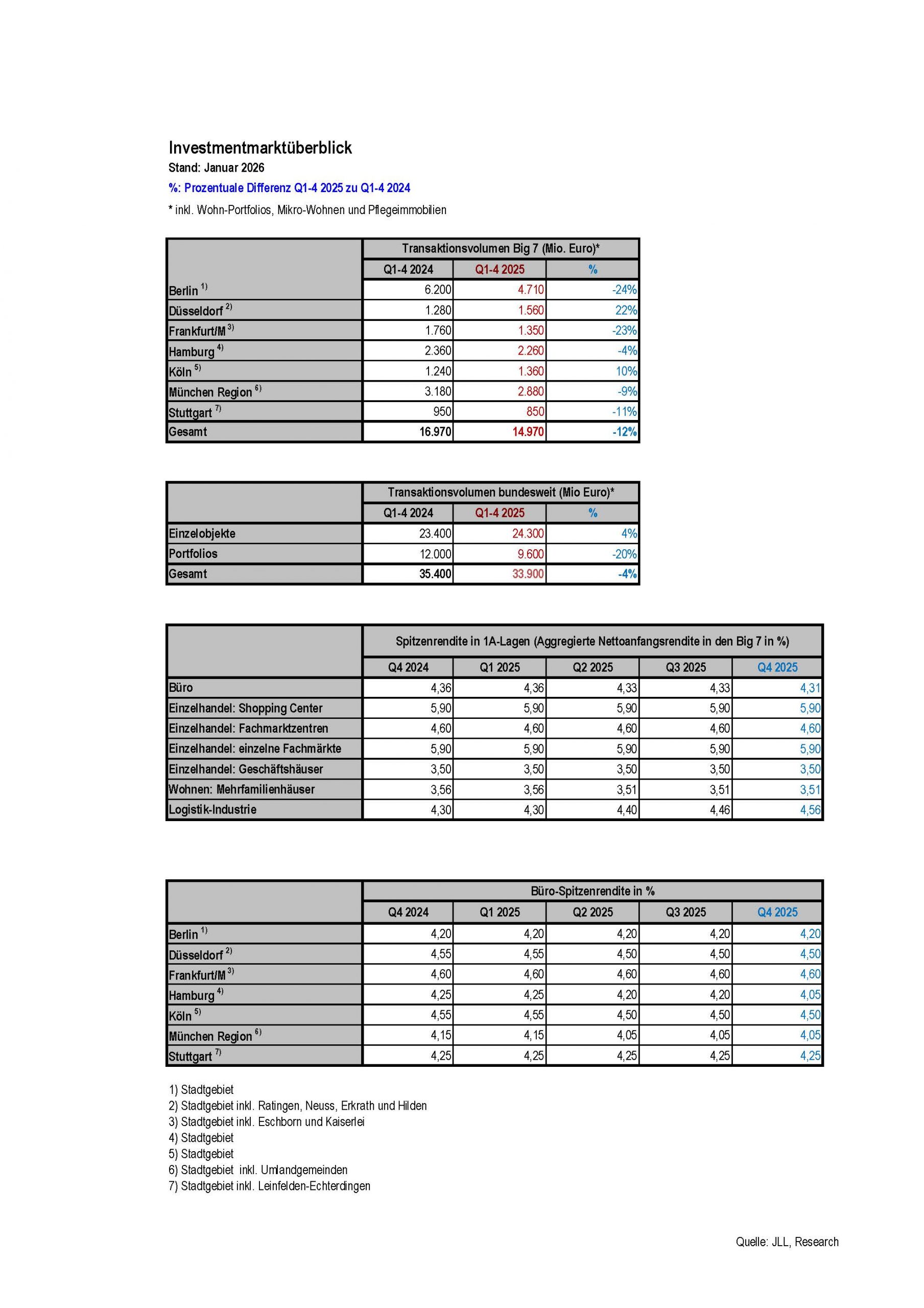

Transaction volume of just under 34 billion euros is slightly below the previous year’s level

The German real estate investment market closed 2025 with a transaction volume of 33.9 billion euros – four percent less than in the previous year. The industry is asking itself: What was it now? A good investment year? Certainly not. But not a really bad one either. Because the truth lies somewhere in between. In retrospect, not only the exogenous geopolitical and economic conditions were too unstable, but also the real estate market still lacks a sustainable trend reversal. “So in the rear-view mirror, the sober realization remains that the positive signals at the beginning of 2025 did not manifest themselves to the full extent and were ultimately only small flashes of light,” sums up Konstantin Kortmann, CEO JLL Germany & Head of Capital Markets.

