing demand, as is the increased private data consumption,” Williams continued. “The data centers necessary for this and especially for AI are increasingly coming into the public eye. Investors from outside the field are also increasingly interested in the market, not least because of the robust market data resulting from the ever-increasing demand for data.”

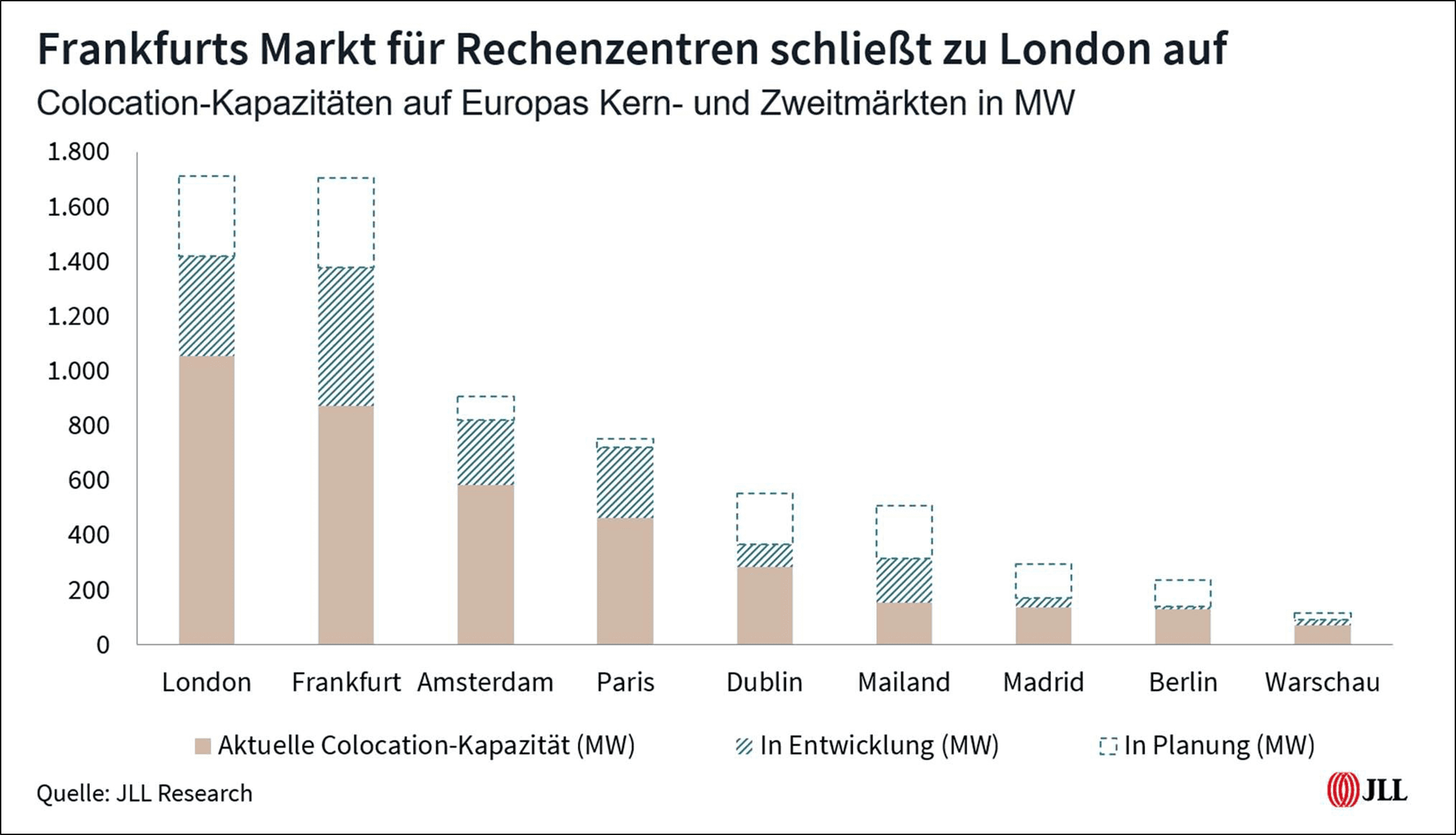

Numerous projects are under development to meet this demand: 1.7 GW of data center capacity alone is currently being developed in Europe’s core and secondary markets, of which around 870 MW are in Frankfurt and London. A further 1.3 GW are currently being planned, with a focus on Milan and Madrid in addition to Frankfurt and London.

“However, limiting factors in new developments create challenges,” says Helge Scheunemann, Head of Research at JLL Germany. “While a lack of electricity availability makes it difficult to find a location, supply bottlenecks are causing development delays. For some projects, the time delay can be up to four years. Although developers are trying to open up new locations to at least circumvent factors such as electricity availability, operators still prefer the core markets.” However, due to the low supply, landlords are in a strong negotiating position and benefit from rising rents.

Regardless of this, the outlook remains positive: Pre-lettings, which give a picture of actual demand, were around 702 MW in 2024 alone – almost twice as high as in 2023. Accordingly, expectations are also high that sales will increase in the course of the year. Total revenue is forecast to be around 276 MW, after around 343 MW in 2024, about three percent less than 2023, the strongest year for data centers in Europe to date.

Growth in the total capacity of the core markets is also expected to weaken slightly in 2025, falling to ten percent, while it was still 13.2 percent in 2024. A new capacity of 31 MW was connected in the current year – slightly less than in the first quarters of the past two years, but more than at the start of 2022 with 18 MW.