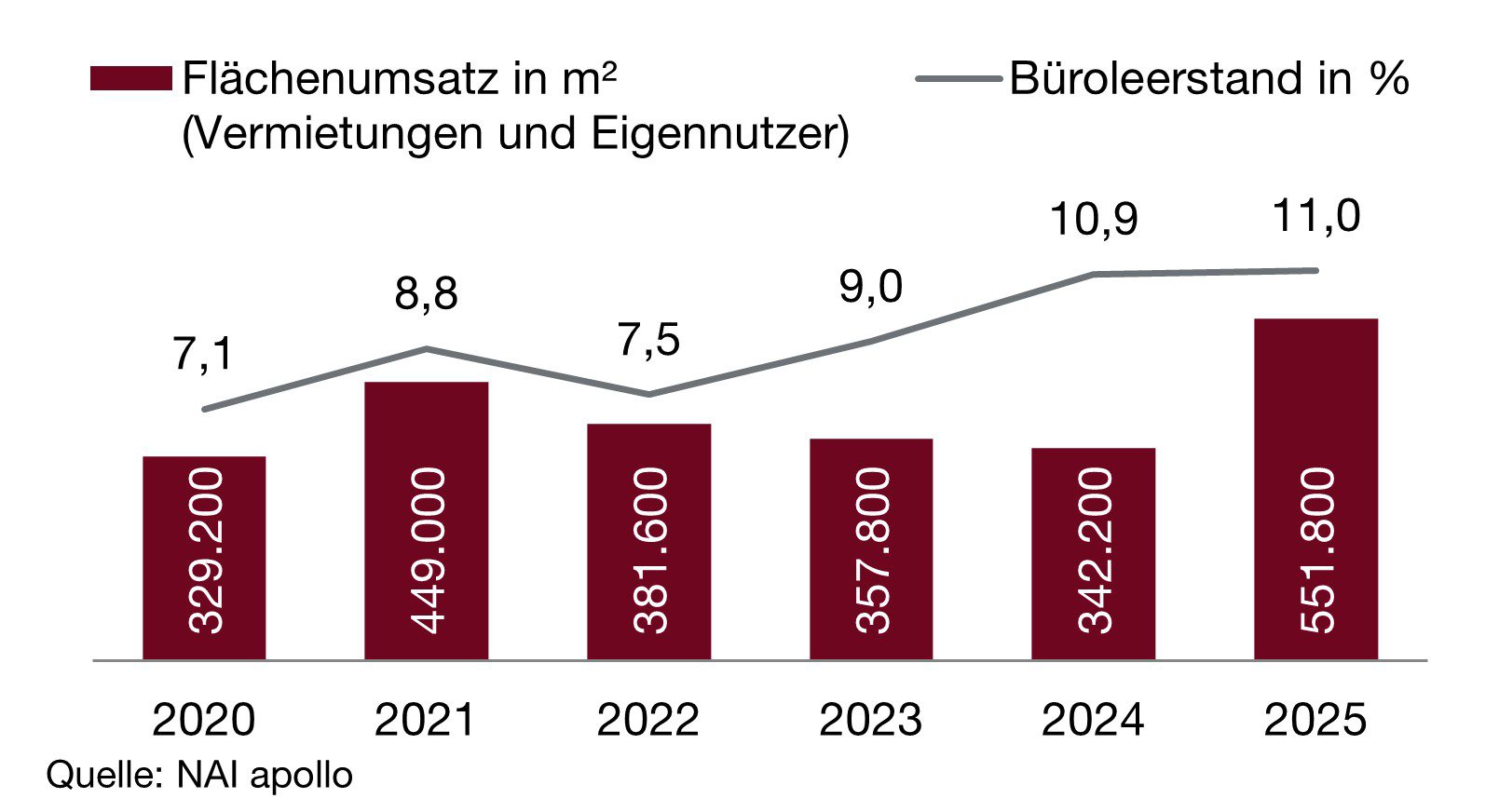

Although take-up on the Frankfurt office space market, including Eschborn and Offenbach-Kaiserlei, declined slightly in the fourth quarter of 2025, there is still a very positive result for 2025 as a whole. According to NAI apollo, a member of NAI Partners Germany, around 96,300 square metres of office space were realised between October and December through lettings and owner-occupiers. Although this exceeds the year-end quarter of 2024 by almost 18,000 square metres, it represents the weakest three-month result in the current course of the year. Buoyed by a strong first half of the year, total take-up in 2025 totals 551,800 square metres. The previous year’s result was thus exceeded by almost 210,000 square metres or over 60 per cent. The medium-term five-year average and the long-term ten-year average are also clearly exceeded at 32.5 and 13.5 percent, respectively. Likewise, the number of deals increased slightly to 431 compared to the previous year (425). There has been a steady increase in recent quarters.

The challenges for 2026 remain great. According to current economic forecasts, there will be slight overall economic growth, but a trend reversal is unlikely to take place. “However, we expect the Frankfurt office market to continue to stabilize. For example, new applications in the large and medium-sized segment are on the market, which will be completed and will support the market. However, it seems difficult to achieve the turnover achieved this year at this point in time,” explains Martin Angersbach, Director Business Development Office Germany at NAI apollo.

Large-scale segment with strongest growth and largest share of sales

Market activity in the past year was characterised by several very large space leases. The project lease of the entire Central Business Tower with 73,000 square metres by Commerzbank stands out, as does the lease of 32,000 square metres in the new 16-storey HPQ offices in the Hafenpark Quartier by ING Deutschland. A total of nine deals were concluded in 2025 with take-up of almost 210,000 square metres above 10,000 square metres. This corresponds to a share of total sales of 37.9 percent and more than a fivefold increase in the previous year’s result in this segment. “But there are also increases of between around 12 and 45 percent in almost all other size classes compared to the previous year. Only in the small-scale segment of less than 1,000 square metres is take-up of 132,300 square metres only at the previous year’s level,” says Dr. Konrad Kanzler, Head of Research at NAI apollo.

