No signs of a market revival – Frankfurt remains in a waiting position

The premium real estate market in Frankfurt is showing a wait-and-see side in the third quarter of 2025. The current analysis by DAHLER, based on ImmoScout24 data, examines the most expensive tenth of all advertised condominiums and houses in the city area, which are defined as the premium segment. The result: The supply is growing in parts, and prices are reacting accordingly. With a median price of €9,977/m² for premium apartments, Frankfurt ranks second among Germany’s top 7 cities, just behind Munich at €14,208. Nevertheless, there is no sign of an upward movement, rather there are many indications of a phase of market adjustment.

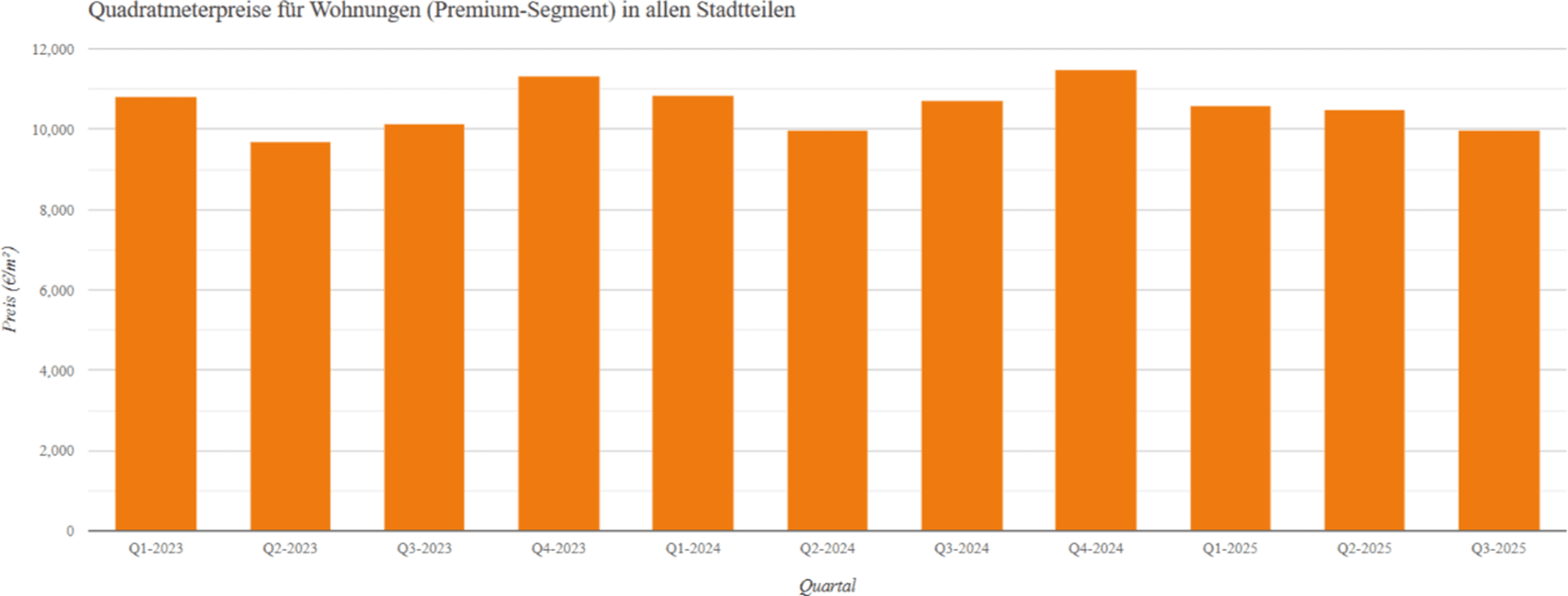

Premium apartments: Slightly falling prices with growing supply

In the premium apartments segment – defined from a price per square metre of around €8,922 – a classic picture emerges for a market on hold. The number of advertisements rose slightly by 4.3% in the third quarter of 2025 compared with the previous quarter. Prices fell by a median of 4.8% to €9,977/m².

“Our impression is that interested parties are currently acting much more cautiously,” says Tobias Ewald, Managing Director of DAHLER Frankfurt. “Supply is growing, but we are observing that demand is not keeping up. Many potential buyers are waiting to see whether the economic and political conditions improve. This is directly reflected in the price development.”

A detailed look at the individual districts reveals some significant differences: In the southern district, the supply has grown – up 88.9% – which has led to noticeable price pressure. Prices there have fallen by 7.9%, but remain at a high level with a median of €9,657/m². The situation is different in the city centre: supply is down slightly (-2.1% compared to Q2-2025), and prices have fallen by 8.5% accordingly.

“In the central locations, we perceive a particularly strong restraint,” says Tobias Ewald.

