Hamburg moves ahead of Munich to the top of the office indicator

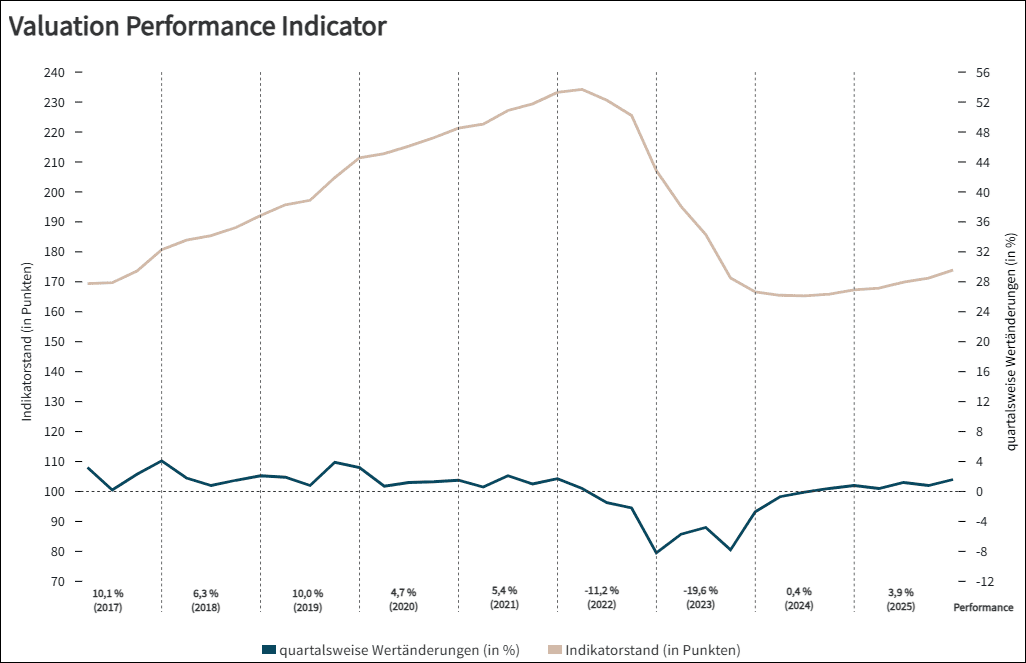

In the final quarter of 2025, the office performance indicator Victor Prime Office recorded growth for the sixth time in a row. At the end of December 2025, the indicator level for the observed top locations in the German real estate strongholds of Berlin, Düsseldorf, Frankfurt, Hamburg and Munich stood at 173.9 points, an increase of 1.6 percent compared to the third quarter. This is the best result since the fourth quarter of 2021. The performance also remains positive compared to the previous year at 3.9 percent (2024: 0.4 percent; 2023: minus 19.6 percent; 2022: minus 11.2 percent).

The development in the fourth quarter is different in the five cities considered: Berlin is slightly in negative territory with minus 0.3 percent and Hamburg leads by a wide margin with an indicator increase of 6.6 percent compared to the previous quarter. Ralf Kemper, Head of Value and Risk Advisory JLL Germany, sums up: “Despite the slight increases over the past six quarters, the Victor has only been able to recover a fraction of the loss in value and is still around 25 percent below its peak in the first quarter of 2022. With this pace of catching-up and the prospects for the German real estate market, it is likely to take a while before the entire loss in value of the two crisis years 2022 and 2023 can be compensated.”

Hamburg is clearly the winner in the fourth quarter of 2025, with observed sales processes and completed transactions providing sufficient evidence for a 15 basis point reduction in prime yield. “The office real estate market in the Hanseatic city was more active than the markets in the other cities last year. Investors apparently appreciate the balanced range of industries on the part of rental demand and the low vacancy rate,” comments Kemper. In addition, the market has benefited from the current “right” lot sizes: The currently most active investor group, family offices with strong equity, prefers investment volumes in the mid to upper double-digit million range, which were available on the supply side in Hamburg. “In contrast, the transaction processes in the stores with larger tickets, for example in Frankfurt, were much tougher,” says Kemper. In addition, Hamburg, as the stronghold with the lowest rent level, has room for further rent increases, despite an increase of five euros to 41 euros/m². Due to the yield reduction, Hamburg is catching up with Munich. With a prime yield of 4.05 percent, both cities have returned to the level of the third quarter of 2023.

Transaction volume rises significantly, prime yields fall slightly

Although the transaction volume on the German real estate market as a whole fell somewhat short of expectations and office properties only took fourth place among the asset classes, the picture for the five real estate strongholds under consideration looks more positive. For example, around 4.1 billion euros were invested in offices here for the year as a whole, which represents an increase of around 36 percent compared to the two weak previous years (2024: three billion euros; 2023: 2.9 billion euros). After prime yields stagnated almost completely in 2024, there was movement in the market last year. In Hamburg, the prime yield fell by a total of 20 basis points over the course of the year, in Munich by ten basis points and in Düsseldorf by five basis points.

