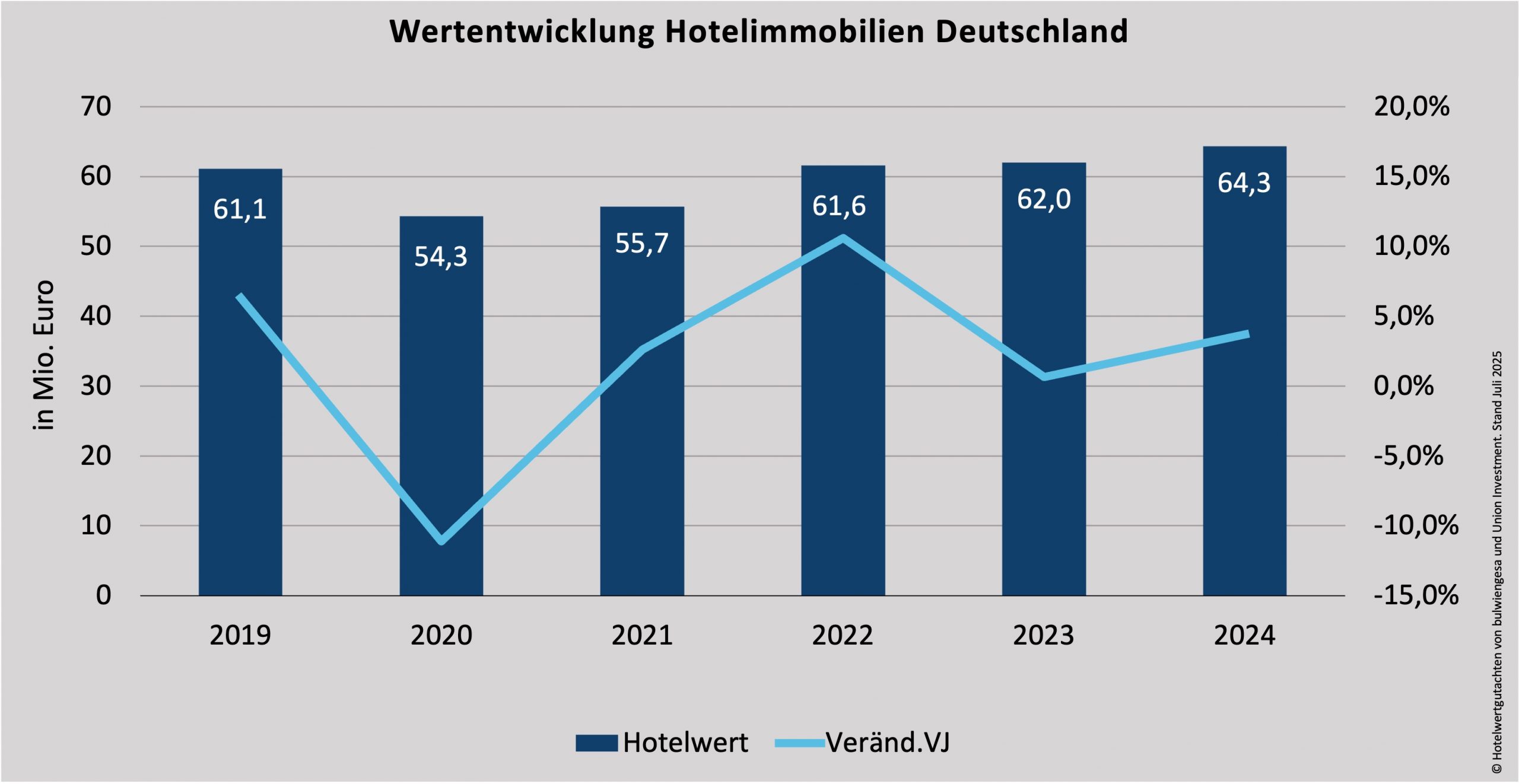

Investment-relevant market volume rises to EUR 64.3 billion

The German hotel investment market has achieved a turnaround. The first half of 2025 shows positive market dynamics and the half-year transaction volume for hotel properties is significantly higher than the level of the past four years. Both domestic and foreign investors are increasingly active in the German market again. Even though the political and economic environment worldwide remains challenging, the good figures on the hotel markets in particular ensured stronger confidence on the investor side. In 2024, a new record of 496 million overnight stays was registered in Germany. The number of overnight stays has thus risen for four years in a row. The positive trend in demand was reflected, among other things, in significantly improved occupancy figures of German hotel businesses, even though the margins of many operators continue to suffer from high cost pressure.

