Major deals postponed to 2026

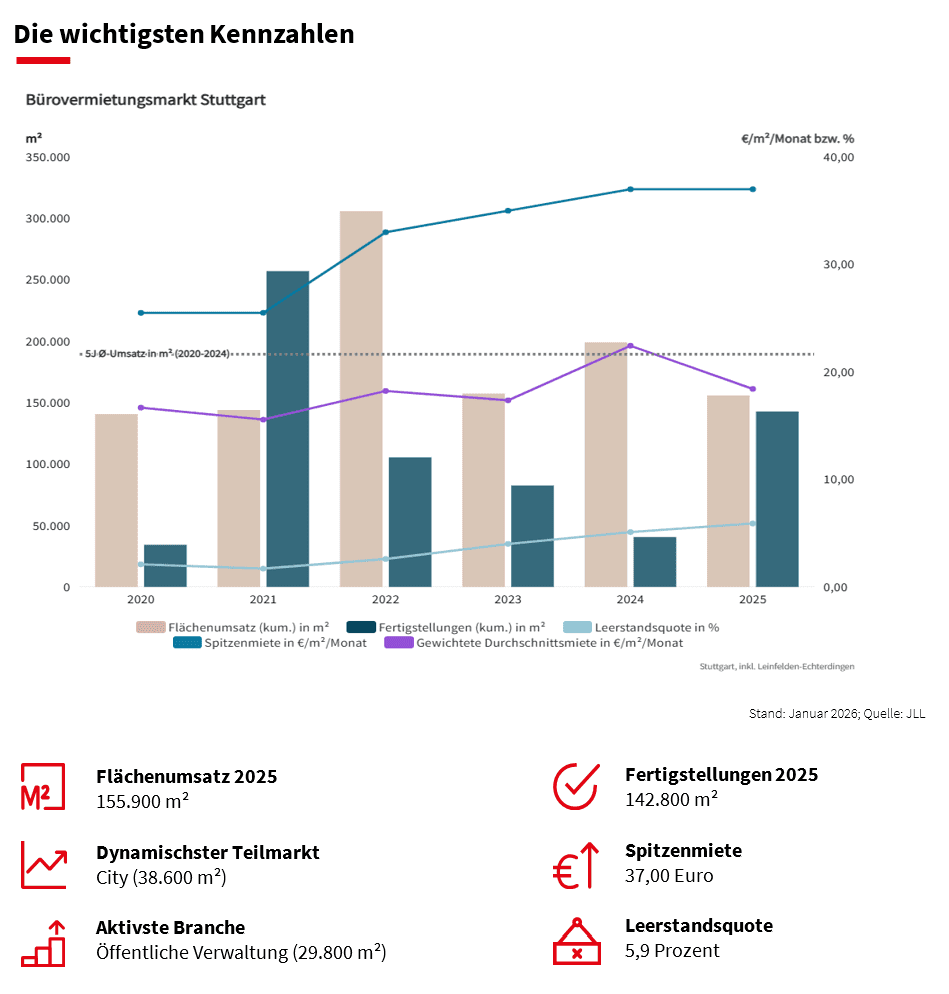

A weaker half-year has led to a decline in take-up on the Stuttgart office market in 2025. While the letting result after the first six months of the year was 101,000 m², just above the previous year’s figure, the total amount at the end of the year stood at 155,900 m². This corresponds to a decline of 22 percent compared to the previous year (199,100 m²); the five-year average was missed by 18 percent, the ten-year by 36 percent.

In 2025 as a whole, there were 206 leases, slightly fewer than in the previous year (215). With a share of 61 per cent, lettings of space in the range of less than 500 m² dominated. The strongest sub-markets were the city with 38,600 m² and Vaihingen-Möhringen with 38,000 m² take-up. Most of the turnover was generated by the public administration (29,800 m²) and industry (28,700 m²) sectors.

“The current economic slump is being felt particularly by Stuttgart as a business location with its high proportion of industry. In combination with geopolitical uncertainties and a lower space requirement as a result of hybrid working models and the prospect of increasing AI integration into work processes, there is significantly less demand for office space overall,” explains Georg Charlier, Branch Manager JLL Stuttgart.

In particular, major deals have been missing recently. Only two leases made it above the threshold of 10,000 m² in the year as a whole: Daimler Truck with 12,700 m² in Vaihingen-Möhringen and the Office for Social Affairs and Participation with 11,500 m² in Stuttgart-West.

Nevertheless, Charlier expects that such major deals will occur more frequently in the future. Several applications are already on the market or are being pitched: for 2026, take-up should therefore exceed the 200,000 m² mark.” He expects moderate growth in prime rents. It is currently 37 euros/m². “In the case of new construction projects, 40 euros/m² are already being discussed in the rent negotiations, but there is still a lack of corresponding agreements,” says Charlier.

However, rents are under pressure for buildings away from the top locations, which has been reflected in the recent decline in average rents. “If something is rented out in peripheral locations, it is about the price. In particular, locations in peripheral locations and with old stock are less in demand. The gap between B and C locations is widening.”