Energy efficiency has become a structural value factor in the real estate market. The new study “The Effect of Sustainability on Real Estate Values” by Wüest Partner shows on the basis of around 1.38 million market and supply data how measurably energy efficiency influences rents, purchase prices and investment decisions today. Building on the analysis from February 2024, the current evaluation with new market data confirms that sustainability is systematically incorporated into pricing.

Since February 2024, the impact of sustainability on real estate values has increased significantly. The current evaluations show price effects of plus 32 percent for condominiums and single-family houses, plus 36 percent for apartment buildings and plus 31 percent for office properties. ESG quality has thus become a permanent, data-based factor in market pricing.

Measurable price and rent effects along the energy efficiency classes

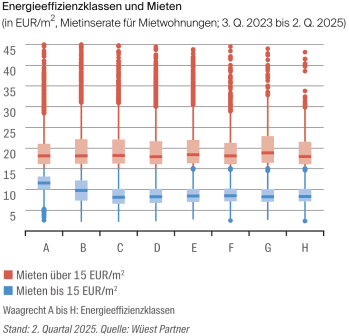

The analysis shows a clear, linear and statistically reliable relationship between energy efficiency classes and market values. With each worse efficiency class, both prices and rents fall measurably.

In the residential segment, the basic rent is reduced by an average of 0.22 euros per square metre per efficiency class. Purchase prices will fall by an average of 107 euros per square metre for condominiums and single-family houses, and by 118 euros per square metre for apartment buildings.

The effects are also significant in the office market: Here, the rent will fall by 0.30 euros per square metre per efficiency class, the purchase price by around 115 euros per square metre. Sustainability is thus becoming a clearly quantifiable economic factor and no longer an abstract ESG criterion. “Our new study shows that energy-efficient renovations already represent a reliable business case today,” says Dr. Michael Heigl. “In transaction advice, we are increasingly observing that buyers are deducting ESG-related capex directly from the purchase price.”

Reliable decision-making basis for investors and portfolio holders

The results are based on a Germany-wide evaluation of market, supply and building data from the period from the third quarter of 2023 to the second quarter of 2025. In the analysis, the variances in micro location, macro location, year of construction, size, number of rooms and structural condition (quality feature) were excluded in order to compare theoretically identical properties that only have different energy efficiency classes.

Wüest Partner links this information in an integrated, model-based platform and thus makes transparent how strongly energy efficiency actually affects market values, rents and investment decisions. Investors, portfolio holders and banks are increasingly using these analyses to identify stranded asset risks at an early stage, prioritise economically sensible restructurings and manage real estate portfolios strategically and risk-adjusted.