“The periphery, on the other hand, is proving to be more robust – there we are observing that demand remains stable. One possible reason is that the proportion of owner-occupiers in the periphery is higher than that of investors. The target group of owner-occupiers is currently more willing to make compromises in terms of location if the property is right in terms of size, price and features.”

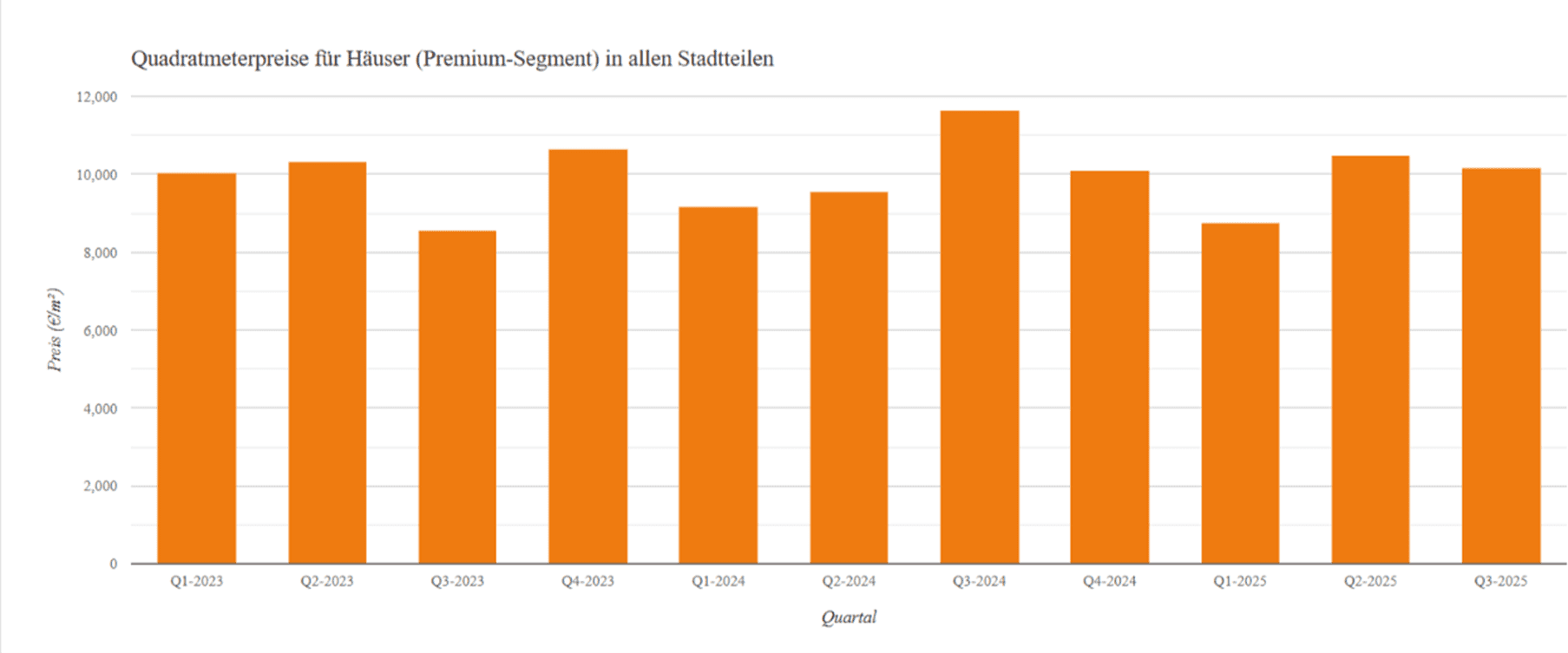

Premium Houses: Stabilization Trends Despite Growing Supply

In the premium house segment – which includes properties with asking prices starting at around €8,341/m² – the situation is somewhat more relaxed. Although prices fell slightly by 2.9% quarter-on-quarter to a median of €10,176/m², demand rose slightly (+0.8%). In addition to Düsseldorf (+17.2% compared to Q2-2025), Frankfurt is one of the few top 7 cities in which the average number of interested party enquiries is increasing. Supply also grew by 5.9%, at a manageable level overall.

“The housing market in the upper segment is showing the first signs of stabilization,” says Tobias Ewald. “This is a positive signal, even if we do not yet see a trend reversal overall.”

The premium housing market Q3-2025 compared to Q2-2025 at a glance:

- In the premium condominium market, the number of offers increased by 4.3% in the third quarter of 2025 (compared to Q2-2025).

- The median price in the premium segment of the condominium market in Frankfurt was €9,977/m² (-4.8% compared to Q2-2025).

The premium house market Q3-2025 compared to Q2-2025 at a glance:

- In the third quarter of 2025, the number of offers on the premium market for houses increased by 5.9% compared with the previous quarter.

- The median price in the premium segment in Frankfurt was €10,176/m², down 2.9% on the previous quarter.

- The number of enquiries registered by ImmoScout24 increased by 0.8% in the third quarter of 2025.