GARBE PYRAMID MAP: Europe’s logistics real estate markets expect subdued momentum and selective growth until 2030

Significantly lower momentum in rental growth is expected over the next five years. Predominantly stable returns in the European core markets with selective market opportunities. Growing independence from European supply chains and production is leading to positive demand impulses.

The economic and geopolitical environment has become much more volatile in recent years; a sustainable calming of the framework conditions is currently not foreseeable. At the same time, no strong economic stimulus is expected in the short term from a broad upswing. Against this backdrop, market momentum on the European logistics real estate markets is expected to remain largely subdued in the coming years. While average annual rent growth over the past five years (CAGR Q4 2020 to Q4 2025) was still 5.7 percent, an increase of only 1.9 percent per year is expected for the next five years.

On the yield side, too, there are signs of a phase of stabilisation: since the turning point at the end of the last market cycle in Q2 2022, the average prime yield across 122 regions has risen from 4.6 per cent to 5.7 per cent, with slight compression tendencies already evident in recent quarters. By 2030, this moderate decline in yields to 5.2 percent is expected in the 88 forecasted markets. For the vast majority of European logistics real estate markets, a slight yield compression is forecast, while a sideways movement is expected in individual regions.

These are the results of GARBE Research’s forecast of the current GARBE PYRAMID MAP, developed together with Oxford Economics, which contains 88 of a total of 122 European logistics regions.

Decoupling of geopolitics and market development.

What is striking is an increasing decoupling between geopolitical events and their direct impact on the European logistics real estate markets. Market reactions are more often delayed and develop very differently from region to region. “A fundamental calming of the geopolitical environment, which many have long hoped for, is not in sight. However, market players are increasingly adapting to this new reality, putting aside their wait-and-see attitude and getting back into action,” comments Tobias Kassner, Head of Research & ESG at GARBE Industrial. “After the market corrections of recent years, we do not expect any further nationwide adjustments. Stability is maintained and growth takes place – albeit selectively and strongly depending on the location.”

At the same time, the increasingly non-transparent and unpredictable market environment is increasing the demands on investors and operators of logistics properties. Therefore, a clear strategic orientation, in-depth local market knowledge and consistent implementation at location and portfolio level are crucial for success. “In a market with high uncertainty, it is not so much the cycle that decides as the quality of asset management. Stable cash flows, active contract and tenant management and close control at the property level are the key success factors today,” says Tom Herrschaft, Head of Real Estate Management at GARBE Industrial.

