Number of trades increasing, but only one major transaction registered

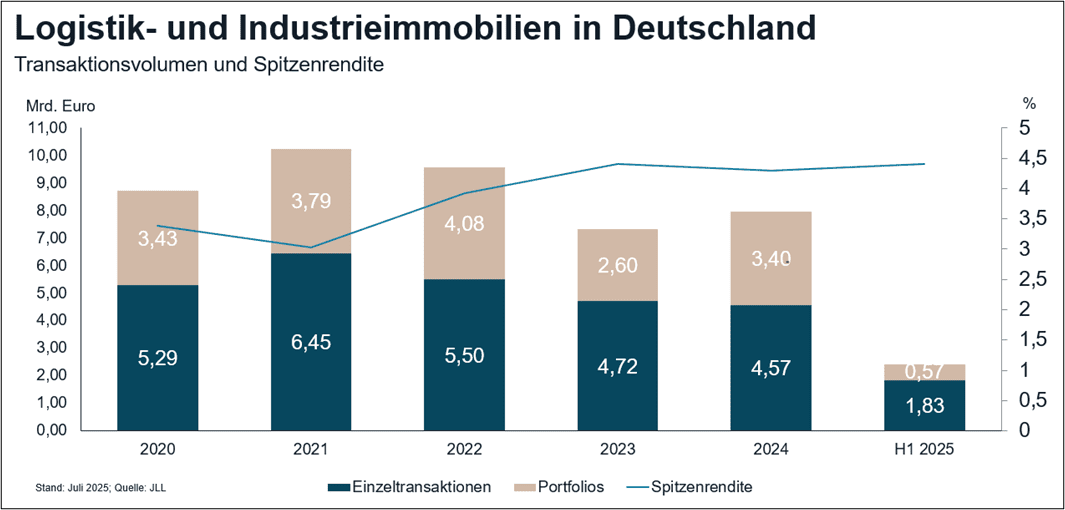

The German investment market for logistics and industrial real estate has improved only slightly since the beginning of the year: the transaction volume in the second quarter of 2025 amounted to around 1.3 billion euros, almost 200 million euros more than in the first quarter. This brings the transaction volume in the first half of 2025 to 2.4 billion euros, which corresponds to a decline of 24 percent compared to the same period last year. However, the transaction volume falls short of the five-year average, which includes the particularly high-volume years 2021 and 2022, by 36 percent.

“The dynamics in the logistics investment market are higher than a look at the transaction volume suggests,” says Diana Schumann, Head of Industrial & Logistics Investment at JLL Germany. “Trades continue to take a long period of time, which is especially true for the portfolio transactions that are in exclusive condition, the signing of which has not yet taken place, but should be reflected in the results in a timely manner. In addition, the number of investment opportunities in the market has increased and the rental markets are also sending more positive signals again, which has a direct impact on the investment markets. Not only a higher number, but also more significant trades are therefore likely to lead to a much stronger second half of the year.” For the year as a whole, Schumann forecasts a transaction volume of around seven billion euros.

Only one deal of more than 100 million euros was registered in the first half of the year, which accounted for just under five percent of the transaction volume, while in the same period last year there were still eleven deals, which together accounted for more than half of the total volume. On the other hand, the total number of deals increased, with 122 deals, 15 more than in the first half of 2024.

“Liquidity for individual transactions of more than 100 million euros is currently limited. Buyers in this segment have higher return requirements, not least because the competition is lower for these ticket sizes,” says Schumann. “The situation is different for smaller volumes. There is more liquidity here and there is an improved basis for buyers and sellers to agree on a price. This situation has been directly reflected in the increased number of transactions and sends the positive signal that the market is willing and the momentum is increasing.”

One of the most significant transactions in the first half of the year was the sale of the Ford plant site in Saarlouis by the car manufacturer to the Saarland Economic Development Corporation. In addition, the “AustralianSuper” fund has entered into a joint venture with the Canadian real estate company Oxford Properties and has acquired a share in its ESCIP portfolio as well as in M7 Real Estate. Real estate also changed hands as part of the takeover of DB Schenker by the logistics service provider DSV.

While core-plus properties usually accounted for around 60 percent of the transaction volume in recent years, it was around 40 percent in the past six months. At 22 percent, core properties increased minimally. Significantly more involved were properties with a value-add risk profile, which now account for 26 percent, as well as opportunistic transactions with slight growth to twelve percent. “In the core segment, liquidity remains limited and selective. Although there are sustainable new construction products on the market, they are often not in the top locations that are in demand. Value-add and opportunistic products have increased, as the return requirements of active and often international capital allow the acquisition of corresponding properties,” explains Schumann.

International market participants were more active on the buy-side at 55 per cent, while they were responsible for only 20 per cent of the volume on the sell-side. On balance, they have thus built up their real estate portfolio by 832 million euros. “As is so often the case, the German market is currently viewed more positively by international players than we ourselves see it and the local economy,” Schumann continued.

There has recently been a slight correction in prime yields, and they are currently at a uniform 4.4 percent in the seven real estate strongholds (Berlin, Düsseldorf, Frankfurt, Hamburg, Cologne, Munich, Stuttgart) and are likely to remain stable. In the same quarter of the previous year, they were 4.4 to 4.45 percent and in the meantime 4.3 percent in the top five locations.