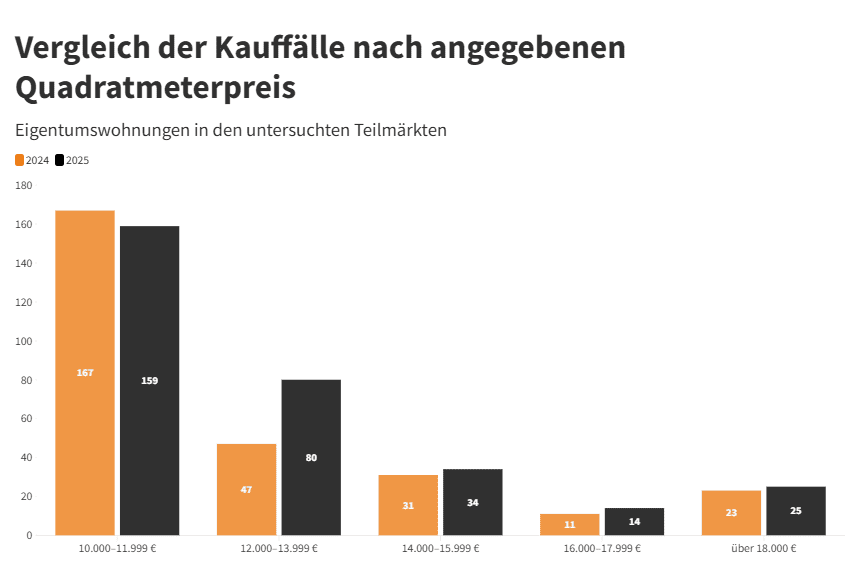

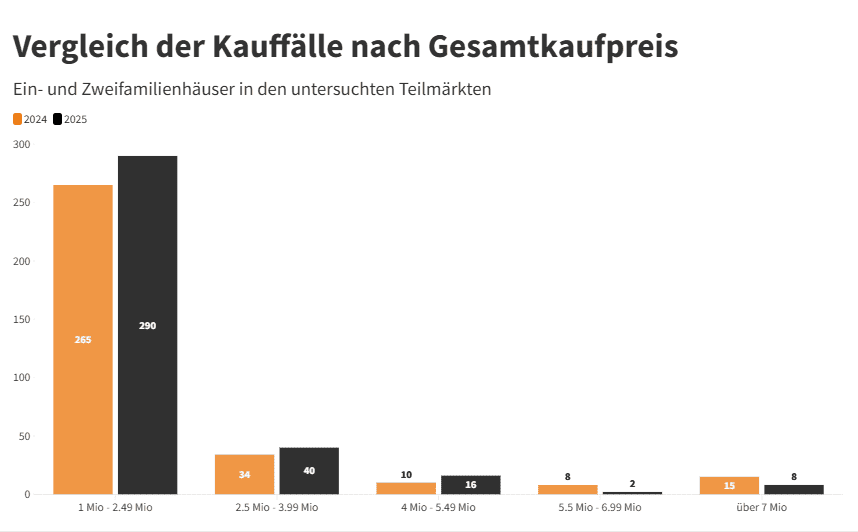

In 2025, the number of transactions in Hamburg’s premium real estate segment increased compared to the previous year, both for condominiums and for detached and semi-detached houses, while take-up for apartments increased slightly and for houses declined. This is shown by an analysis by DAHLER, which takes a look at the transaction activity in the sub-markets* Alster-Ost, Alster-West/Eppendorf, Alstertal/Walddörfer, Eimsbüttel/Altona/St. Pauli, Elbvororte, HafenCity, Niendorf-Schnelsen and Rahlstedt. The Hamburg premium segment was considered, which includes purchases of condominiums with a stated price per square metre of over €10,000 as well as detached and semi-detached houses with a purchase price of €1 million or more. The preliminary data1 of the official appraisal committee for property values in Hamburg, which depicts the transactions actually realised in 2025 and 2024, were used as the basis for the analysis.

In 2025, a total of 312 condominiums in the premium segment were sold (+11.8% compared to 2024) and 356 detached and semi-detached houses (+7.2% compared to 2024). As a result, sales of €445.8 million were achieved for condominiums and sales of €699.3 million for detached and semi-detached houses. The most expensive condominium cost € 13.5 million and was sold in Harvestehude. The highest price per square metre was called up in Rotherbaum at €36,971/m². In the case of detached and semi-detached houses, the highest sale sum of € 12.5 million was in the Nienstedten district.

