Rental growth in the second half of 2025 will be lower overall than in the previous year

Growth in residential rents slowed down in the second half of the year. However, the individual cities show extremely different developments. The range ranges from a growth of nine percent in Hamburg to a stagnation of asking rents in Berlin. Purchase prices for condominiums, on the other hand, are rising somewhat more strongly than in the previous year, especially in existing buildings.

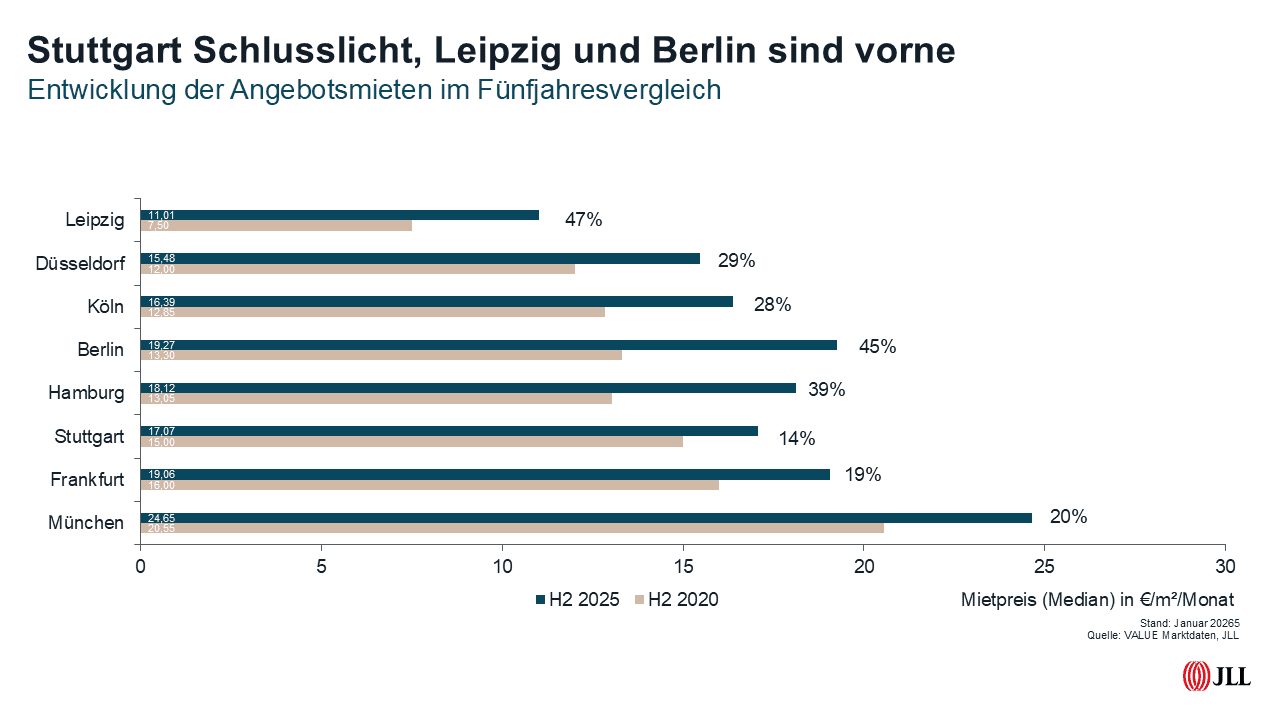

In the eight cities surveyed – Berlin, Düsseldorf, Frankfurt, Hamburg, Cologne, Leipzig, Munich and Stuttgart – asking rents rose by an average of 4.4 percent year-on-year (median). In the second half of 2024, the rent increase was still 7.7 percent. The median asking rent is 18.17 euros/m². By far the cheapest apartments are still available in Leipzig. Here, an average of 11.01 euros/m² is called. On the other hand, apartment hunters in Munich have to pay more than twice as much (24.65 euros/m²).

In the independent cities outside the metropolises, rent growth was slightly lower at 3.4 percent. Here, too, the growth rate of the previous year (3.9 percent) was undercut. Asking rents in the rural districts, on the other hand, showed a more dynamic development at 4.4 percent (previous year: 2.9 percent).

A total of around 35,000 rental offers and 41,000 purchase offers were evaluated for the analysis. Both new buildings and existing buildings were considered.

