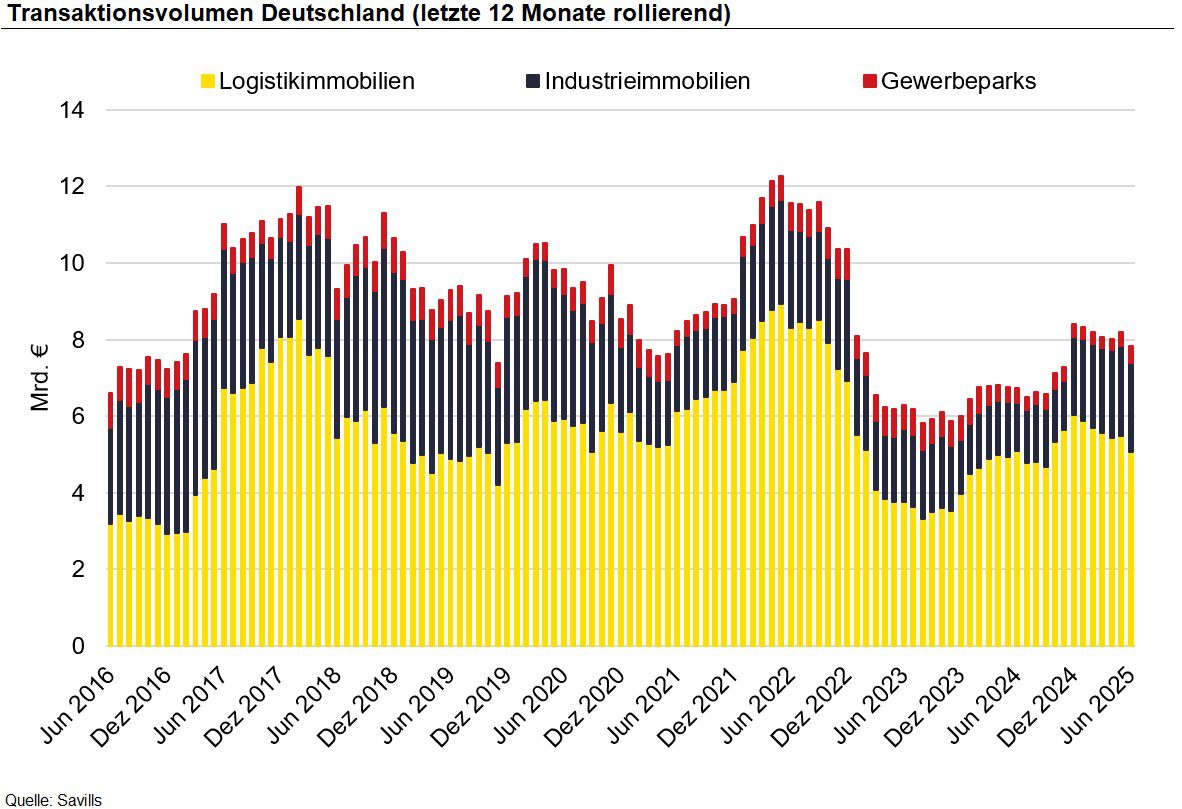

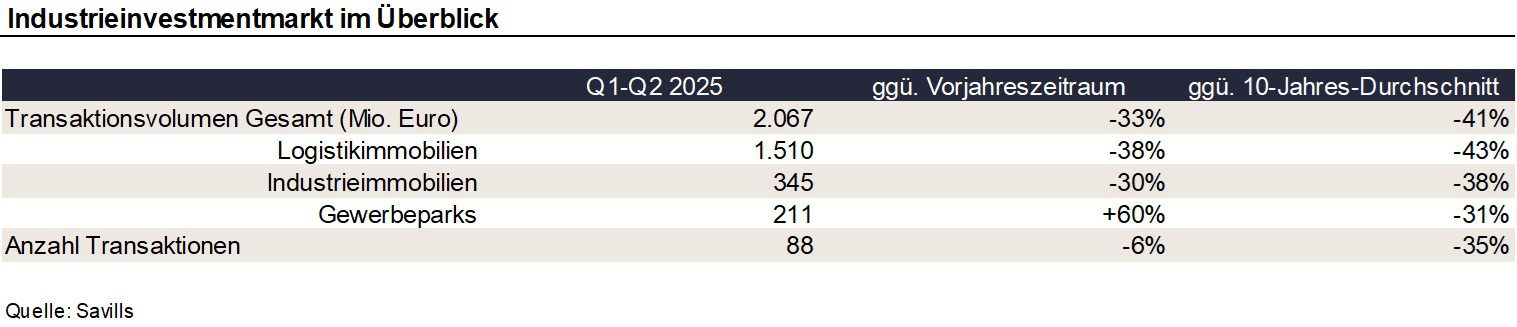

According to Savills, around 2.1 billion euros were traded on the market for industrial and logistics real estate in the 1st half of 2025. Compared to the same period last year, this corresponds to a decrease of 33%. Compared to the 10-year average, sales were even 41% lower. In the last twelve months, Savills has registered about 190 transactions, down 11% from the same period last year. The prime yield for industrial and logistics properties was 4.4% at the end of June, unchanged from the previous quarter and also unchanged from the previous year’s figure.

Bertrand Ehm, Director Investment at Savills, comments on the market as follows: “There are currently only a few core transactions to be observed. In times of rising vacancies and an end to the rise in prime rents, buyers are placing high demands on industrial and logistics properties, where prices are called for prime yields. The market is proving to be very sensitive in terms of location, remaining maturity and factors. In addition, there is general uncertainty, partly as a result of the trade dispute. This combination means that the upswing in the investment market for industrial and logistics real estate is experiencing a dampener. Nevertheless, we are observing inflows of funds and expect that this capital pressure will lead to slightly falling yields again in the future.”

With a transaction volume of EUR 5.1 billion, logistics real estate has contributed the most to investment turnover in the last twelve months, followed by industrial real estate (approx. EUR 1.1 billion) and business parks (approx. EUR 426 million).