“Small is beautiful” has also been the motto of investors in the past twelve months, because in contrast to the volume, the number of registered transactions has increased by ten percent compared to 2024, but the average size of a transaction has fallen from 32 million to 27 million euros at the same time. What remains is the realization that ran like a red thread through the year: Transactions beyond 100 million euros are missing. In 2025, there was also comparatively little activity with 51 deals and again significantly less than the 74 deals booked in 2024. “A look at the buyer landscape provides an explanation. Institutional investors such as insurance companies, open-ended funds, sovereign wealth funds and pension funds in particular are still holding back, and only when they venture back onto the trading floor will the investment market gain noticeable momentum,” Kortmann analyses.

Faster lending could provide positive impetus

Will they do so in the new year? “In any case, the declarations of intent are there, with Berlin, Frankfurt, Hamburg and Munich, four German cities among the ten cities with the best investment prospects named by investors in the current Emerging Trends in Europe study by ULI/PwC,” observes Helge Scheunemann, Head of Research at JLL Germany. Another signal comes from the statistics of the European Central Bank (ECB). For example, bank lending to companies in the euro zone accelerated in November 2025. Financial institutions extended more than three percent more loans to companies than a year earlier, which was the strongest increase since mid-2023. “If an increased demand for loans can be seen as a harbinger of an increased willingness to invest, this gives reason to be confident that the real estate market, which is massively determined by debt capital, will also benefit from it,” says Scheunemann.

This is also in line with the results of the Difis (German Real Estate Financing Index), which was able to make up ground in the fourth quarter and thus tended back into positive territory. Although financing rates (ten-year swap rates) rose from 2.68 percent to 2.93 percent in the fourth quarter, they are still around 50 basis points below their peak in October 2023. More movement in the international financial and interest rate markets could come in May, when US Federal Reserve Chairman Jerome Powell hands over the baton to his successor.

Sales pressure is limited for many players

Another key factor in the fact that the market has not yet regained momentum in the past year is that portfolio holders have not yet had to realise book value losses due to the continued availability of debt capital and extensions of loans, and therefore many have not exerted any selling pressure. “It is doubtful whether this will remain the case for all portfolio holders, and this could lead to an increase in transaction activity in 2026,” Scheunemann expects.

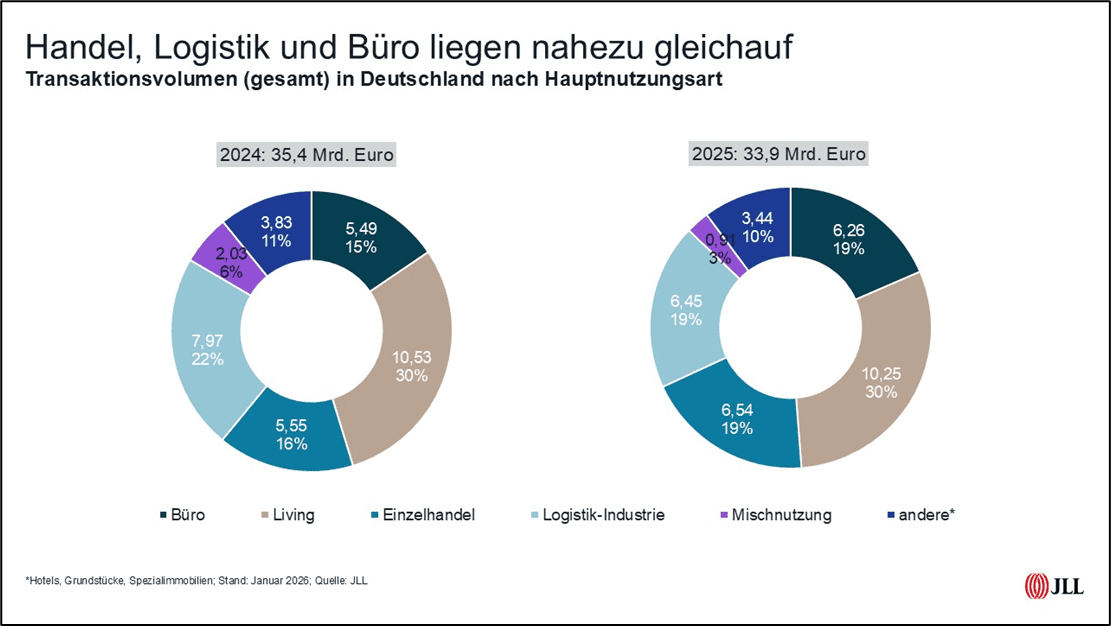

Asset classes: Living in first place – revival in retail continues

At the end of 2025, the distribution of transaction activity by asset class has changed again. Although Living is still clearly in first place in investor demand with 10.2 billion euros invested in residential real estate, nursing or student apartments and a share of 30 percent, there have been interesting shifts behind it. The slight upturn in the office market that could be observed before the end of the quarter could not be confirmed in the final quarter. In the last three months of 2025, office properties with a volume of 1.4 billion euros changed hands, almost 30 percent less than in the third quarter. Nobody expected a year-end rally, but the last quarter was ultimately only the third-best of the year. The absence of major transactions is particularly noticeable in the office segment. The largest transaction in Germany in the fourth quarter was the sale of the Spreebogen in Berlin for a high double-digit million euro amount. In the full-year result, it was enough for 6.3 billion euros and a share of just under 19 percent, and thus only fourth place among the asset classes.

