Take-up of 44,300 square metres – 56 per cent less than in the same period last year

In the first half of 2025, Munich’s industrial and logistics real estate market achieved take-up of 44,300 square metres. This was 56 percent below the result of the same period last year. The shares of take-up by owner-occupiers (minus 55 percentage points to just four percent) and new buildings (minus 37 percentage points to 26 percent) also declined significantly. This is the result of a recent analysis by the global real estate service provider CBRE.

“The low take-up is due to a combination of reluctance on the part of users due to the overall economic situation and a lack of existing space available at short notice,” says Maximilian Sänger, Team Leader Industrial & Logistics Munich at CBRE.

In a year-on-year comparison, prime rents for logistics space even rose by five percent to 10.75 euros. “Land prices are not falling, nor are construction costs – accordingly, the prime rents that are usually achieved in new buildings will continue to remain at least stable,” explains Sänger. “Rather, there is a willingness on the part of the owners – whether it is a new building or existing building – to grant potential tenants expansion subsidies or rent-free periods. Currently, five percent rent-free periods are usually granted.”

Within the past twelve months, the big-box vacancy rate in Munich has risen from 0.2 percent to 0.9 percent and is still at a very low level. “In the absence of speculative project developments, no further significant increase in vacancy is to be expected, and even in existing buildings, larger areas rarely become available,” says Sänger.

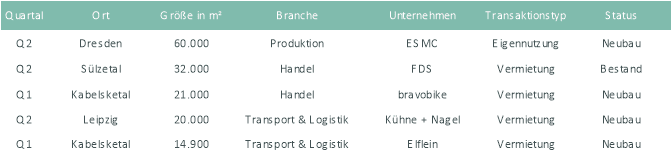

Transport and logistics companies lost a significant share of take-up – by 28 percentage points to 49 percent. Production and trading companies (including online retailers), on the other hand, were able to maintain their market share and remained almost stable at ten and five percent respectively.

Outlook for the rest of the year

“For the year as a whole, take-up of up to 150,000 square metres is expected – depending, among other things, on the granting of building permits for two user-specific new developments in the size segment over 20,000 square metres,” says Sänger.

Munich logistics market: Take-up of space (letting and owner-occupancy)