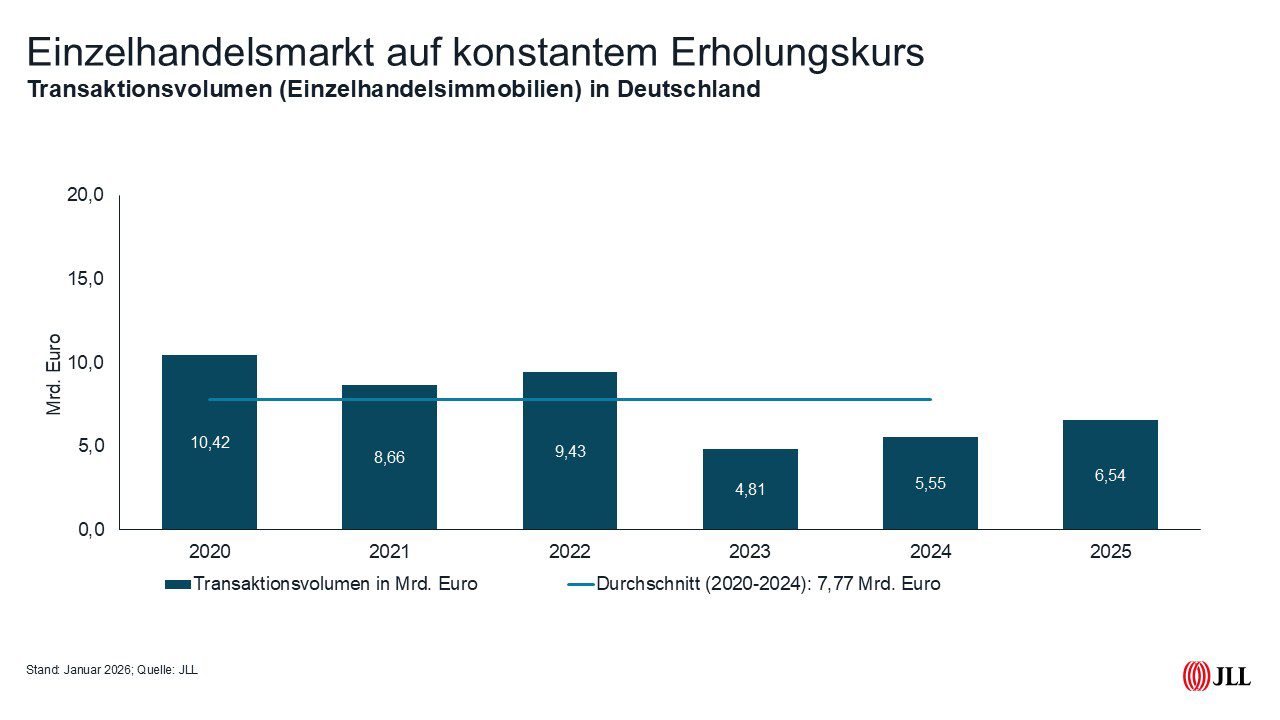

Strong fourth quarter generates year-on-year increase of one billion euros

The investment market for retail real estate continued its recovery and, at EUR 6.54 billion, achieved a transaction volume of around EUR 1 billion more than in the previous year – an increase of around 18 percent. After the significant dip in 2023 and the slight improvement in 2024, the market is now visibly working its way back to its own five-year average of 7.78 billion euros and is now only 16 percent below. At the same time, the number of transactions rose significantly from 209 to 248.

“The final spurt in the fourth quarter with a volume of 2.35 billion euros in particular led to this renewed growth. It is also the strongest single quarter of the past three years and shows how the market is gradually working its way out of the trough and attracting more investors again,” says Sarah Hoffmann, Head of Retail Investment at JLL Germany. “At the same time, the momentum has increased noticeably, because with 79 transactions, the final quarter of 2025 is also the strongest single quarter of the past three years. The next step now would be to keep this level as constant as possible over the year.”

The number of major transactions has remained constant at ten compared to 2024, but the total volume of these transactions has risen by more than ten percent from 2.64 billion to 3.03 billion euros.