Due to the two largest transactions in the months of October to December across all asset classes – the sale of the Oberpollinger department store in Munich for around 380 million euros and the Designer Outlet Center Neumünster for around 350 million euros – retail properties moved into second place. More than 6.5 billion euros were invested in this type of use in the year as a whole. In addition to inner-city department stores and commercial stores, the revival is also noticeable in the continued constant demand for supermarkets and food-anchored specialty stores.

International trade policy has calmed down somewhat after the excitement and discussions surrounding the U.S. tariff policy towards the end of the year. Retailers and logistics companies have adapted to the new realities. Ultimately, the investment market for logistics real estate also benefited from this. Real estate changed hands for 2.2 billion euros in the fourth quarter, more than in any other quarter of the year. With a cumulative total of almost 6.5 billion euros for 2025, the logistics industry sector ranks third in the ranking of asset classes. Against the background of the particular vulnerability of this sector to geopolitical and economic events, this result is positive despite the slight decline compared to the previous year. Foreign investors in particular were active and were responsible for nine of the ten largest deals of the year.

“Even though there were some transactions by traditional institutional investors in the last quarter despite general restraint, a review of the year as a whole showed a trend towards an increased commitment of long-term oriented, discretionary family offices and other private structures, which on the one hand have fast decision-making processes and on the other hand usually also have a very good equity base. However, since these buyer groups only deal with high three-digit prices in exceptional cases, they cannot completely close the gap in the market,” says Konstantin Kortmann .

Whether there will be new impetus from the topics of defence and security in 2026 depends, among other things, on how closely and cooperatively the state and the private real estate industry will work together to quickly implement the planned investments in terms of infrastructure, barracks and production capacities. “In our view, however, a significant trend will continue to shape the investment market in 2026: real estate investments must be based on the improvement of operating cash flow if they want to be successful. Relying solely on yield compression is no longer sufficient to increase or maintain value,” Kortmann expects.

Share of real estate strongholds in transaction volume declining

The seven real estate strongholds (Berlin, Düsseldorf, Frankfurt, Hamburg, Cologne, Munich, Stuttgart) recorded a total transaction volume of almost 15 billion euros in the annual result. This corresponds to a decrease of twelve percent compared to 2024. Their share of the total German volume thus fell from 48 percent to 44 percent. “Even though the development was very heterogeneous regionally, the balance sheet at the end of the year still shows that the lack of major office deals affects each of the seven metropolises. After all, the two Rhine metropolises of Düsseldorf and Cologne recorded an increase in transactions of 23 and ten percent respectively compared to 2024,” explains Helge Scheunemann. Berlin is still in first place with 4.7 billion euros despite a significant decline compared to 2024. In addition to the Upper West as the largest office transaction of the year, the capital continues to benefit from its attractiveness for residential real estate. Munich follows at a distance with 2.9 billion euros and Hamburg with 2.3 billion euros. However, the very good office leasing year in the banking metropolis should also provide more revival in the office investment market in the new year,” predicts Scheunemann.

Yields remain at their previous year’s level

The yield development on the real estate market shows little change at the end of the year, but it is inconsistent depending on the asset class.

In the case of office properties, the aggregated net initial yield in the seven metropolises fell minimally to 4.31 percent, solely due to an adjustment in Hamburg. The second movement in yields was in the logistics and industrial real estate market. After the increase in the third quarter, there was a further increase of ten basis points to 4.56 percent at the end of the year. Compared to 2024, prime yields have thus increased by an average of 26 basis points. “This price correction has been confirmed by the completed transactions in the fourth quarter, and the further development of yields is likely to be strongly influenced by when the rental markets pick up speed again,” explains Scheunemann.

The yields on government bonds are under observation, as they often serve as a point of orientation for investors. At the end of 2025, yields on the ten-year German government bond rose to 2.9 percent. Concerns about rising national debt caused prices to fall in all industrialized countries, especially in Germany. In return, yields rose accordingly. This reduced the risk premium for an office property investment to currently around 146 basis points, compared to 189 basis points at the end of 2024. Nevertheless: “Over the course of the year, investors with German government bonds made a nominal loss of more than one and a half percent due to the price decline. In such a (theoretical) comparison, real estate performs significantly better, with investors able to achieve a nominal total return of eleven percent from 1 January 2025 to 31 December 2025 with fully let top office properties. Even after deducting inflation, there is a clearly positive return in real terms,” Scheunemann calculates.

Willingness to take risks will only increase again in exceptional cases