The trade fair and congress business, as well as major events such as concerts and the European Football Championship, drove up occupancy rates in city hotels in 2024, while the holiday hotel industry benefited from domestic tourism. As a result, the revenue-related performance indicators of the hotel industry in 2024 were almost back to pre-Corona levels.

The positive development of the hotel market was also reflected in the performance of hotel properties last year. According to the calculation carried out by Union Investment and bulwiengesa, the investment-relevant portfolio of hotel properties (excluding new developments) in Germany increased in value by an average of 1.5 per cent.

In the past year, the decline in construction activity has also become clearly visible in the hotel segment. As a result of the years 2022/23, in which project developments were initially put on hold in many cases due to the challenging financing and cost situation, the bulwiengesa Development Monitor now shows around 450,000 sqm of hotel space in 2024. However, depending on location criteria, property and concept characteristics as well as the operator qualities, a significantly higher investment relevance can be determined for the completed hotel rooms than in previous years. Overall, around 80 percent of all hotel rooms built in 2024 meet the investment requirements of institutional investors and thus made a significant contribution to the performance of German hotel properties.

Positive performance

As a result, a total value of existing and new-build properties of EUR 64.3 billion can be calculated for the German hotel real estate market at the end of 2024, which represents an increase of 3.7 percent compared to the property value from 2023 (EUR 62.0 billion). “The fact that in 2024 the upscale segment (4-star without luxury) accounted for about 60 percent of all completions and that not only capacity utilization but also RevPar developed extremely dynamically here had a positive effect on performance,” says Sabine Hirtreiter from bulwiengesa. “However, the fact that the 4-star category has the highest completion figures in 2024 is crucially due to the fact that serviced apartments were included here due to comparable lease rates.”

Example heading

The average value per room rose to 152,000 euros in 2024 (+ 4.8 percent year-on-year) due to the growth in investment-relevant units and was thus above the pre-Corona level for the first time (2019: 150,800 euros). Depending on the location, year of construction and operator concept and quality, the value range of a hotel room ranges from an average of 136,500 euros in the budget/economy segment to 284,000 euros in the upper upscale/luxury hotel industry. In the upper upscale segment in particular, above-average increases in room revenues were achieved last year due to significantly improved occupancy rates, which is reflected proportionately in a significant increase in value.

Serviced apartments outgrowing their niche

Serviced apartments have recently gained in importance. These commercial residential/lodging concepts with a focus on long-stay were responsible for about 29 percent of all completed rooms. “During the pandemic, the segment has positioned itself as a confident winner due to its crisis resilience. The performance figures impressively show that serviced apartments have now outgrown their niche,” says Martin Schaller, Head of Asset Management Intercontinental at Union Investment. The occupancy rate in this segment in 2024 was an average of 81 percent and the ADR (Average Daily Rate) was 91 euros, according to the consulting firm Apartmentservice. Operator chains such as Numa, Stayery, Bob W. or Limehome are currently taking a strongly expansive path with a focus on digitizing processes,” says Martin Schaller.

Serviced apartments and hotels are increasingly seen as a solution for conversion projects. In 2024, for example, changes of use accounted for ten percent of the total volume of hotel rooms realized. Potential areas for changes of use arose in particular in many locations dominated by offices, in which the addition of other types of use is to ensure an improved mix and lively quarters in the future. “In general, however, the following applies: whether the conversion can be carried out profitably depends largely on the building substance, the actual demand for hotel beds and the flexibility of the future operator,” emphasizes Martin Schaller.