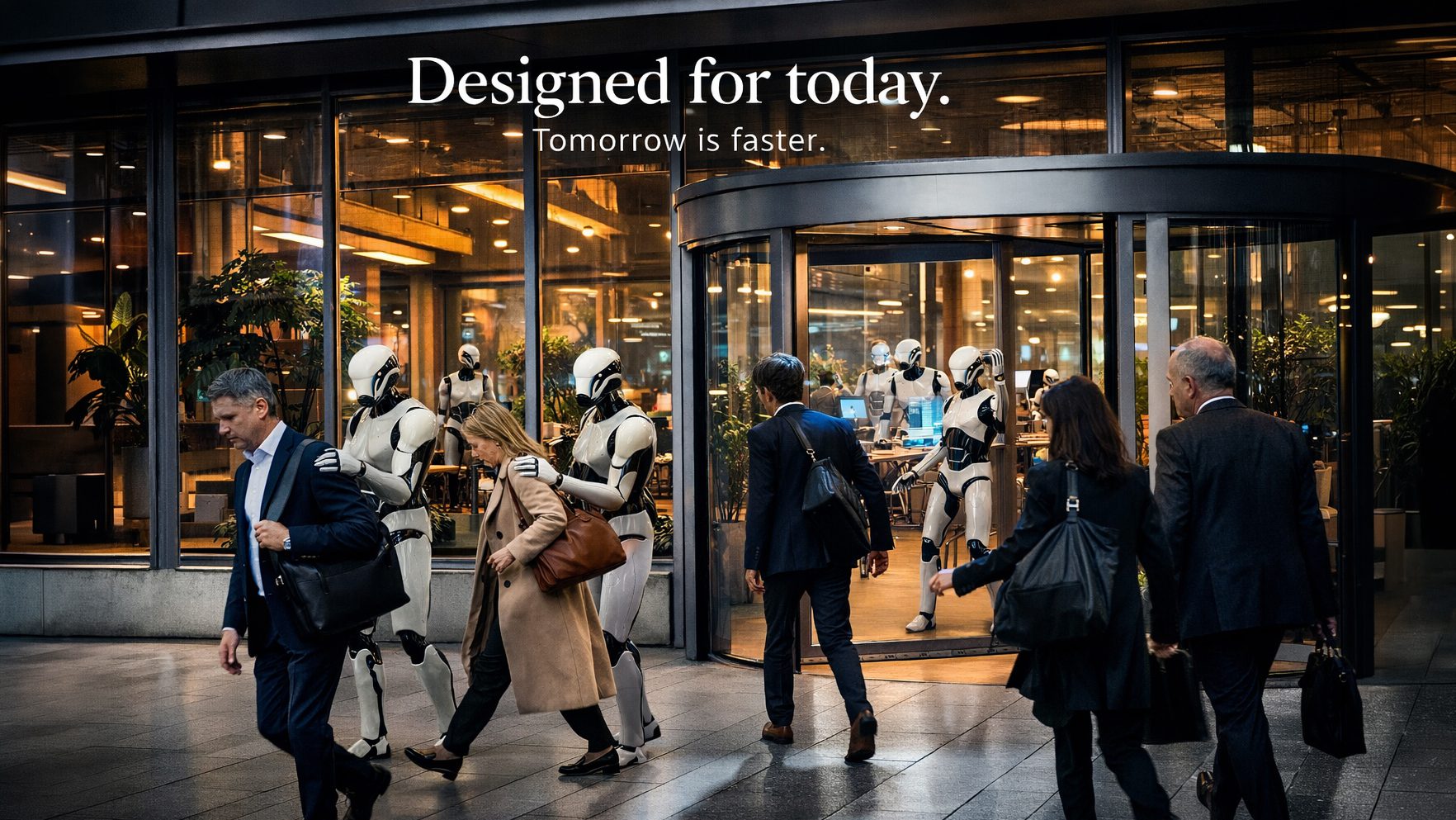

AI makes office properties less plannable and CapEx has to be rethought.

The current discussion about modern office real estate is often conducted as a CapEx question. This view now falls short.

1. Change of perspective

New buildings are considered technically optimised, ESG-compliant and therefore “finished” in the long term.

This is a classic CapEx perspective. In fact, however, the fate of office properties is less and less primarily concerned with the amount of CapEx, but increasingly with a question of time.