“In 2025, Hamburg’s premium real estate market will continue a trend that had already begun in the previous year. The number of transactions is increasing in large parts of the market, especially in established premium locations such as the Elbe suburbs. This benefits a market environment in which suppliers and prospective buyers have increasingly converged in terms of price in recent quarters,” explains Björn Dahler, Managing Director at DAHLER, and adds:

“This rapprochement creates more willingness to conclude deals on both sides and ensures that transactions are concluded more frequently. The development points to a gradual revival of market activity. At the same time, the sales trend shows that this upswing is not going straight and has not yet reached the level of previous peak phases. It therefore remains to be seen how exactly this positive momentum will be reflected in broader revenue growth.”

Parallel to the increasing transaction activity, however, there is noticeable restraint in the new construction segment. Of the total of 312 premium apartments sold in 2025, 106 units were new-build properties, which corresponds to a share of 33.9%. In the previous year, this figure was significantly higher: in 2024, 114 of a total of 279 premium apartments sold were registered as new buildings, which corresponded to a share of around 40.9%. The share of new construction in the premium segment has thus fallen by around seven percentage points within one year.

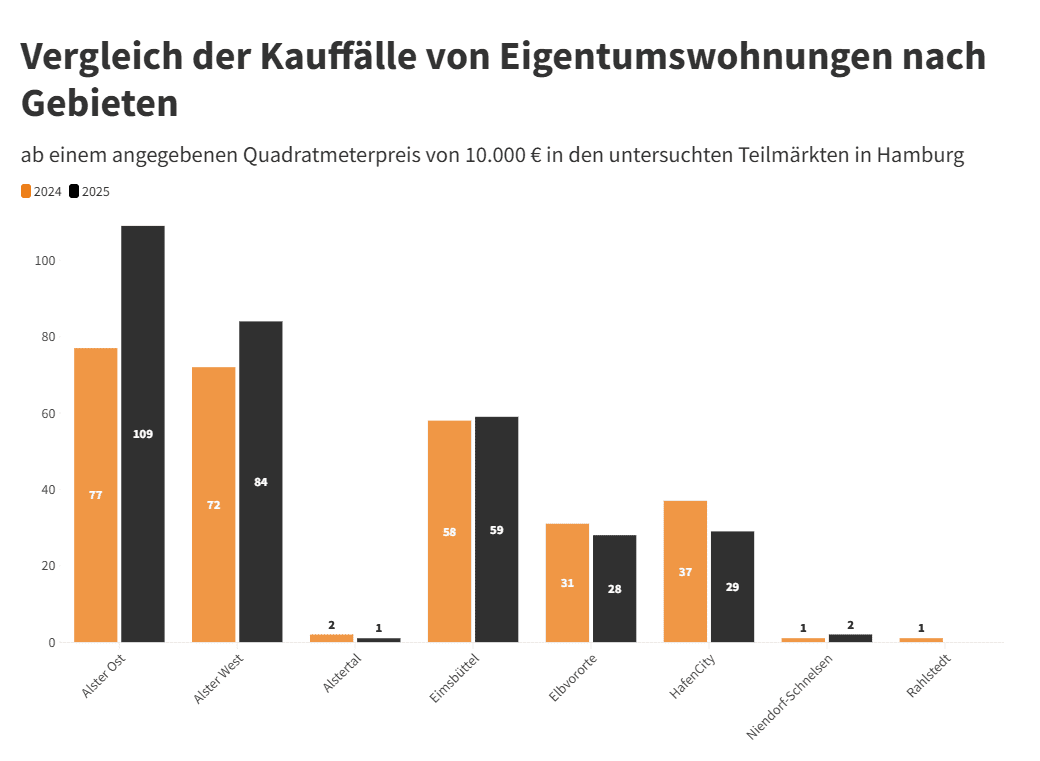

Condominiums at a glance (from a stated price per square metre of €10,000 in 2025)

- In 2025, a total of 312 condominiums were sold, increasing the previous year’s level by 11.8% (2024: 279).

- Total revenue in 2025 was €445.8, an increase of 1% compared to the previous year, when it was €442.5 million.

