The European logistics real estate markets are showing broad stabilization with selective upward trends. In the fourth quarter of 2025 in particular, individual regions developed positively. On average, prime rents rose by 1.3 percent over the course of the year, while yields fell by six basis points. These are the results of GARBE Research in the current GARBE PYRAMID MAP, which will be published on 29.01.2026. The PYRAMID MAP is an overview of prime rents and net initial yields for the 122 most important European sub-markets for logistics real estate in 25 countries.

“The hoped-for broad trend reversal is not happening for the time being. What is emerging is a stabilization with a clearly selective character,” says Tobias Kassner, Head of Research & ESG at GARBE Industrial. According to Kassner, decision-making processes in purchasing and leasing remain lengthy in many places, and the differences between A and B locations continue to increase. “Something is possible, but not everywhere. If you want to seize opportunities, you have to know exactly where it’s worth looking.”

Traditional monetary policy stimulus and macroeconomic factors are no longer having the usual effect under the current framework conditions – especially against the backdrop of changed geopolitical developments. “Accordingly, in-depth market knowledge and experience are becoming significantly more important. In the current market environment, value creation is primarily achieved through active asset management and targeted positioning at the property level,” says Kassner.

Great Britain: Strong market with good foundations

The British logistics real estate market continues to be one of the structurally strongest in Europe and worldwide. Demand is driven by strategies to strengthen supply chain resilience and structural impulses from the defence and e-commerce sectors. As a result, take-up is already well above pre-pandemic levels. Deals in central England in particular contributed to this.

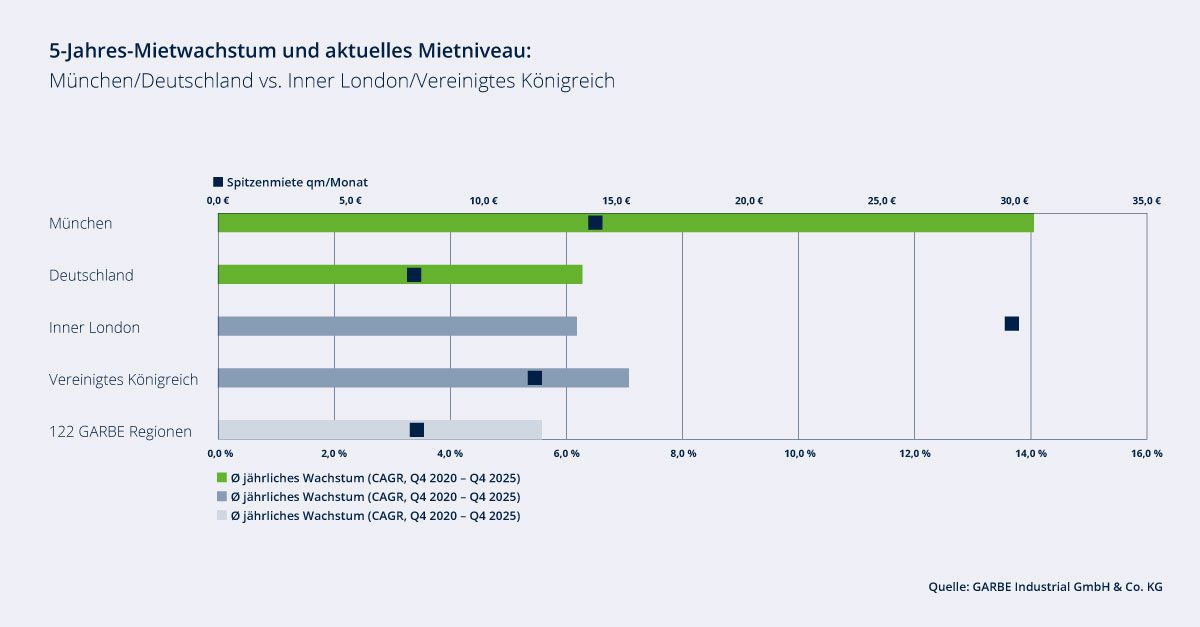

In terms of rent development, ten out of eleven regions analysed in Great Britain and Northern Ireland are above the European average of 5.6 per cent with an average annual rent growth rate (CAGR) of 7.1 per cent. Inner and Greater London lead the rental ranking of the European sub-markets. On the yield side, Inner London is also among the closely aligned European top group with a prime yield of 4.6 percent.

“Great Britain remains the strongest logistics real estate market in Europe,” says Kassner. “The core regions continue to show clear rent growth. Liquidity is high, even if a buyer’s market currently prevails. Despite short-term volatility, the long-term foundation is convincing.” According to Kassner, this development can be seen as a positive signal for the continental European markets, as market movements in the UK often occur in advance.

