Düsseldorf real estate investment market

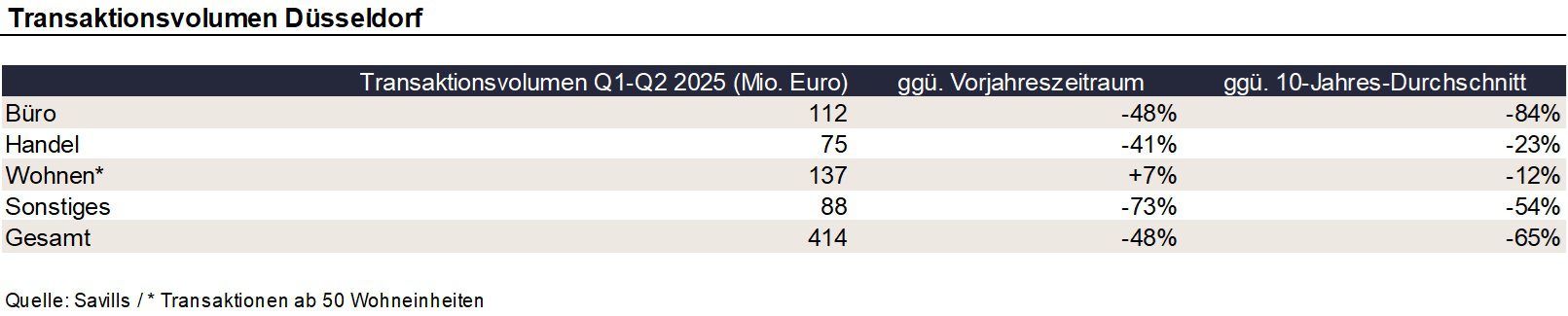

According to Savills, around 414 million euros were turned over in the Düsseldorf real estate investment market in the 1st half of 2025. Compared to the same period last year, this corresponds to a decrease of 48%. Compared to the 10-year average, sales were 65% lower. In the last twelve months, Savills has registered 28 transactions, an increase of 4% compared to the same period last year. Prime yields for offices and commercial buildings were 4.5% and 4.4% respectively at the end of June, unchanged from the previous quarter and the previous year’s figure.

Stefan Mellies, Director Investment at Savills in Düsseldorf, comments on the market as follows: “There are currently many properties being marketed and it is very likely that we will have more Comparables in the next few months that owners and investors can use as a guide. We are already observing that owners willing to sell are increasingly realistically estimating the achievable sales prices. Potential investors are particularly picky about the location and make noticeable price reductions in the event of location disadvantages. Accordingly, the chances of selling are highest in the good locations, regardless of the risk class. In the prime locations, properties with development potential are even particularly in demand.”

With a transaction volume of EUR 190 million, residential real estate* has contributed the most to investment turnover in the last twelve months, followed by industrial/logistics real estate and office real estate (approx. EUR 150 million each).

Against the backdrop of increasing willingness to sell and more realistic price expectations of many owners as well as the growing number of active investors, Savills expects a gradual increase in transaction activity in the future.

* Only properties with at least 50 residential units