Joint study by JLL and Munich Re shows need for action for owners

Climate change is becoming the biggest risk factor for commercial real estate. Increasing extreme weather events cause high losses, reduce property values and cause insurance costs to skyrocket. According to a joint study by JLL and Munich RE, insurance premiums for office buildings have risen by an average of eight to twelve percent per year since 2018 – well above the inflation rate. In the years 2022 to 2024, many office properties even recorded premium increases of 15 to 25 percent. On average, they are currently between 1.20 euros/m² and 1.80 euros/m² per year, and almost 2.00 euros/m² for high-quality office buildings with fully comprehensive insurance. “Insurance costs are the fastest-growing type of cost for commercial real estate. Owners need to address this and invest in the resilience of their buildings to protect assets,” says Helge Scheunemann, Head of Research at JLL Germany.

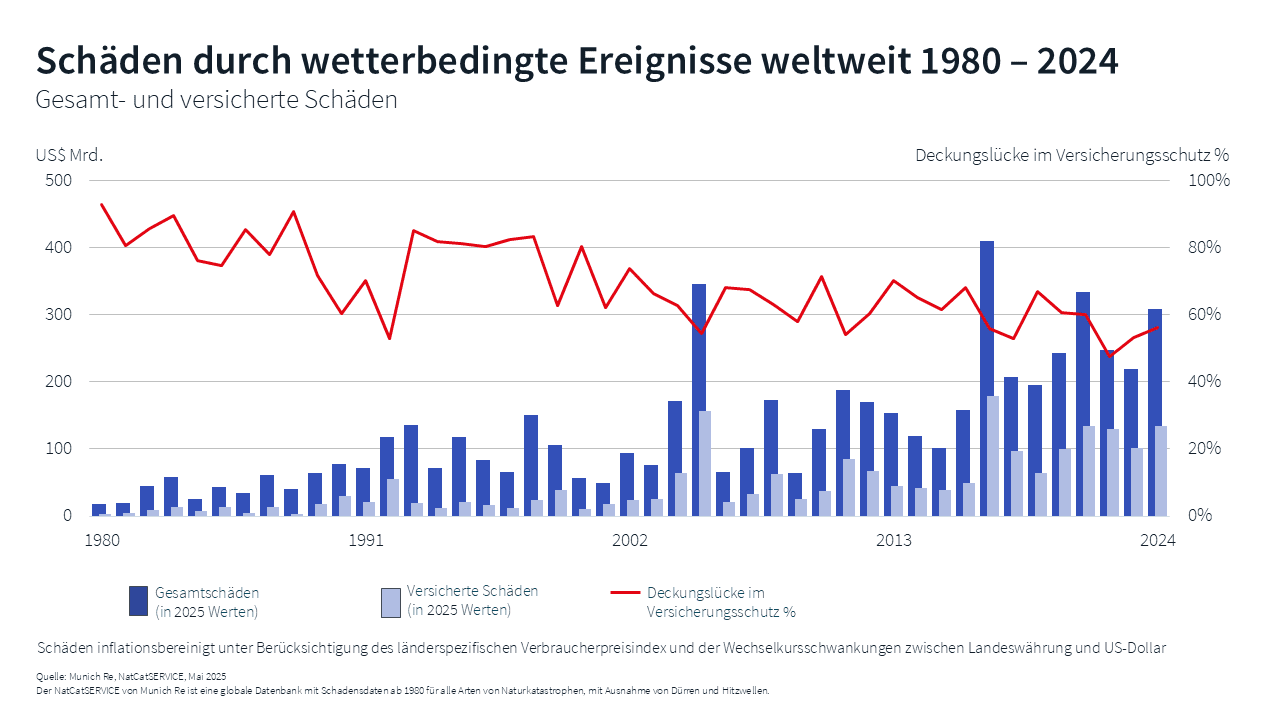

In the first half of 2025, total losses from natural catastrophes worldwide totalled US$ 131bn, the second-highest figure since the survey began in 1980. Almost 90 percent of this is due to extreme weather events such as storms, hail and floods. However, a significant part of the damage is not insured. The coverage gap was recently almost 60 percent. “Full insurance cover has now become very expensive. The owners of real estate therefore need an adaptation strategy and should actively pursue climate risk management,” advises Scheunemann.

