In the third quarter of 2025, several developments will converge in the seven most relevant premium real estate markets in Germany: In the majority of the markets, supply of both premium apartments and houses increased, while demand and asking prices fell. This is illustrated by a recent analysis by premium real estate broker DAHLER, which took a close look at the development of supply and demand data from Germany’s largest real estate platform, ImmoScout24, in Germany’s top 7 cities*. The premium segment of the housing market and the market for condominiums was considered, which each includes the most expensive 10% of the offers advertised on ImmoScout24.

Condominium market: Supply of premium apartments is growing, prices are declining

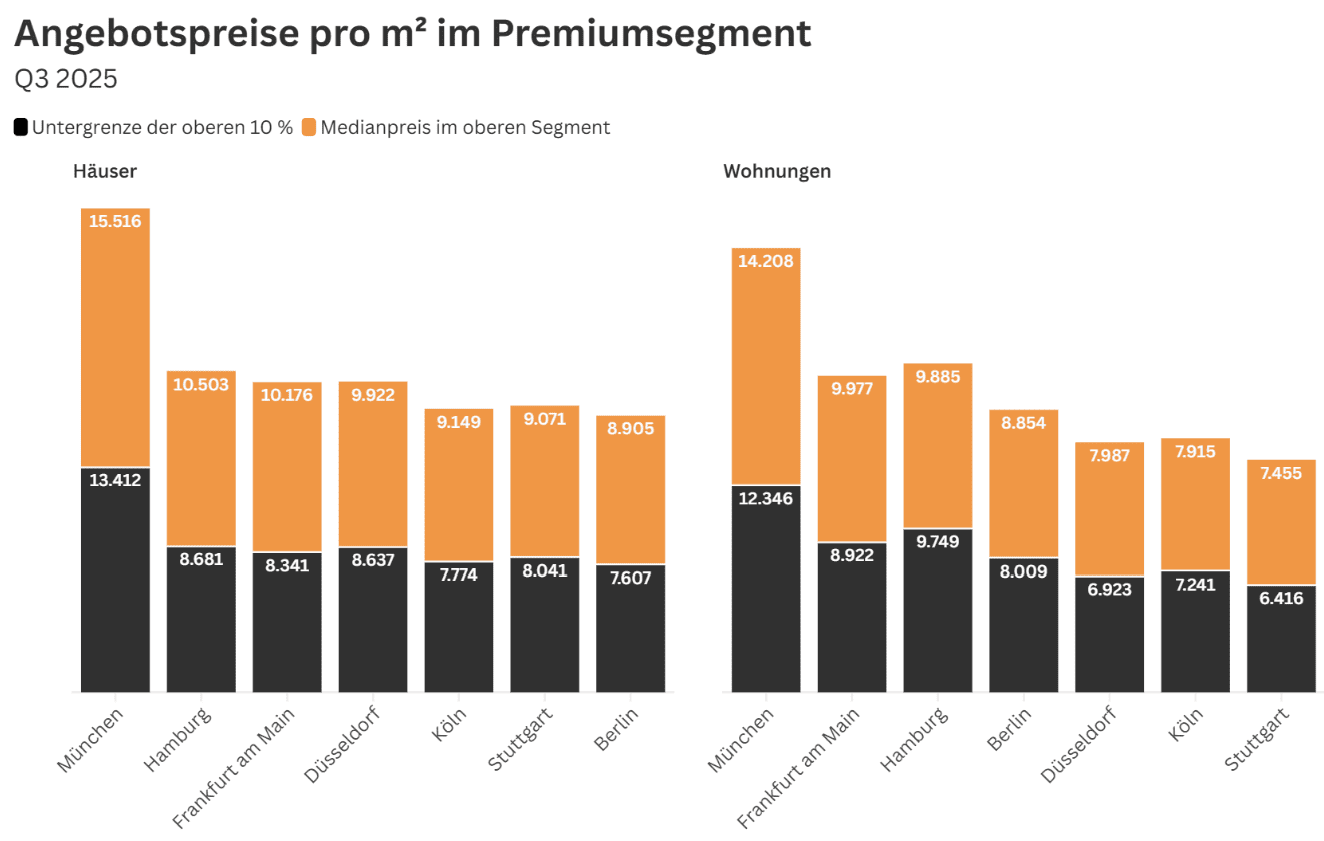

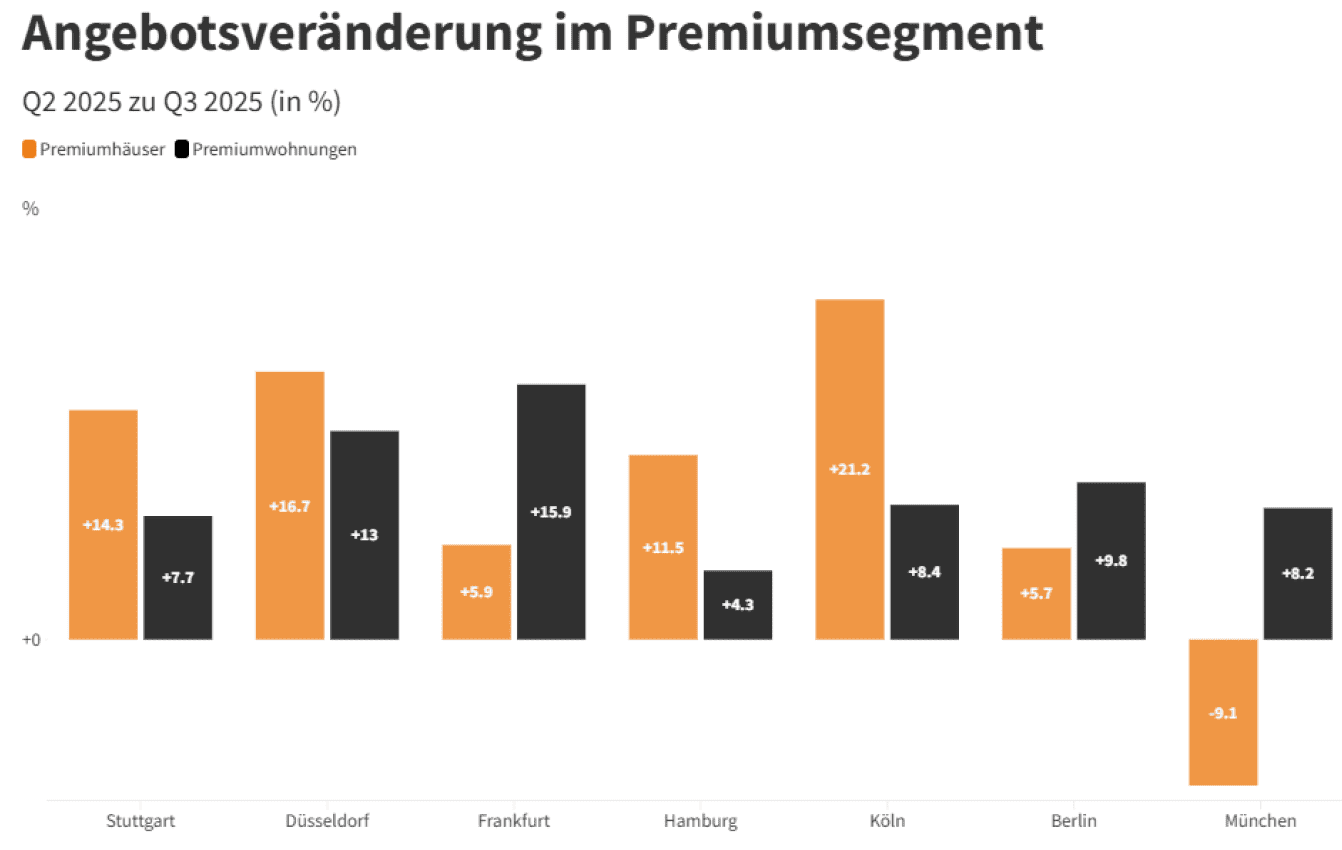

The number of premium apartments listed on ImmoScout24 continued to rise in the third quarter of 2025 – as in the previous quarter. However, the market situation has clearly changed: across all top 7 cities, the number of offers increased by a total of 9.4%. The level of growth varied: While an increase of 13% was recorded in Hamburg, for example, it was 15.9% in Düsseldorf and 4.3% in Frankfurt am Main (Q2-2025 to Q3-2025).