Germany: Rental hotspots and selective recovery

In Germany’s core regions, the market will be stable in 2025 with good demand for space and selective rental growth. Munich and Berlin City are among the clear pioneers. While Munich presents itself as a homogeneous market, a strong distinction must be made between Berlin’s core market and the surrounding area of Berlin. Over the past five years, Munich has become the most expensive logistics location in the eurozone and is continuously widening its gap to the national average. Both regions have also been leading in rental growth since the fourth quarter of 2020: The average annual growth rate (CAGR) is 14.1 percent for Munich and 12.7 percent for Berlin City.

Other top regions such as Hamburg, Düsseldorf and Frankfurt are also showing a stable development. Positive impetus is also coming from Bremen: The location, which has long been considered a market of concern, was able to successfully rent out vacant space in 2025 and is once again showing rental growth potential.

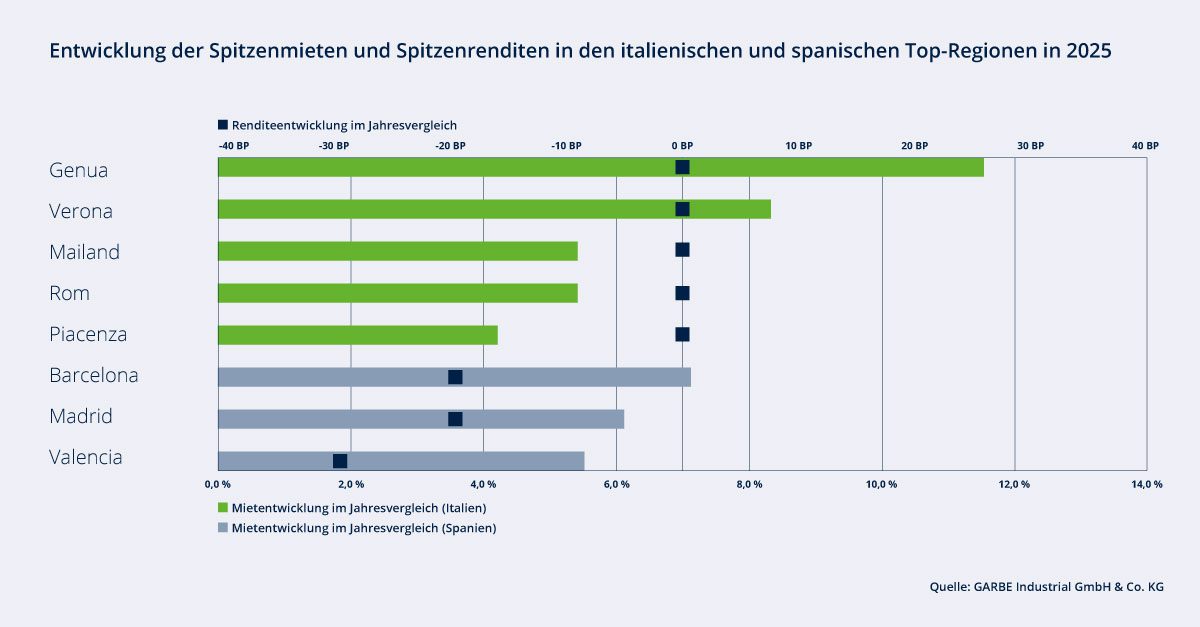

Spain: High rental momentum and demand meet tight supply

Spain is one of the relative outperformers in the European logistics real estate market in 2025. In the core regions of Barcelona, Madrid and Valencia, rents rose significantly. All three regions are among the ten most dynamic markets in the GARBE ranking. Especially in the central locations of Madrid and Barcelona, a structural shortage of supply is meeting persistently high demand for users and investors. The speculative pipeline is small, which further increases the pressure on rents. Valencia is gaining in importance due to numerous infrastructure measures, especially the port expansion.

Kassner comments: “Spain combines rental growth, supply shortages and international investor interest in a way that can currently only be found in a few markets. With yields of around five percent and rents rising at the same time, the market remains particularly attractive for value-add and core+ strategies.”

Italy: Early cycle with structural potential

Last year, Italy was one of the most interesting logistics real estate markets in Europe, driven by stable demand, limited supply and an active investment environment. “While Spain is already showing slight yield compressions, yields in Italy are moving sideways – and thus offer additional room for manoeuvre from an investor’s point of view. This offers attractive entry opportunities, especially for developers and Core+ strategies,” explains Kassner.

The rental markets were largely robust with a high proportion of build-to-suit and build-to-own projects as well as long-term contract terms. At the same time, a complex approval environment limits the volume of new construction, which keeps supply permanently scarce.

In particular, the core regions of Milan and Rome are showing a stable performance. Strong growth impulses are currently coming from Genoa, Verona and Piacenza. Year-on-year from the end of 2024 to the end of 2025, prime rents rose by 11.5 percent in Genoa and 8.3 percent in Verona, while Piacenza recorded significant growth, especially in the second half of 2025.

Detailed figures and methodological information can be found in the interactive GARBE PYRAMID MAP, the updated version of which will be available from 29.01.2026. The data referred to in the text come from the PYRAMID project.