Selective rental growth and stable yields

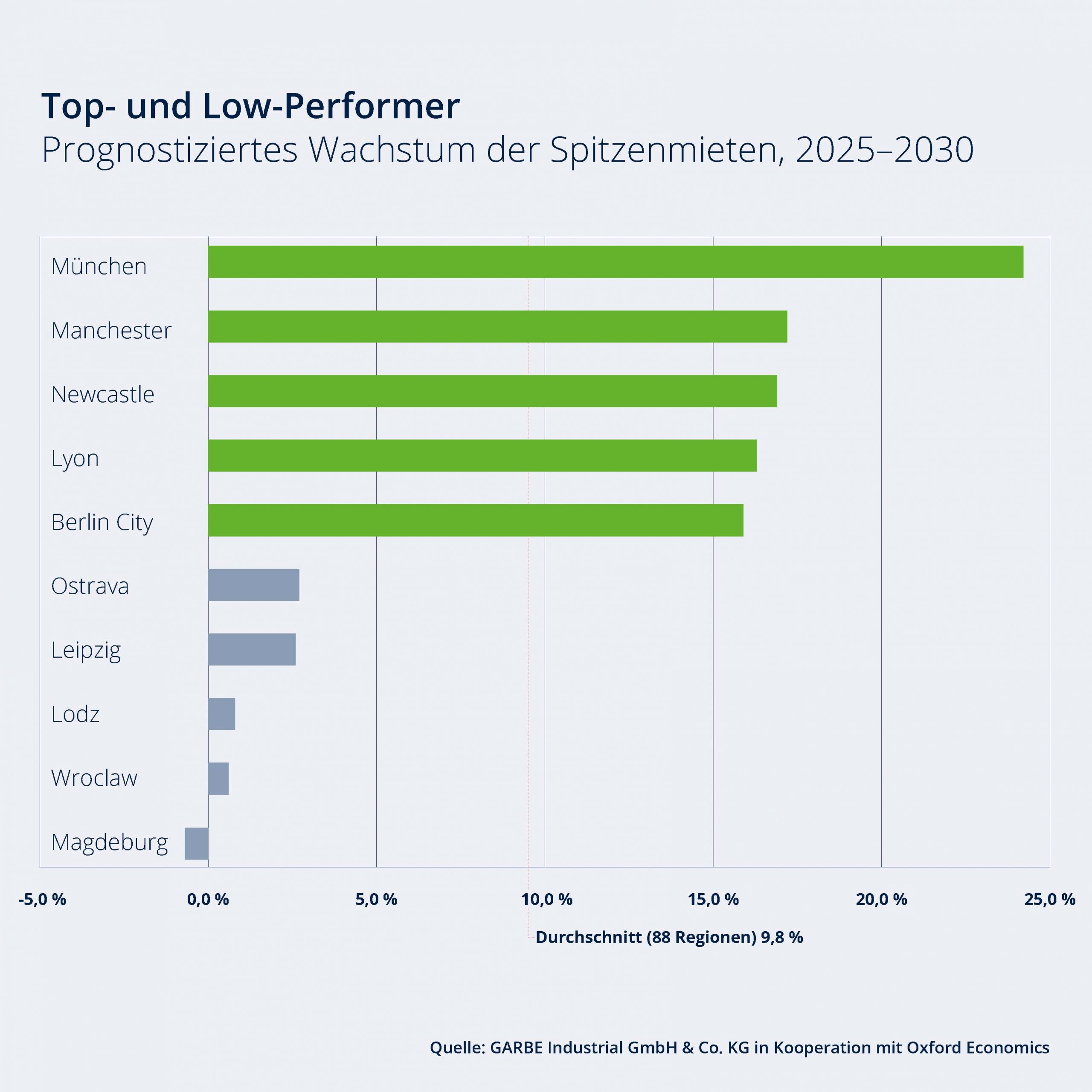

Despite the generally subdued market dynamics, the GARBE forecast continues to show growth potential in a large number of European logistics markets. In 45 of the regions analyzed, prime rents are expected to increase by more than ten percent by 2030. The strongest impetus comes from established core markets in countries such as Germany, Great Britain, France and the Netherlands. Munich in particular clearly stands out from the other markets: high demand, structurally tight supply and the economic strength of the location suggest that the dynamic rental growth of recent years will continue.

On the yield side, the outlook is cautiously positive, with established markets also likely to lead the way. The most attractive performance prospects are offered above all by liquid core markets, where moderate rental growth meets stable yields. The United Kingdom and France provide a vivid picture of the current market situation and future development prospects. Both markets exemplify how demand, rental dynamics and yield profiles are currently shaping up in established European logistics regions.

UK Market Insight

The logistics real estate market in the UK is consolidating, but at the same time offers further growth potential. The increasing interest of Asian e-retailers with concrete expansion plans, especially in well-connected port locations, is striking. Overall, large-scale logistics properties are in demand in established regions such as the north-west of England or the Midlands with the economic areas of Manchester and Birmingham, which is leading to real rental growth in these sub-markets.

The defense and aerospace industries are also increasingly emerging as a demand driver. The limited availability of suitable land further supports the rent level.

Market Insight France

The French logistics real estate market is stable with a cautiously positive outlook. Demand continues to be strongly driven by retail and e-commerce. Additional impetus comes from the defence and aeronautics sectors, especially in regions such as Toulouse. At the same time, demand is shifting from older portfolios to modern, ESG-compliant logistics properties. Vacancies are mainly concentrated in northern regions and mainly affect older properties.

Comparable impulses across countries

“Similar structural drivers are at work across national borders. E-commerce remains a key demand factor, increasingly also due to Asian providers who are expanding their presence in Europe. Changing trade flows, realigned supply chains and the focus on strategic resilience and defence will shape the logistics real estate markets in the long term and provide decisive impetus,” says Kassner.

Detailed figures and methodological information can be found in the interactive GARBE PYRAMID MAP. The data referred to in the press release comes from the PYRAMID project.

Note Images and image rights: The use of the sent graphic is permitted in the context of reporting on the company GARBE Industrial. Editing of the photos may only be done as part of normal image editing.