The flattening of total rents in the metropolises was mainly driven by the development of rents for new buildings. While rents for existing apartments on offer rose by 5.1 percent, the surcharge for new buildings was only 0.7 percent. In the previous year, the average rents for new buildings still recorded an increase of 7.4 percent. Dr. Sören Gröbel, Director of Living Research at JLL Germany, assesses the market development: “With a lower supply of new apartments and an increasing proportion of rent-controlled apartments, not only is the volatility of rent development increasing, but also the influence of individual completed properties. As a result, the development of new-build rents is more strongly influenced by the specific characteristics of the properties than by the actual market development.”

The development of new building rents was dominated by Berlin. In the federal capital, asking rents fell by a median of 4.4 percent, or by 1.5 percent after adjusting for quality. In contrast, the other cities showed strong growth in some cases: Particularly significant rent increases were observed in Düsseldorf (9.7 percent), Hamburg (7.6 percent) and Munich (6.6 percent (both adjusted for quality).

In absolute terms, Munich remains by far the frontrunner in new construction rents with a median new construction rent of 26.44 euros/m², followed by Hamburg (23.50 euros/m²), Stuttgart (22.37 euros/m²) and Berlin (21.50 euros/m²). At 14.04 euros/m², Leipzig continues to be the rental housing market with the cheapest average rents for new buildings among the cities analysed.

Berlin distorts the development of rents

In the high-price segment, the rent increase in the second half of 2025 was lower than in the market as a whole. On average, prime rents in the metropolises grew by 2.2 percent and thus at the level of the previous year. In contrast, rents in the lower rent group rose by an average of 7.7 percent, significantly more than in the previous year (5.7 percent).

This development is particularly clear along the rent distribution in Berlin. While the upper segment declined (minus 2.3 percent), new contract rents in the lower rental price segment recorded a significant increase of 13.1 percent and currently stand at 11.43 euros/m². “With a spread of 15.4 percentage points between the upper and lower rental price segments, Berlin thus shows the clearest distortion along the rental distribution of all the markets analyzed,” Gröbel emphasizes.

No major changes in rental dynamics are expected in 2026

In 2026, growth in new contract rents will continue as a result of too little new construction activity, but will selectively lose momentum. On the one hand, it is to be expected that purchasing power will develop less strongly after the significant growth in 2025 and thus influence the affordability of the rental housing market. On the other hand, affordability has already been identified as a limiting factor in the upper rent segments. “A decreasing feasibility of higher rents in the premium segment was already emerging as an early indicator in 2025. Slight corrections in the new contract rents offered, such as those observed in the Berlin rental housing market, also reflect this,” explains Gröbel.

