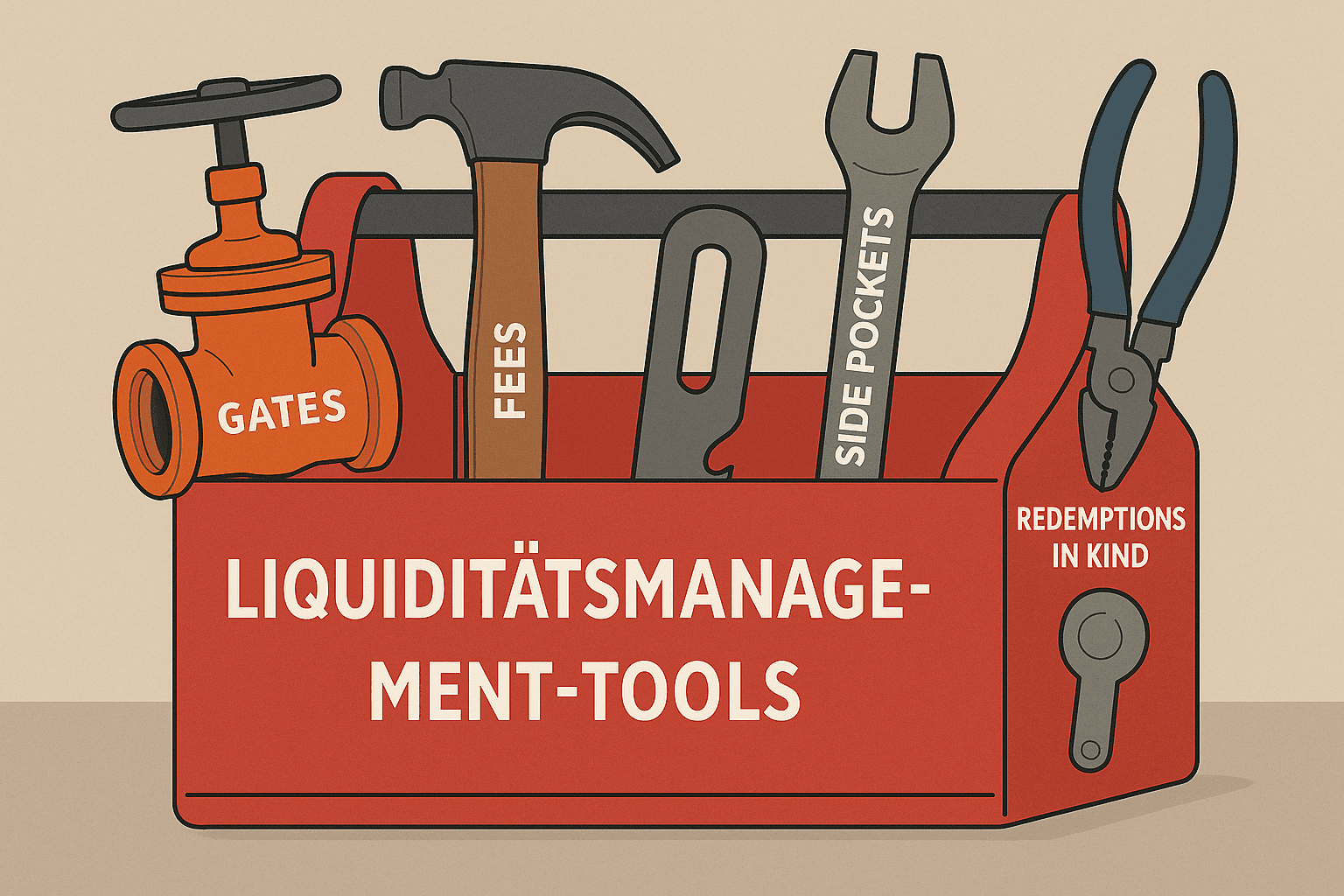

With a whole toolbox of liquidity management tools (LMTs), the regulation aims to create more stability for open-ended investment funds in the future. But the question remains: Are these instruments really a protective shield in the crisis – or in the end just a promise of good weather?

The Fund Risk Limitation Act (draft bill BMF) sets out until 16. April 2026 will amend EU Directive 2024/927. A transitional period until 2027 applies to existing funds, which was preceded by intensive debates – including at the Financial Stability Board (FSB) and the Organization of Securities Commissions (IOCSO).

In future, open-ended investment funds – i.e. UCITS and open-ended AIFs – will have to include at least two LMTs in their documents (money market funds: one LMF). The goal is a balancing act:

- Investor protection (no “first mover advantage” of investors returning share certificates early),

- Market stability (no fire sales),

- but without making open-ended investment funds permanently unattractive.

The toolbox

LMTs have been in practice for some time, but so far voluntarily. Now the selection will be mandatory and monitored by the supervisory authority. In addition to swing pricing, side pockets and anti-dilution mechanisms, the following are particularly relevant for open-ended real asset AIFs:

- Redemption Gates / Extended Notice Periods

Runoffs are limited in time or quantity.

Advantage: orderly liquidation instead of run.

Controversy: Investors feel “locked in”, liquidity problem only postponed. - Redemption Fees / Charges

A percentage discount on redemption accrues to the fund.

Advantage: Protection of long-term investors.

Controversy: Investors perceive it as a “punishment”. - Redemptions in kind

Instead of cash, there are assets.

Advantage: no forced sale in stress.

Controversy: Hardly practical for private investors – who wants an office property instead of money?

The AIFMs are quite flexible in the selection of LMTs, with the guidelines set by the Final Report submitted by ESMA to the EU Commission on 15 April 2025 with the Draft Regulatory Technical Standards (RTS) and the guidelines on LMTs .

Controversial issues: effectiveness and “bogus liquidity”

How effective are LMTs really?

- The ECB (Working Paper Series (No 2825)) examined corporate bond funds. Result: Redemption restrictions actually act as a disincentive for returns and reduce procyclical sales. Fund managers have had to sell fewer assets and have been able to continue their strategy more consistently.

- However, this is probably not transferable one-to-one to tangible assets. For example, in the case of open-ended real estate funds (Germany, Austria), it has been shown that despite redemption periods, fund managers sold real estate on a large scale in order to prepare for foreseeable returns. Panic was not the driver, but precaution. This stretches liquidity, but does not prevent selling pressure – procyclicalism only shifts.

- In addition, there is the sales debate: “Too much disclosure kills the product”, according to some associations. While supervisors see LMTs as an “airbag”, the industry fears a warning sign. Investors demand transparency, scientists see a fundamental illusion: a fund is legally open, but in fact closed in times of stress.

RESULTS:

- Investor protection: Yes, the first mover advantage will be reduced.

- Empirical: ECB proves effectiveness in bond funds.

- However, in the case of tangible assets, the procyclical principle remains in place – it is only postponed in time.

- Dilemma: Open-ended funds remain legally open, but in times of stress, liquidity becomes fiction. For supervisors, this is stability, for investors it can seem like a label fraud.