The implicit assumption of previous cycles was that we invest in the end state of the market. Today, it should be more realistically called: We are investing in an intermediate state. This is exactly where AI comes into play – not just as a tool in everyday work, but through its independent effect as an accelerator of requirement cycles.

2. The error in thinking after the last wave of adjustments

In the context of market consolidation, a conclusive narrative is currently emerging: the disruption caused by working from home has been processed. ESG is priced in. New usage concepts have been defined. High-quality land is scarce. Accordingly, high capital values appear to be justified in this respect.

Admittedly, this argumentation is understandable. However, if you take the speeds of change triggered by AI seriously, you will realize that this view is also very static . Is this possibly a blind spot? The possible blind spot is that it is extrapolated from the last adjustment , not from the speed of future changes.

Investors like nothing less than uncertainty when it comes to making investment decisions. The narrative that the last disruption has been worked through – with the implied assumption that it was also the last – is therefore understandable, but possibly misleading.

3. Structural risk increase through AI

The statement is far too alarmist and at the same time too undifferentiated: AI increases the risk for office properties because it makes space superfluous. That falls short. The effect of AI is likely to be primarily economic.

AI is changing work organization, productivity, and decision-making processes. So space requirements will probably not be completely eliminated in the future. However, office space requirements are likely to shift faster and less linearly than in previous cycles.

This concerns, among other things:

- Surface depth and layouts

- Flexibility and reusability

- Technical infrastructure

- Lease agreement logics

- Location Requirements

Above all, however, the half-life of “state of the art” is shortened.

AI does not shorten the useful life of buildings – it shortens the duration of their market conformity.

4. Thesis and antithesis: Two plausible futures

The dilemma of the effect of AI on office space becomes particularly clear here: it is simply not predictable at the moment. There are two plausible, opposing narratives.

Thesis:

Part of the market assumes that AI will lead to more high-quality office work in the long term. Routine activities are automated, new tasks are created. Knowledge work is becoming more intensive, collaborative and demanding. In this logic, the demand for well-equipped, central office space is increasing, even if its use changes.

Antithesis:

An equally plausible view argues in the opposite direction. AI increases productivity so much that fewer office workstations are needed. Activities in accounting, reporting, IT or administration could be done with fewer staff.

In this scenario, there is not a technical but a quantitative demand risk: a possible oversupply of space – even in the high-quality, energy-efficient segment.

It remains to be seen which of these developments will predominate. The decisive factor is that both are plausible.

5. Orientation by looking in the historical mirror

A look back helps to classify this uncertainty. Investors who invested in modern new office buildings ten to fifteen years ago acted rationally. The buildings were technically up-to-date, the locations attractive, the user concepts in line with the market.

Nevertheless, home office, ESG requirements, changing user behavior – and new CapEx waves followed. This was not a misjudgement by the investors at the time, but a structural break, the speed of which was underestimated.

The central insight from this is that uncertainty should not be negated, but at least priced.

6. CapEx: Not just a cost block, but a risk buffer

Against this backdrop of forecast uncertainty, the role of CapEx is shifting. Whereas CapEx used to be seen primarily as a cost factor, it is now increasingly an adjustment option.

The value of modern assets lies not in their current state, but in their ability to be readjusted. If you firmly believe that you have the perfect office standard today, you may be underestimating the speed of the next change.

7. Consequences for asset management

The uncertainty of the forecast has sober consequences:

- Lifecycle CapEx should not be modeled as an exception, but as a structural component.

- Conversion capability and modularity deserve greater weight than maximum initial efficiency.

- Technical flexibility is more valuable than perfected individual solutions.

- High entry prices are not proof of quality, but an indication of low tolerance for error.

- Segmentation will be central: The effects of AI will not run homogeneously across locations and sub-markets.

These points also expressly apply to new buildings that are in high demand today.

Interim grade despite all the uncertainty: Aren’t these also good times for specialised asset managers? In an environment in which pure investment managers are increasingly withdrawing, the ability to manage assets operationally should become more important again.

8. 📌 Conclusion: Clear addressing of structural risk

- The risk described here is neither cyclical nor ESG-specific, nor is it a short-term market phenomenon.

- It is a structural risk that arises from the accelerated change in usage requirements. AI is not one scenario among many, but the pacesetter.

- The greatest danger of modern office properties is not their age –

but the assumption that they are already finished.