Hamburg real estate investment market

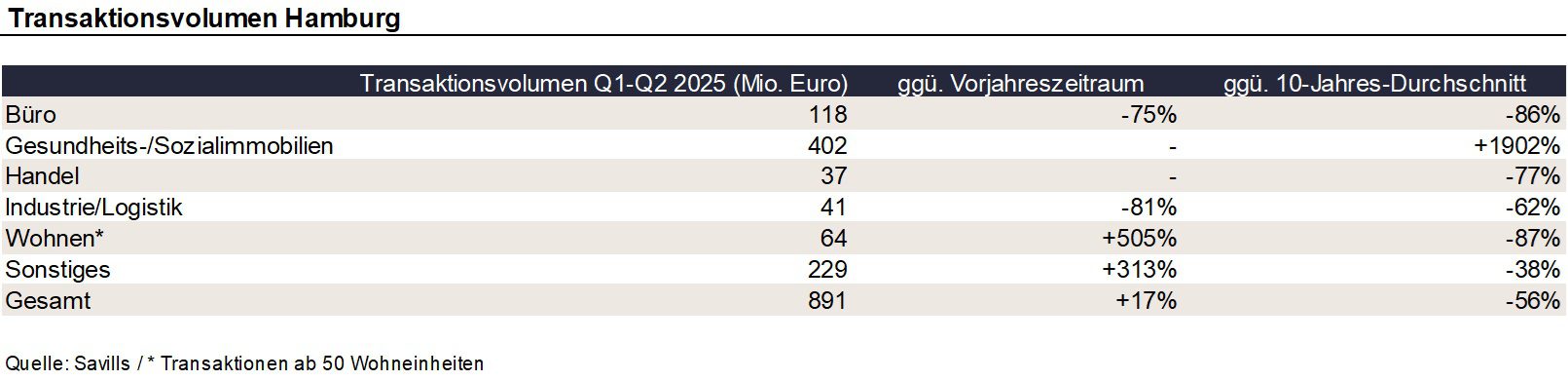

According to Savills, around 891 million euros were turned over on the Hamburg real estate investment market in the 1st half of 2025. Compared to the same period of the previous year, this corresponds to an increase of 17%. Compared to the 10-year average, sales were 56% lower. In the last twelve months, Savills has registered about 40 transactions, which represents a decrease of 9% compared to the same period last year. Prime yields for offices and commercial buildings were both 4.3% at the end of June, unchanged from the previous quarter and also unchanged from the previous year’s figure.

Jörn Roock, Director Investment at Savills in Hamburg, comments on market developments as follows: “The significant increase in the number of sales preparations at the beginning of the year is gradually being reflected in increasing transaction activity. In some cases, we are seeing real competition among bidders again – especially for core-plus and value-add properties in good locations. In addition, core office properties continue to be the focus of individual sources of capital, although the price expectations of buyers and sellers are often still too far apart. Deals such as the Tichelhaus are currently still the exception, but could have a signal effect and help to reduce the existing price difference.”

With a transaction volume of EUR 450 million, healthcare/social real estate has contributed the most to investment turnover in the last twelve months, followed by retail and office properties (approx. EUR 440 million each).

Against the backdrop of increasing willingness to sell and more realistic price expectations of many owners as well as the growing number of active investors, Savills expects a gradual increase in transaction activity in the future.