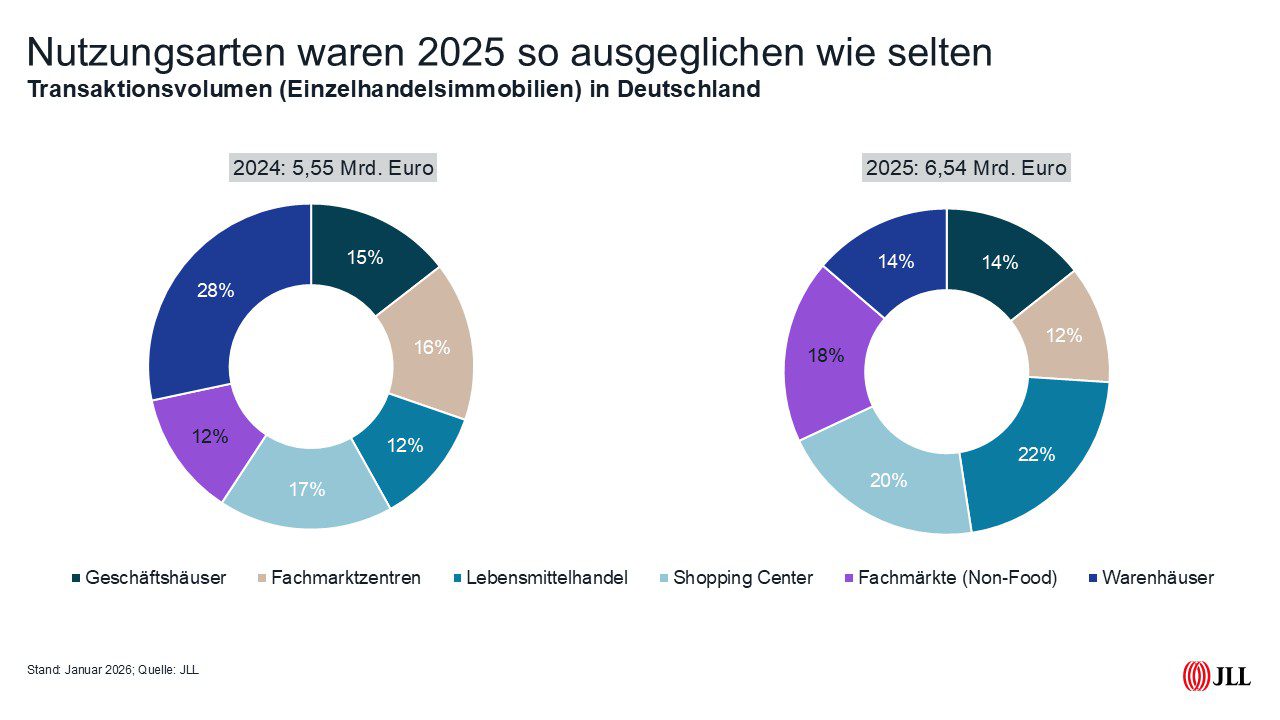

“In contrast to previous years, however, in 2025 there was no particular type of use in the focus of investors, but there was broad interest in all categories and their respective investment advantages,” observes Hoffmann. Although food-anchored markets lead the field, this time a 22 percent share of the transaction volume is enough for the top position. Meanwhile, specialist stores without a food content achieve 18 percent and retail parks twelve percent, so that together specialist retail park products account for 52 percent and thus just over half of the total volume. Shopping centers come in second place among the individual types of use with 20 percent, while commercial buildings and department stores are tied at 14 percent.

Where possible, investors tried to minimise risk and invested 46 per cent in core products and a further 27 per cent in core-plus properties. Value-add transactions accounted for 23 percent of the volume, while opportunistic properties accounted for only five percent. This may not seem like much, but at the same time it is the highest proportion in the past five years.

Private investors achieved a 22 percent market share on the buy-side last year

In the buyer structure, private investors stood out in particular with 22 percent last year. Even though they rank second behind asset and fund managers (38 percent), it is by far the highest rate in recent years and a multiple of the five-year average of six percent. “Private investors are primarily focusing on commercial buildings in Germany’s top locations and are currently taking advantage of the increased sales plans of institutional players. Properties are also traded in the 1a locations of the B and C cities, where regional private investors in particular have a chance,” says Sarah Hoffmann. “The transaction of the Schuster sports store in Munich’s city center is an ideal example of this, as private investors were involved on both the buyer and the seller side.” Corporates also account for a double-digit share of 19 percent.

On the seller side, private investors are even closer to the front-runner asset and fund manager at 23 percent, which accounts for 25 percent. However, real estate companies also play an important role here with a share of 19 percent, ahead of corporates, which account for 13 percent.

Meanwhile, the ratio of German and foreign buyers is constant. Here, domestic investors (53 percent) are once again just ahead of the international competition. The sell-side, on the other hand, is much more volatile, with foreign investors accounting for the majority of sales in 2024 for the first time in years at 58 percent. In the past year, however, the pendulum swung back again and German investors accounted for 61 percent of the market on the seller side. Foreign investors thus expanded their holdings in Germany by around half a billion euros on balance.

High-street yields remain stable since the fourth quarter of 2023

Prime yields in the central prime locations have remained constant throughout, as they have been since the fourth quarter of 2023. Commercial buildings in Munich have the lowest prime yield at 3.2 percent. This is followed by Berlin and Hamburg with 3.4 percent, ahead of Frankfurt (3.5 percent) and Düsseldorf (3.6 percent). The field of seven metropolises is completed by Stuttgart and Cologne with 3.7 percent each.

Retail parks (4.60 percent) as well as shopping centers and individual specialty stores (5.90 percent each) also kept their prime yields constant throughout the year. “This reliability makes retail real estate particularly interesting for many investors because it allows for greater predictability. Here, the asset class benefits from the fact that many changes already began at the beginning of the pandemic and not only after the Russian attack on Ukraine, thus enabling a time advantage for the new price discovery, which is now paying off as stability,” explains Hoffmann.

Outside the seven core cities, favourable real estate in top locations of attractive cities continue to realize factors around the 20-fold – but these remain exceptional. “Most transactions are in the range of ten to 15-fold factors. In December alone, our house accompanied five transactions with multi-story textile retailers outside the seven metropolises,” summarizes Sarah Hoffmann.

“For 2026, we expect a slight increase in transactions for commercial buildings with a continued strong price spread between A-locations and locations outside these markets. The importance of sustainability in building fabric, location and rents is becoming more and more important and is very much highlighted by investors as well as financiers.”