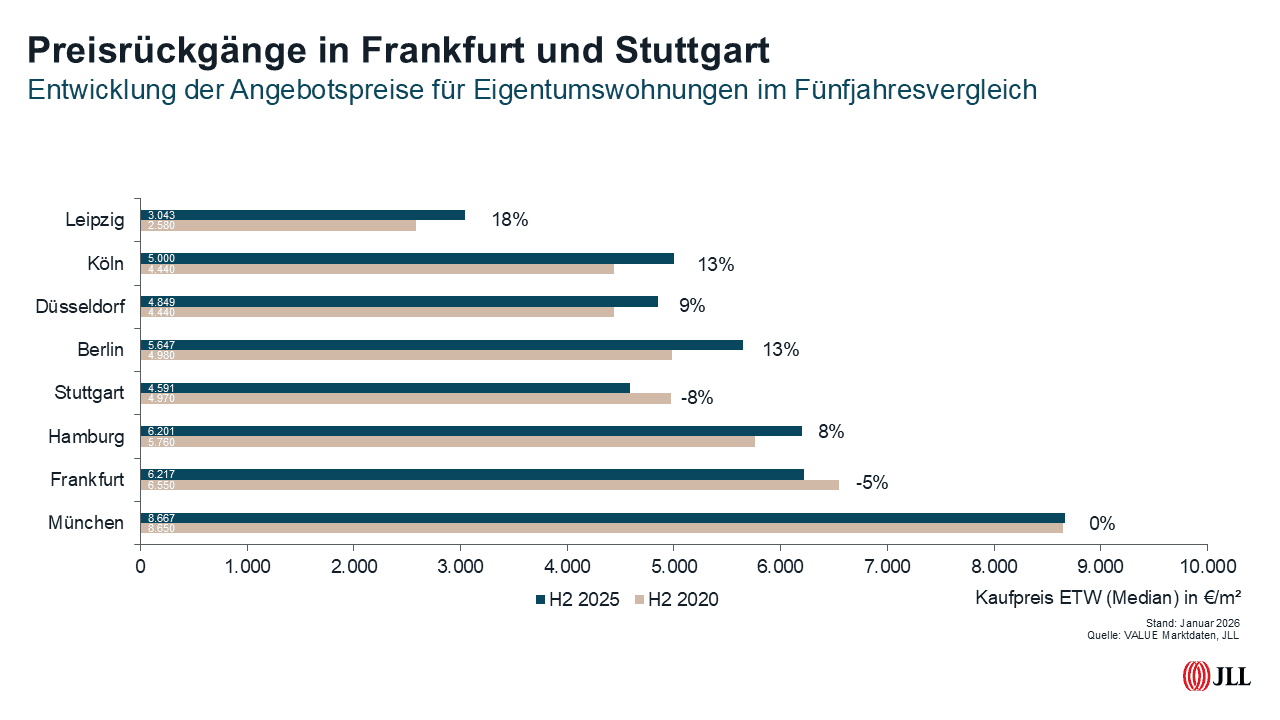

Purchase prices for condominiums are rising more sharply again

Overall, however, there has been an enormous increase in rents over the past few years. On average, rents rose by 42.3 percent over the five-year period. Because the purchase prices for condominiums have risen only moderately in the same period, the ratio of rental and purchase costs has also converged again. This is one of the reasons for the positive development of the condominium market in 2025. On average, there was a price increase of 1.7 percent to an average of 5,527 euros/m². This means that the price increase for condominiums has continued to accelerate slightly, after a decline of 0.7 percent compared to the previous year’s figure was observed last year.

Existing apartments played a significant role in this, rising by 3.1 percent in the second half of the year compared to the median figure of the previous year, after a decline of 0.5 percent in the previous year. The highest price level is in Munich at 8,275 euros/m², followed by Frankfurt (5,923 euros/m²) and Hamburg (5,614 euros/m²). Instead, purchase prices for new-build apartments are in a sideways movement with an increase of 0.2 percent. The most expensive apartments in this segment are once again in Munich with an average of 11,291 euros/m², ahead of Hamburg (8,946 euros/m²) and Stuttgart (8,169 euros/m²).

Marketing advantages for existing apartments

“While prices in the existing segment have fallen more sharply in recent years than in the new construction segment, where prices are less flexible due to the link to production costs, the opposite picture is now emerging in the beginning of the upswing phase with a more dynamic development in the existing segment,” says Roman Heidrich, Lead Director Residential Valuation JLL Germany, summarizing the results.

The residential property market received an additional boost in 2025 from the limited availability on the rental housing markets, which led to shifts in demand. This development is also reflected in an accelerated sales velocity. While the average supply period of existing apartments decreased by 12.4 percent in 2025 compared to the previous year, it was only 4.9 percent for new-build apartments. “The average duration of the offer already illustrates the differences in marketability: While existing apartments have to be marketed for an average of around 13 weeks, it is about 23 weeks for new-build apartments,” says Heidrich.

He assumes that the condominium market will continue to improve in 2026. However, no additional impetus is to be expected from the financing costs. “Interest rates will remain stable in 2026 or are even likely to rise slightly. So the recovery process could prove to be lengthy.”

Asking rents and asking purchase prices are evaluated from value market data, which are characterized by particularly broad market coverage. In doing so, JLL analyses all rent and purchase price offers of the free housing market concluded at the respective time of consideration and presents them as median values. The respective twelve-month periods are considered. The presentation of the analysed data sets extends to the district level, differentiated into building age classes and apartment sizes. Further detailed evaluations are available on request.

* In the quality-adjusted consideration of price developments, the changes in the data sets of the half-years with regard to the condition and equipment of the properties as well as with regard to the micro-locations are excluded using a hedonic approach. All trends are checked for validity, even if this is not explicitly mentioned in the text.