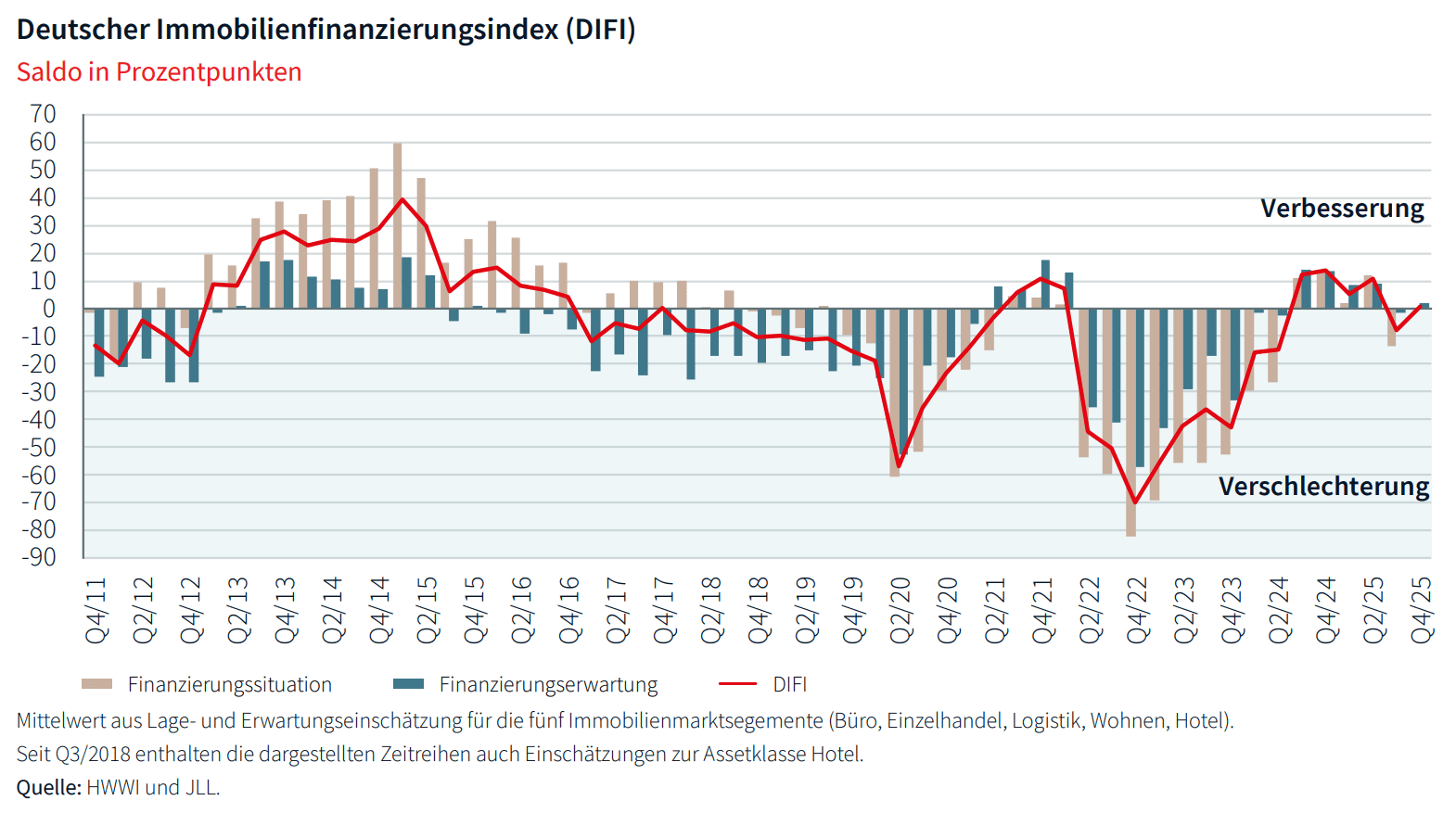

Sentiment index Difi gains points at the end of 2025 and closes in positive territory

Sentiment among real estate financing experts improved at the end of 2025. After the German Real Estate Financing Index (Difi)* had suffered significant losses in the previous quarter and slipped into negative territory, it is back in the positive zone in the fourth quarter of 2025 at 0.7 points. In particular, the current situation on the financing market is assessed more positively by market players.