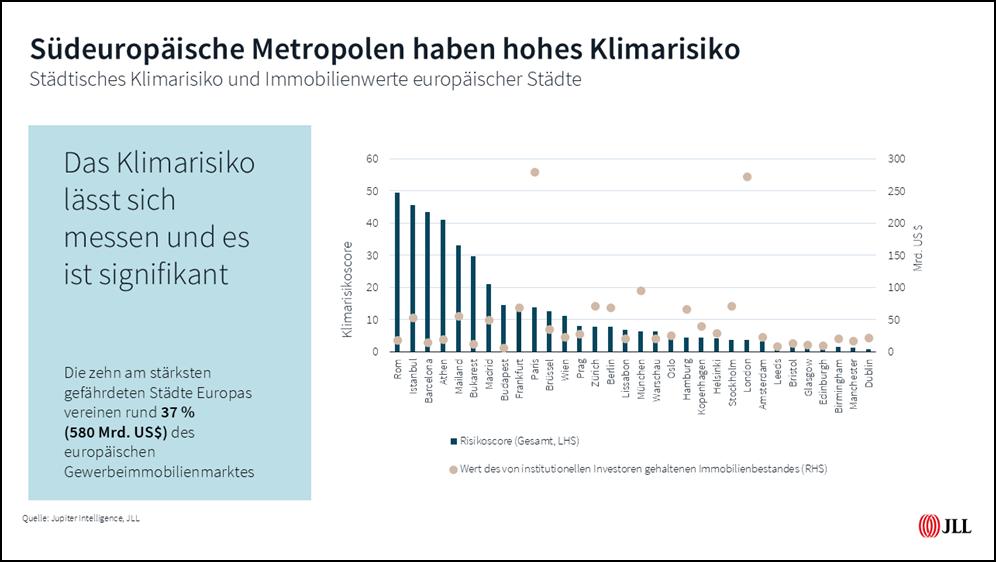

Locations near the coast are particularly at risk. But there is also a risk of severe damage in the interior as a result of overflowed rivers, severe storms, heat waves and droughts. JLL has analysed the climate risk for European metropolises. According to the report, the ten most vulnerable cities, including Frankfurt, Berlin and Munich, combine real estate values of 580 billion US dollars – more than a third of the entire European commercial real estate market.

Investors assess climate risks in their purchase reviews

“As investors increasingly incorporate physical climate risk into their due diligence and investment strategies, vulnerable cities and municipalities are increasingly under pressure. This is especially true for those municipalities with extensive institutional real estate portfolios. They are called upon to take adaptation measures to protect private and public assets,” says Scheunemann. These could be, for example, investments in flood protection and early warning systems as well as more intelligent land use.

Banks are also dealing with the consequences of climate change. In an expert survey conducted in autumn 2024, only a third of respondents considered the potential effects of extreme weather events to be important or very important when assessing the risk of real estate financing. In the long term, however, the importance will increase significantly: the proportion of respondents who attach very high or high weight to these criteria in risk assessment in five years will double, while the proportion of those who consider extreme weather conditions to be not at all or hardly important will halve to 26 percent.

Users also look at the vulnerability of their buildings

Last but not least, building users are also sensitized to the topic. In the JLL study “Future of Work”, almost every second company surveyed said that by 2030 they would only choose buildings that can withstand extreme weather conditions. “We are witnessing a fundamental change in the valuation of real estate,” explains Martina Williams, Head of Work Dynamics at JLL Northern Europe. “Properties that are adapted today are the first-class assets of tomorrow – all others could become the lost assets.”

Physical measures such as flood protection, windproof shutters, impact-resistant windows, improved roofing, drainage, and fireproof materials can mitigate the effects of extreme weather events. Through adjustments, property owners can better protect their assets from longer-term risks and manage future insurance costs.

“Despite high initial costs, continued investment in resilience and energy efficiency measures will pay off in the long term through lower insurance premiums and more stable deductibles. Adapting to climate change is becoming an unavoidable necessity and a significant opportunity that investors can no longer ignore,” Williams said.