Martina Williams, Head of Work Dynamics Northern Europe and Helge Scheunemann, Head of Research Germany

Data centers are among the fastest-growing asset classes in the real estate sector. Fueled by the boom in artificial intelligence (AI), they are increasingly attracting the interest of investors. However, a central challenge for investors and operators alike is the high energy demand of the asset class, as can be seen from the JLL analysis “Energy supply for data centers“. In 2025, for example, the global energy consumption of data centers is likely to be between 600 TWh and 1050 TWh, depending on the scenario – which would make them responsible for around two percent of global energy consumption. In Germany, the share is even higher at almost 3.7 percent and almost 18 billion KWh.

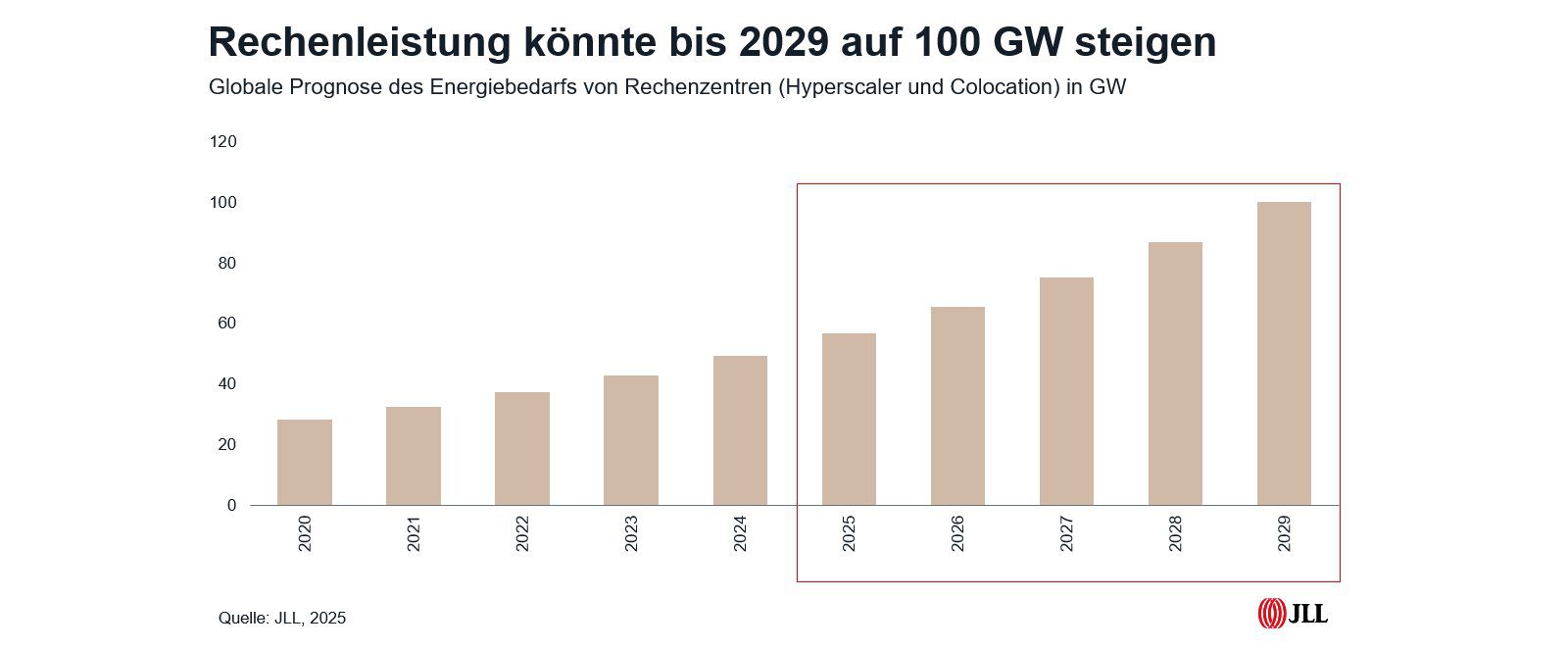

“Although intensive research is being done on energy efficiency, technological progress is leading to an increase in the demand for electricity from data centers, especially due to the growing performance of new AI chips. In some cases, these consume up to 300 percent more electricity than their previous generation,” explains Martina Williams, Head of Work Dynamics Northern Europe at JLL. Work Dynamics provides specialized outsourcing services to companies. These include real estate consulting and services in corporate real estate and integrated facility management, portfolio and technology management as well as project and development services. “The increasing demand for AI services, voice and image datasets, and deep learning applications will continue to have a significant impact on electricity demand in the near future,” Williams explains. After the global capacity of data centers was 28 GW in 2020 and most recently 50 GW, it is forecast to increase to around 100 GW by 2029.

In many countries, Small Modular Reactors (SMR) are being discussed as a low-carbon solution to the high energy requirements of data centers and could play a greater role from 2030 onwards. Germany, however, is pursuing a different approach: the German government is focusing on environmentally friendly solutions, in particular increasing energy efficiency and expanding renewable energies.

The Energy Efficiency Act stipulates that data centers must cover half of their electricity consumption with electricity from renewable energies since 2024 and completely from 2027 – at least on the balance sheet. In addition, operators will have to prove a share of at least ten percent reused energy when commissioning from July 2026, which is to increase gradually and will be 20 percent when commissioned from July 2028.

“The limited availability of electricity in Germany poses a challenge for the development of data centers,” emphasizes Helge Scheunemann, Head of Research at JLL Germany. “According to distribution system operators, new electricity capacities will only be available to a very limited extent until 2030, although they cannot be ruled out depending on the location and power requirements. Bottlenecks in the provision of sufficient pipeline infrastructure and the few permits for new lines are also an obstacle.”

As a consequence of the electricity shortage in established markets such as Frankfurt and Berlin, operators and developers are also expanding into other regions, where similar challenges are emerging in the long term. In order to meet the growing energy demand, additional power plants, also with gas as the primary source and later conversion to hydrogen, as well as the expansion of the power lines are essential.

The use of waste heat from data centers will play a greater role in the future. The aim is to feed these into municipal heating networks in order to supply households with heat efficiently and cheaply. However, this requires the expansion of heating networks and closer cooperation between data center operators and municipal energy suppliers. Municipalities should take this circumstance into account in their heat plans, which they must draw up by mid-2028 anyway.

“Legislators, municipalities, network operators and data center operators must work together more closely to ensure that Germany continues to be an attractive location for data centers,” Williams emphasizes. “In particular, the potential as a ‘green’ location is there, after all, Germany is at the forefront of Europe in terms of photovoltaic capacity and is one of the countries with the highest offshore wind capacities worldwide.” With a share of 61.7 percent of renewable energies in electricity consumption in 2024 with an increasing trend and the expansion of energy efficiency, sustainable operation of data centers in this country is very possible.