The Difi is collected and published by JLL and the Hamburg Institute of International Economics (HWWI) and reflects the assessments of financing experts. The situation on the credit market in the past six months and the expected development in the next six months are assessed on a quarterly basis. The difi is calculated as an unweighted average of the balances of the two sub-indicators financing situation and financing expectation of all types of use.

Compared to the previous quarter, the situation indicator jumped upwards with a point increase of 13.4 points. In contrast, the gain in the expectations indicator is only 3.2 points. With final values of minus 0.4 points (situation) and plus 1.8 points (expectation), both sub-indicators are close to each other, which, according to Andreas Lagemann, Senior Researcher at HWWI, suggests that only a slight improvement in the framework conditions on the financing market can be expected in the coming months.

Basically, the assessments of market players would fit the volatile investment market, which fluctuates between disillusionment and sometimes positive surprises. “However, the players have already priced in many risks and the financing conditions give reason for cautious optimism at least in the second half of 2025 – even in a long-term comparison.”

With the exception of logistics, the balance of situation and expectations assessment has increased for all types of use. Wohnen is making up the strongest ground, achieving an increase of 27.7 points to 38.6 points. The office asset class is also making substantial gains (up 12.4 points), but remains in negative territory on balance (minus 18.2 points). While there was a similar development for the retail sector (plus 8.3 points to minus 7.5 points), the hotel segment made it back into the plus zone (5.6 points) after a balance of zero points in the previous quarter. On the other hand, the financing conditions for logistics real estate are considered more problematic. The balance value fell by 12.5 points to minus 15.0 points.

The comparison of the two sub-indicators makes it clear that the experts for the office, hotel and logistics segments expect the current financing situation to brighten. This is particularly true for the office sector. Here, the difference is largest at 18.2 points. For the residential and retail use types, on the other hand, the forecasts are more pessimistic than the current assessment of the situation.

“More than ever, rental markets supported investment markets in 2025 and will continue to do so this year. Real estate investments and financing must continue to rely on improving operating cash flow if they are to be successful. Relying solely on yield compression is certainly not enough to increase or retain value,” says Helge Scheunemann, Head of Research at JLL Germany.

He sees a positive development for the ailing asset class: “Even if investors continue to be sceptical about office properties, the trend is going in the right direction. The transaction volume after the first three quarters was already noticeably higher than the previous year’s figure. Smaller office deals in particular work well. However, market players are still having a hard time with large-volume transactions.”

Loan-to-value ratios are increasing across the board

Every six months, the experts are also asked about the financing conditions as part of the Difi. In the case of the loan-to-value ratios typical of the market (loan-to-value; LTV), core products are rising for all asset classes, most notably for residential real estate (up 4.1 percentage points). The current LTVs range from 72.3 percent for residential buildings to 60.6 percent for hotels. In the value-add segment, there are slight increases for residential, retail and office, while LTVs for logistics and hotels are falling slightly. The range here ranges from 63.6 percent (residential) to 57.9 percent (hotel).

Loans for value-add product will become more expensive

The picture is mixed in terms of margins. While average margins in the core segment are mostly declining or stagnating, there are significant increases in the value-add sector, with the exception of hotels. The strongest growth here was recorded in the residential sector with a plus of 25 basis points. Nevertheless, housing loan margins remain the lowest, averaging 200 basis points. For financing hotels in the value-add risk category, margins of 259 basis points are due on average. Similarly, for core products, residential real estate at 109 basis points and hotels at 180 basis points offer the lower and upper ends of the spectrum.

Dominik Rüger, Team Leader Debt Advisory JLL Germany, assumes that loan conditions will develop in favor of borrowers in the coming months: “Competition in the financing market has increased significantly across the board in recent months. Pfandbrief banks, savings banks, cooperative banks, but also international credit institutions are back in the market and are open to new business. In addition, credit funds are increasingly relying on back-leveraging, which also increases market liquidity. As a result of the increased financing supply, margins and LTVs will come under pressure.”

*Note: 24 experts took part in the survey of the German Real Estate Financing Index from 17 November to 26 November 2025. The assessments of the market situation (past six months) and market expectations (next six months) were queried. The percentage shares of the response categories and the percentage point changes compared with the previous quarter (Δ previous quarter) are shown. The balances result from the difference between the positive and negative response categories (such as “improved” and “deteriorated”). The Difi is calculated as an unweighted average of the balances of the financing situation and the financing expectation of all types of use.