The office leasing market in 2025 was robust at a low level in the persistently weak economic environment. At around 2.28 million m², the letting volume in the five real estate strongholds in 2025 was similar to the previous year (2.27 million m²). However, a detailed look reveals different tendencies. While demand for weaker location and property qualities is declining, the interest of companies in prime properties in central locations remains strong. This high demand meets an increasing shortage of space: vacancies in the top locations are low and range from 3.3 percent in Munich city center to seven percent in Düsseldorf’s banking district. The decline in the number of completions and the dried up pipeline for new construction sites over the next three years are exacerbating the shortage of supply. As a result, prime rents in all five cities have risen sharply in the course of the year.

Differing index development in the five real estate strongholds

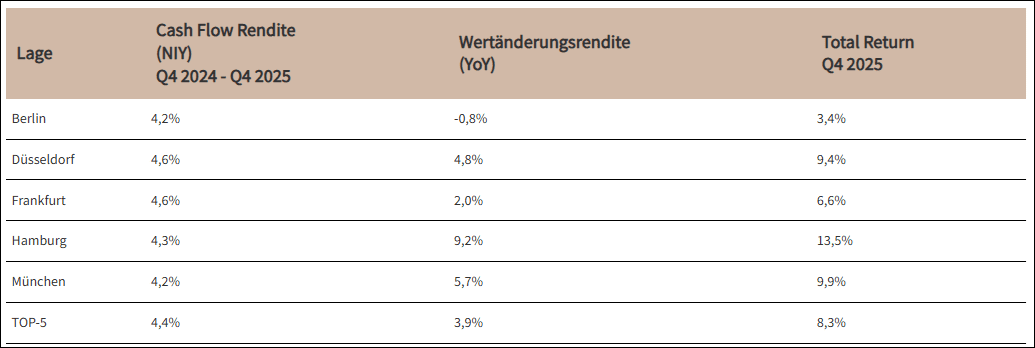

In the fourth quarter of 2025, the five prime locations developed quite differently. Hamburg has by far the largest jump in performance at 6.6 percent. The new indicator level is quoted at 198.6 points, surpassing the leader Munich for the first time in two years. In the final quarter, the Hanseatic city benefited both from the aforementioned yield compression of 15 basis points and from a sharp increase in prime rents. In Düsseldorf, the indicator climbed by 2.4 percent to 158.5 points. With stagnating yields, this was mainly due to impulses from the rental market. There were also no changes in prime yields in the other three cities in the fourth quarter, so that the indicator was mainly influenced by the different developments in rents. In Frankfurt and Munich, this resulted in a slight increase in indicators of 0.4 percent each to the new indicator levels of 152.6 points in the Main metropolis and 194.1 points in the Bavarian capital. Only in Berlin’s top locations did the indicator fall minimally by 0.3 percent to 180 points.

The renewed increase in indicators in the fourth quarter of 2025 also influenced the annual performance calculated across all locations (comparison of the indicator level Q4 2025 to Q4 2024). At 3.9 percent, it is significantly higher than in 2024 (0.4 percent). Analogous to the quarterly performance, Hamburg’s city center also leads in a year-on-year comparison with 9.2 percent, ahead of Munich with 5.7 percent. Düsseldorf’s banking situation lands in the middle of the field at 4.8 percent. At the bottom of the list are the Frankfurt banking situation with an annual performance of two percent and the Berlin top locations with an indicator decline of 0.8 percent.

Ralf Kemper “After the latest yield compressions, Hamburg is establishing itself as one of the top three cities in Germany, along with Munich and Berlin. Frankfurt and Düsseldorf are currently lagging behind, both in terms of yield level and indicator level. However, Frankfurt’s office market has had an excellent letting year – at almost 600,000 m², take-up is on a par with the best years before Corona, prime rents climbed from 50 to 52 euros within a year, and new construction activity will remain at a low level for the foreseeable future. Strong letting data are often the harbingers of increased investor interest and a revival in the investment market. We are therefore curious to see whether the opportunities to buy office properties that do exist will lead to transactions in the first half of 2026.”

The framework conditions remain tense in view of the global crisis situation. Nevertheless, economic growth of one percent is expected for 2026. “This supports our forecast of an increase in the letting of office space in Germany by around ten percent. The past year and the ECB’s interest rate policy have shown that pure interest-induced growth in the real estate market is a thing of the past. “Fundamental real estate data counts again, profits and increases in value will be generated in the next few years mainly from the operating cash flow of the properties. Therefore, strong signals from the rental markets are essential for a further revival of the investment market.”