There is also a clear trend in price development: the median price in the top 10% across all top 7 cities fell by 3.3% in the third quarter of 2025 compared to the previous quarter. The most significant decline of 6.3% took place in Düsseldorf, where it was €7,987/m² in Q3-2025. There was an opposite trend in Cologne, where the median asking price per square metre climbed by 2.5% to €7,915 in Q3-2025.

Premium houses in the third quarter of 2025: Rising supply meets lower demand

Similar to the housing market, there was also a clear development in the housing segment: Across all top 7 cities, the number of advertised premium houses increased by 11.9% compared to the second quarter of 2025. The most dynamic increase in supply was recorded in Cologne (+21.2%, Q2-2025 compared to Q3-2025), while the smallest increase was recorded in Berlin (+5.7%, Q2-2025 compared to Q3-2025). Only in Munich was there a decline of 9.1%.

In the analysis of all premium house markets in the top 7 cities, the median asking price fell slightly (-0.3% compared to Q2-2025). As in the previous quarter, the highest price in Q3-2025 was in Munich. Here, a median asking price of €15,516/m² was determined (-6.8

% compared to Q2-2025). The highest percentage price increase was recorded in Düsseldorf, with a value of €9,922/m² (+4% Q2-2025 compared to Q3-2025).

A look at the development of demand

“The number of contact requests per premium property for sale fell slightly in the third quarter – by around 4.2 percent in the top 7 cities. This is mainly due to seasonal reasons and is also due to the strong growth in supply: Many owners in the premium segment are currently willing to sell. At the same time, buyers are currently acting somewhat more cautiously. Demand is therefore spread over more available properties, so that the individual advertisement receives fewer enquiries,” says Kristian Kehlert, Head of Market Analysis at ImmoScout24.

“The analysis makes it clear that the German premium real estate market is in a phase of readjustment,” says Björn Dahler, Managing Director at DAHLER, and elaborates: “Above all, there is a supply-side impulse coming into the market: Many providers are now more willing to sell their properties in the current price environment, which means that supply is also outstripping demand in some cases. Prospective buyers, on the other hand, are currently acting more cautiously across the board and are considering their purchasing decisions for longer. In addition, many are still waiting for more stable financing conditions. Demand has therefore not disappeared, but has become more selective. So on a broad scale, we are not experiencing a crisis, but a market adjustment at a high level.”

*These are Berlin, Hamburg, Munich, Düsseldorf, Frankfurt am Main, Cologne and Stuttgart.

The premium housing market of Germany’s top 7 cities Q3-2025 to Q2-2025 at a glance:

- The number of advertised offers increased by around 9.4% in the third quarter of 2025 compared with the previous quarter.

- The median asking prices in the premium segments examined fell by 3.3%.

- Among the top 7 cities, the highest price increase was recorded in Cologne at 2.5% – the highest price decrease in Düsseldorf at 6.3%.

- In Q3-2025, supply grew in all the metropolises examined: in Düsseldorf the most significant at 15.9% and in Frankfurt am Main at 4.3%.

The premium house market Q3-2025 to Q2-2025 at a glance:

- In the premium segments of the housing markets of Germany’s top 7 metropolises, the number of offers increased by 11.9% overall.

- The median asking prices fell slightly (-0.3% compared to Q2-2025).

- The highest increase in the median asking price was recorded in Düsseldorf (+4% compared to Q2-2025), while the median price fell by 6.8% in Munich (Q2-2025 to Q3-2025)

- The highest percentage increase in supply was recorded in Cologne with 21.2%, while in Munich the supply decreased most markedly with a loss of 9.1%.