- Most transactions were registered in the Alster-Ost submarket (109), followed by Alster-West (84) and Eimsbüttel (59).

- The number of transactions increased most strongly in Alster Ost, amounting to 109 (+41.6% compared with 2024).

- The highest price per square metre paid was €971/m² and was paid in Rotherbaum. The most expensive individual sale was paid in Harvestehude at € 13.5 million.

- Of the 312 condominiums, 73 had a price per square metre of over €14,000/m² and 25 had a price of over €18,000/m².

- A total of 106 of the 312 properties sold were new apartments, which corresponds to a share of 33.9% (-7% compared to 2024).

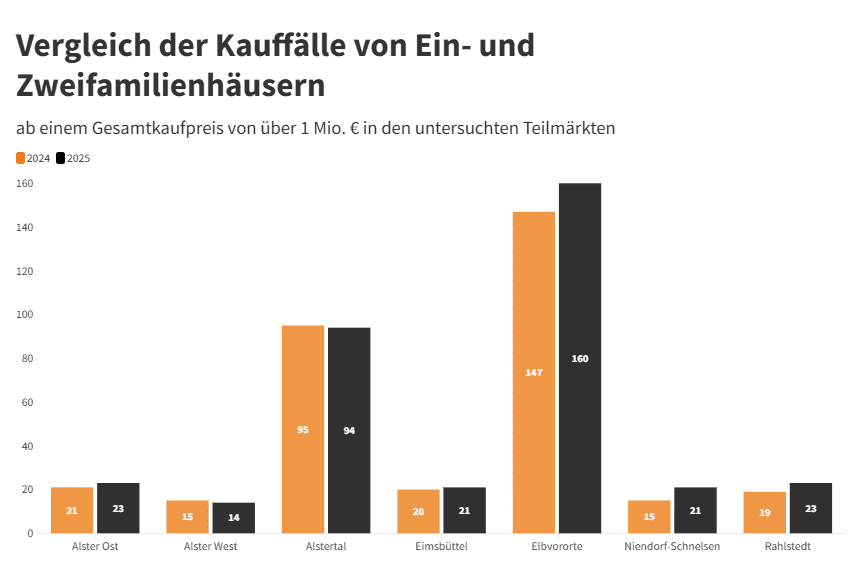

Detached and semi-detached houses at a glance (from € 1 million in 2025)

- In 2025, a total of 356 properties were sold. The number of transactions was thus 7.2% higher than in the previous year, when 332 houses were sold.

- A total of €699.3 was turnover, which corresponds to a decrease of 11% compared to 2024 (2024: €788.8 million).

- Most transactions were registered in the Elbe suburbs (160), followed by the Alster Valley (94).

- Among the 356 houses sold, 97 cost more than €2 million and 8 properties cost more than €7 million.

- The most expensive detached and semi-detached house was sold at €12.5 in Nienstedten.

1 For the year 2025, transactions received by the Valuation Committee by 19.01.2026 will be integrated into the evaluation.

*Overview of sub-market divisions:

Alster-Ost: Alsterdorf, Barmbek-Süd, Eilbek, Hohenfelde, St. Georg, Winterhude, Uhlenhorst

Alster-West/Eppendorf: Eppendorf, Harvestehude, Hoheluft-Ost, Rotherbaum

HafenCity: HafenCity

Eimsbüttel/Altona/St.Pauli: Altona-Altstadt. Altona-Nord, Eimsbüttel, Hoheluft-West, Lokstedt, Stellingen, Sternschanze, St. Pauli

Elbe suburbs: Bahrenfeld, Blankenese, Groß Flottbek, Hochkamp/Osdorf, Nienstedten, Othmarschen, Ottensen, Rissen, Sülldorf

Alstertal: Bergstedt, Duvenstedt, Hummelsbüttel, Lemsahl-Mellingstedt, Ohlsdorf, Poppenbüttel, Sasel, Volksdorf, Wellingsbüttel, Wohldorf-Ohlstedt

Rahlstedt: Bramfeld, Farmsen-Berne, Marienthal, Rahlstedt, Tonndorf

Niendorf-Schnelsen: Eidelstedt, Fuhlsbüttel, Langenhorn, Lurup, Niendorf, Schnelsen