Take-up just misses previous year’s level

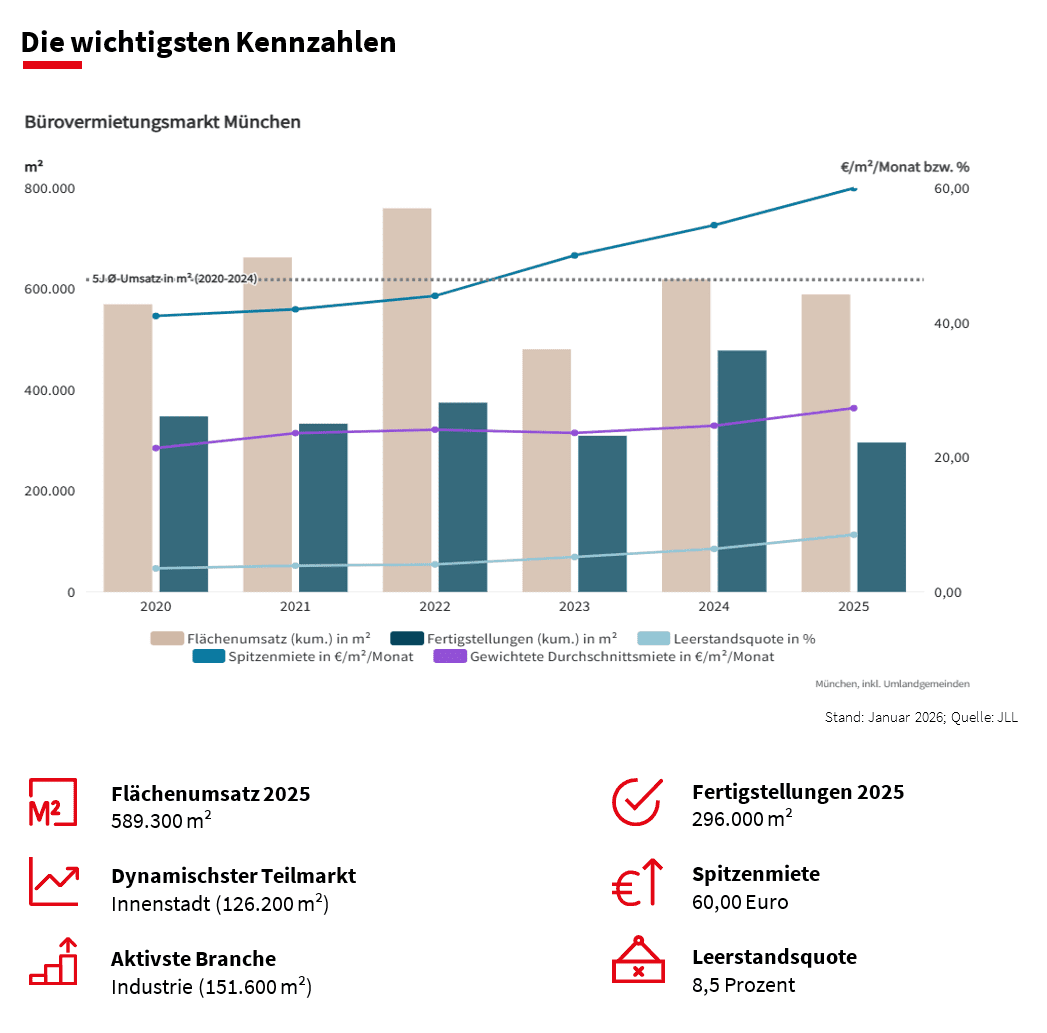

Despite a good final quarter, take-up on the Munich office market fell slightly in 2025. A total of 589,300 m² of lettings were registered. This is five per cent less than in the previous year (619,600 m²) and than the five-year average (618,600 m²). Compared to the ten-year average (736,800 m²), however, the difference is already more significant.

Market activity has increased from quarter to quarter. With 207 deals and take-up of 173,600 m², the fourth quarter was the strongest. “And that’s despite the fact that one or two major deals didn’t make it over the finish line by the end of the year,” emphasizes Fritz Maier-Hartmann, Senior Team Leader Office Leasing and Branch Manager at JLL Munich. In total, this amounts to around 75,000 m², which will ensure a corresponding take-up in the first months of 2026.

In 2025 as a whole, 682 rentals were registered, 36 fewer than in the previous year (718). Slightly more than one in two was in the size class of less than 500 m². Six deals exceeded the 10,000 m² mark, including the lease of Siemens in the Werksviertel with around 33,000 m² and Thüga AG with 14,000 m² in the Bruckmann Quarter, corner of Nymphenburger Straße 84-86, Lothstraße 3-5. The most popular sub-markets were the city centre (126,200 m²), east (113,200 m²) and Westend (59,100 m²).

“Not only the absolute top locations in the city centre are in demand, but also well-connected districts and streets such as the Werksviertel. However, everything outside the main line of the S-Bahn is having a hard time and is struggling with structural vacancies,” says Maier-Hartmann. At 16 percent and 13.2 percent, the vacancy rate is by far the highest in the North and East submarkets. Across the market as a whole, the rate is 8.5 percent.

In the very good inner-city locations, on the other hand, the available space is scarce, which continues to put pressure on prime rents. This has risen by more than five euros within a year and has now reached the threshold of 60 euros/m². Maier-Hartmann expects this development to continue: “In particular, the group of business-related services ensures that the prime rent is driven up.”

For 2026, Maier-Hartmann expects a further increase to 62 euros/m². The forecast for take-up is 680,000 m². Meanwhile, completions are expected to decline from 296,000 m² in 2025 to 190,400 m².