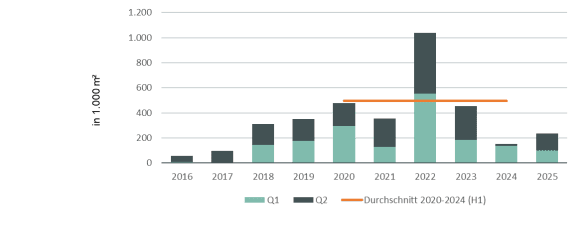

Take-up of 235,300 square metres* in the first half of 2025 – 53 per cent more than in the same period last year

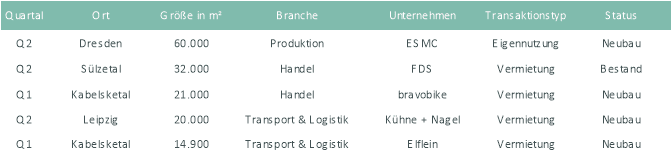

The industrial and logistics real estate market in Central Germany recorded take-up of 235,300 square metres in the first half of 2025, 53 per cent higher than in the same period of the previous year. ESMC’s own use in Dresden, which comprised 60,000 square meters of new construction space, had a major impact on the result. Nevertheless, take-up of space declined both in new buildings (minus 15 percentage points to 72 percent) and in the form of owner-occupancy (minus 28 percentage points to 41 percent). These are the results of a recent analysis by the global real estate service provider CBRE. The Central Germany market area examined includes the regions of Leipzig/Halle (102,500 square metres, down 16 per cent), A4 Saxony (71,600 square metres, up 616 per cent), A4 Thuringia (29,600 square metres, up 77 per cent) and Magdeburg (31,600 square metres, up 532 per cent).

“Even though take-up in the first half of 2025 developed positively compared to the previous year, the market dynamics remained mixed. The market area along the A4 in Saxony has developed most positively – not only due to ESMC’s own use in Dresden,” says Mirko Baumann, Team Leader Industrial & Logistics East Germany at CBRE.

This is reflected, among other things, in the development of the vacancy rate, which has increased by 6.1 percentage points to 9.1 percent within the industrial and logistics real estate market in Central Germany over the past twelve months due to restrained demand. However, along the A4 in Saxony – i.e. in the Dresden area – the vacancy rate at the end of the second quarter of 2025 was only 3.4 percent. Within the market area, clear regional differences are therefore recognizable.

“With regard to the Leipzig region, we continue to expect a positive development locally – despite the large number of new construction sites currently available in Leipzig. Because as soon as the economy picks up speed again, interest in Central Germany and then initially in Leipzig should quickly pick up speed again,” says Baumann.

With the exception of the A4 Saxony market area (up two percent to 6.10 euros per square meter), prime rents fell slightly everywhere: minus three percent to six euros in Leipzig/Halle, minus three percent to 5.80 euros in the A4 Thuringia area and minus four percent to 5.50 euros in Magdeburg.

The focus of the market activity was on the take-up of space by production companies (up 29 per cent to 96,800 square metres). Retailers (including online retailers) also recorded a significant increase of 135 percent to 59,100 square meters. Logistics and transport companies had take-up of space, which increased by 48 per cent to 79,500 square metres.

Outlook for the rest of the year

“For the year as a whole, there are signs of take-up that is unlikely to be below the level of 2024 at around 450,000 square metres at the time,” Baumann expects. “Central Germany currently offers the greatest potential for large-scale project developments, so tenants will find a good selection that they do not have in western or southern Germany.”

*Outside of the top 5 markets, CBRE only records deals of 5,000 square metres or more.

Logistics market in Central Germany: take-up of space (letting and owner-occupancy)