Take-up halved compared to the previous year

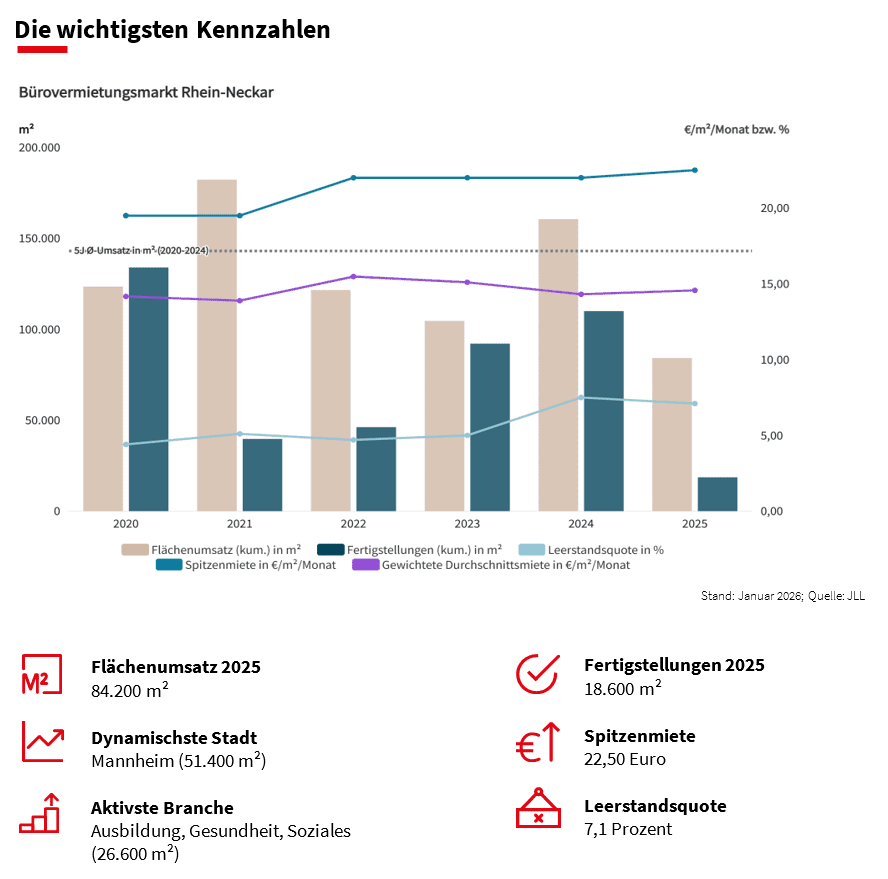

After a strong office leasing year in 2024, the Rhine-Neckar metropolitan region suffered a significant setback in 2025. In the cities of Mannheim, Heidelberg and Ludwigshafen, deals totalled 84,200 m² – a decline of almost half (160,600 m²). Compared to the five-year average, the minus has a similar dimension of 41 percent.

In all three cities, take-up was lower than in the previous year: in Mannheim by 21 per cent to 51,400 m², in Heidelberg by 47 per cent to 24,900 m² and in Ludwigshafen by as much as 84 per cent to just 7,900 m². However, with 48,900 m² in the previous year, this was also a historic high in the balance sheet. There was a lack of large leases across cities. Only in Mannheim did several deals make it over the threshold of 2,000 m². The largest deal was provided by the Cooperative State University with 8,000 m² at Mannheimer Straße 108, followed by the ICS Group with around 3,000 m² at Konrad-Zuse-Ring 29.

“Several larger applications have been postponed. In addition, there is currently a shortage of premium space, especially in Mannheim. We are seeing strong demand in this market segment, but too little supply, which is slowing down take-up,” comments Konstantinos Krikelis, Metro Lead Office Leasing & Investment JLL Rhein-Neckar. In 2025, only 10,800 m² of office space was completed in Mannheim, which has already been fully let. “This year, the pipeline is better filled and available new construction space will come onto the market again.”

The focus on high-quality space in central locations has once again led to a slight increase in prime rents. In Mannheim, it will be 22.50 euros/m² at the end of 2025. In Heidelberg, too, there was a moderate increase to 19.50 euros/m², while in Ludwigshafen it fell by two euros to 14 euros/m².

Despite the low take-up, the vacancy rate in the region has fallen slightly. In Mannheim, it is by far the highest at 10.1 percent. In Heidelberg, the rate is 5.4 percent, in Ludwigshafen only two percent. “However, the low vacancy rate in Ludwigshafen is not due to demand, but to a lack of supply,” Krikelis emphasizes. There were no completions in 2025, but in 2026 12,000 m² will be added to the office market, but it has already been fully let. In addition, the office space stock has been reduced by 16,000 m² due to the demolition of the Rathaus-Center.

Krikelis expects low take-up in Ludwigshafen this year as well. In Mannheim and Heidelberg, the rental result is likely to pick up again, provided that the postponed major searches are completed.