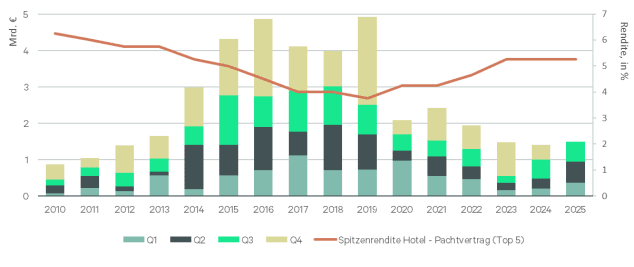

The German hotel investment market reached a transaction volume of 1.5 billion euros in the first three quarters of 2025. This corresponds to an increase of 50 percent compared to the same period last year and exceeds the average value of the first three quarters of the past three years by 34 percent. The third quarter of 2025 alone accounted for 550 million euros, which corresponds to an increase of seven percent compared to the same period last year. The prime yield remained stable at 5.25 percent (gross). These are the latest results of an analysis by global real estate service provider CBRE.

“The hotel real estate business is slowly but noticeably gaining momentum again. Rising transaction volumes, larger deal sizes and the return of core capital signal the beginning of the new real estate cycle. This development in the hotel segment is supported by continued strong fundamentals, which means that the hotel asset class is currently increasingly becoming the focus of investors compared to other asset classes,” says Helena Rickmers, Head of Hotel Investment at CBRE in Germany.

The number of overnight stays recorded in the first seven months of 2025 is practically at the record level of the previous year, with a minimal decline of 0.2 percent. “Despite the numerous major events and the European Football Championship last year, the volume of overnight stays will remain at a consistently high level in 2025. Although average room rates in many hotel markets have not risen further so far this year after adjusting for inflation, numerous establishments have been able to improve their occupancy rates slightly,” says Sabine Lüftenegger, Head of Hotel Advisory and Development Services.

Own operators particularly active

The most active group of buyers so far this year has been equity-rich owner-operators, who invested around 409 million euros, accounting for 27 percent of the total volume. They are taking advantage of the start of the new real estate cycle to invest in operator-free properties and drive their expansion. They were followed by real estate companies with 283 million euros (19 percent) and private investors with 241 million euros (16 percent). The share of foreign buyers rose to 63 percent, the highest level in the last 10 years, indicating a growing international interest in the German hotel market.

The value-add strategy remained the dominant investment strategy in the current year, accounting for 44 percent of the transaction volume to date. At the same time, the core segment recorded significant growth and achieved a share of 25 percent of transaction activity.

The trend towards larger transactions continued: In the first three quarters, eleven deals with a volume of more than 50 million euros each were recorded – more than twice as many as in the same period last year (five transactions). As a result, the average lot size rose by 61 percent to 26.7 million euros.

57 percent of the total hotel volume was accounted for by the top 7 markets. The strongest hotel investment market so far this year has been Berlin with a share of 22 percent of the total volume (322 million euros), ahead of Munich with 18 percent (276 million euros) and Cologne with eleven percent (165 million euros).

Guidance for the full year 2025

“Investors’ interest in hotel real estate as well as product availability and the deals already in the transaction process allow a positive view of the hotel investment market. In 2025 as a whole, an investment volume of a good two billion euros is likely,” Rickmers expects.