Largest market share falls on the group of banks, financial service providers and insurance companies

By far the strongest industry group is once again banks, financial service providers and insurance companies. Driven by the major deals of the year, they account for the majority of take-up with around 178,400 square metres or 32.3 per cent. Compared to the previous year, this represents an increase of 68.8 percent. In second place are companies from the fields of management consulting, marketing and market research, which have more than tripled their previous year’s result and now come to 78,200 square meters. The construction and real estate industry occupies third place; take-up at the end of the year totalled 43,400 square metres, an increase of 11.7 per cent compared to the previous year. “The financial sector was and remains by far the most important demand for space for office properties in Frankfurt, which has received a further boost this year due to large leases. But other industries, such as the consulting sector, have also increasingly looked for premises. In general, there is broad industry demand, which is underlined by multi-digit growth rates in take-up in various industry groups,” summarizes Michael Preuße, Head of Office and Retail Letting at NAI apollo.

Central locations and high-quality new-build properties in the focus of demand

128,500 square metres of this year’s take-up is accounted for by the banking sector, by far the most important sub-market in Frankfurt. In the main CBD location, which includes the banking location, a total of 271,600 square metres have been turned. Almost half of the take-up can therefore be located here. At the same time, the share of leases in projects, new buildings and revitalisations remains at a high level – in the segment over 1,000 square metres at 55.3 per cent of total city take-up. In the banking situation, this even reaches almost the 75 percent mark. “The year 2025 clearly shows that demand is aimed at modern space in the city’s top locations. The provision of an attractive workplace, the improvement of the external image and the fulfilment of ecological sustainability requirements are high priorities for companies,” says Preuße. “However, such rentals are often associated with space reductions. When moving, less space is usually rented than vacated. New working models with home office and mobile working make this possible,” adds Angersbach.

Prime rent with significant increase

The focus on central locations and top properties has led to a significant increase in the rent level in 2025. Above all, rents in the Omniturm, in T1 of the Four or even Commerzbank’s major deal in the Central Business Tower have caused prime rents to rise significantly. At the end of the year, this amounted to 53.30 euros per square metre, 4.30 euros above the previous year’s figure. Although the area-weighted average rent recently showed only slight growth, it increased by 6.60 to 31.70 euros per square metre compared to the previous year. “This reflects the large-scale deals in the CBD as well as the high demand for modern ESG-compliant space, which is mainly found in higher-priced new buildings and revitalised existing properties. The Fürstenhof, where Allianz Global Investors will move into around 17,400 square metres, or the Park Tower with the leasing of over 20,500 square metres by KPMG are prominent examples of such revitalisations that are already fully let before completion. The rents achieved in new space are on average more than 10 euros per square metre above the average total market rent,” says Kanzler.

Vacancy rate up again

The vacancy rate, which was characterised by stabilising trends in the summer months, rose again at the end of the year. New free completions that have come onto the market, such as parts of the revitalized Omega House in Offenbach’s Kaiserlei, have contributed to this, as have negative net absorptions in the course of moves. At the end of the year, a total of 1.26 million square metres will be available for rent at short notice. This corresponds to a market-active vacancy rate of 11.0 percent. While the year-on-year increase is still small at 0.1 percentage points, a longer-term comparison shows the rapid growth in vacancies in Frankfurt in recent years. “At the end of 2023, the vacancy rate was still 9.0 percent, 2 percentage points below the current level. In absolute terms, 2025 will record the highest vacancy rate since 2014,” says Preuße. However, a distinction must be made: While properties with attractive features in central locations have very low space availability, older existing buildings are affected by increased vacancies regardless of their location.

Due to the completion of new developments and revitalisations, almost 60,000 square metres of office space came onto the market in 2025. “This is the lowest completion volume in the past 15 years and significantly less than was forecast in the course of the year. Of the new space, 78 percent will still be available for rental at the end of the year,” says Kanzler. The largest objects are components B and C of the Omega House in Offenbach. For 2026, the expected completion volume will increase to around 120,000 square meters. The pre-letting rate here is currently around 50 percent.

Trend expected to continue in 2026

Demand for office space will remain high in 2026. “Numerous companies from different industries are striving to optimize their office space. However, they usually also combine a qualitative improvement with a quantitative reduction in the area. The focus will continue to be on central locations and top properties,” says Kanzler. This is an increasing problem: the corresponding space supply is becoming increasingly less and the new construction activity is clearly too low to counteract this. It is particularly difficult for areas above 10,000 square meters. Large inner-city developments are already fully or largely let, as the Central Business Tower, the Fürstenhof or the Park Tower show. Construction starts of new projects in the entire market area are increasingly delayed or cancelled altogether, so that no relief is expected in the near future. This limits market activities. “Existing properties that do not have a new construction standard, but meet the most important user requirements in terms of quality and location, could benefit from this. In the case of older properties, it will be much more difficult to find new tenants or retain existing tenants without revitalisation and rent reductions. New vacancies are inevitable here,” explains Angersbach.

This situation means that rents in the top segment are expected to continue to rise. The average rent, on the other hand, is limited by the lack of vacant large spaces in the new construction segment. Consequently, little change is to be expected here. The vacancy rate should also stabilise in the coming months or increase only slightly as a result of space reductions in the course of moves. “In terms of take-up, we expect earnings to be below the level of the year just ended. Large and medium-sized land applications will be completed, but will not reach the volume of 2025. Thus, a sales result in the range of the long-term averages and thus slightly above the 450,000 square metre mark is realistic for 2026,” Preuße sums up.