Following EIOPA’s drafts on the Level III – Amendments to the Implementing Technical Standards (IST) published on 10 July 2025, the EU Commission has now also submitted its proposals for amended Level II implementing provisions to the Solvency II Directive for consultation on 17 July 2025. The draft of the Level II Implementing Rules, which has been submitted after revision, is intended to be adapted to the amended Solvency II Directive. With the publication of the draft, a seven-week consultation phase has begun, which is to be completed by 5 September.

Recap: What is Solvency II?

Solvency II sees itself as the European harmonised set of rules for insurers. This makes it the counterpart to Basel III for credit institutions. Like Basel III, Solvency II also relies on risk-oriented, three-pillar supervisory architectures with capital, governance and transparency requirements:

- Quantitative requirements: minimum capital requirements of insurers

- Qualitative requirements: Internal controls and governance systems

- Transparency and reporting obligations

Recap: What does Level II mean here?

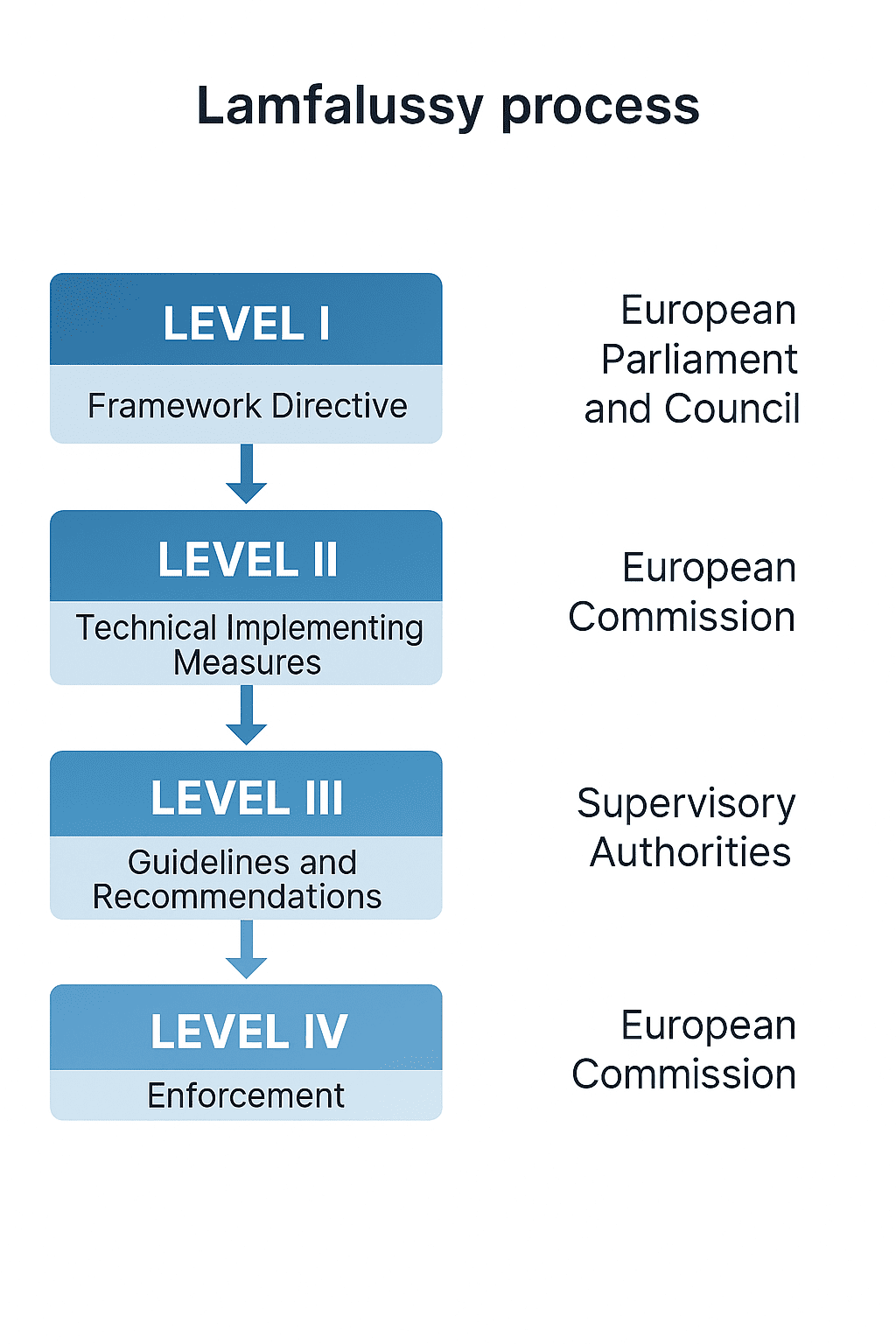

The draft presented by the EU Commission concerns Level II on solvency. But what does Level II actually mean? Specifically, these are the implementing provisions of the Solvency II Directive. Calculation approaches of the Solvency Capital Requirements (SCR), requirements for Quantitative Reporting Templates (QRTs) and valuation methods for assets and liabilities are set out here. In other words, to know how the main obligations of insurers under the Solvency II Directive are to be implemented, take a look here. Here is a little classification knowledge:

- The terms Level I, Level II and Level III come from the so-called “Lamfalussy Process”.

- This is a four-stage EU legislative process that was developed in the EU in 2001 specifically for the securities sector. Because this procedure was originally based on a proposal by the “Committee of Wise Men”, the name of this EU legislative procedure, which is specifically applied to the financial sector, is inextricably linked to the name of the chairman of this committee. And that was Baron Alexandre Lamfalussy.

- Level I (“Policy”) says what to do. Level II (“Implementation Regulations”) tells you how to do it. Level III (“Supervisory coordination and application”) says how it should be done uniformly in Europe. And what about Level IV? Ah, that’s one of those little EU ironies: There are four levels, but only three “levels”. The three levels relate to rule-making, with the fourth level representing oversight and enforcement.

The EU Commission’s proposed amendment specifically concerns Level II, i.e. the implementing provisions, by making a direct reference to the Solvency II Directive at Level I for ELTIFs and lower risk funds.

Why has the EU Commission’s proposed amendment to Level II been put on the table?

Since the application-related specification of the objectives and requirements of the Solvency II Directive (2009138/EC) at Level I is carried out by the implementing provisions at Level II, there has been a need for revision from time to time since their initial introduction. These are usually targeted adjustments to market conditions, new supervisory findings or other political initiatives. And so it is here. On the one hand, the EU Commission’s new amendment proposal to the implementing provisions at Level II is intended to align with the amended Solvency II Directive at Level I. And on the other hand, the EU Commission is formulating ambitious goals in the form of less regulatory effort and more competitiveness. In this respect, the reaction of the German Insurers’ Association (GDV) can be described as indifferent, which wants to see “a step forward” in the proposed amendment to Level II and at the same time “still need for improvement”.

Apart from fundamental criticism from the associations: What is in the bag for the ELTIF and other so-called lower risk funds?

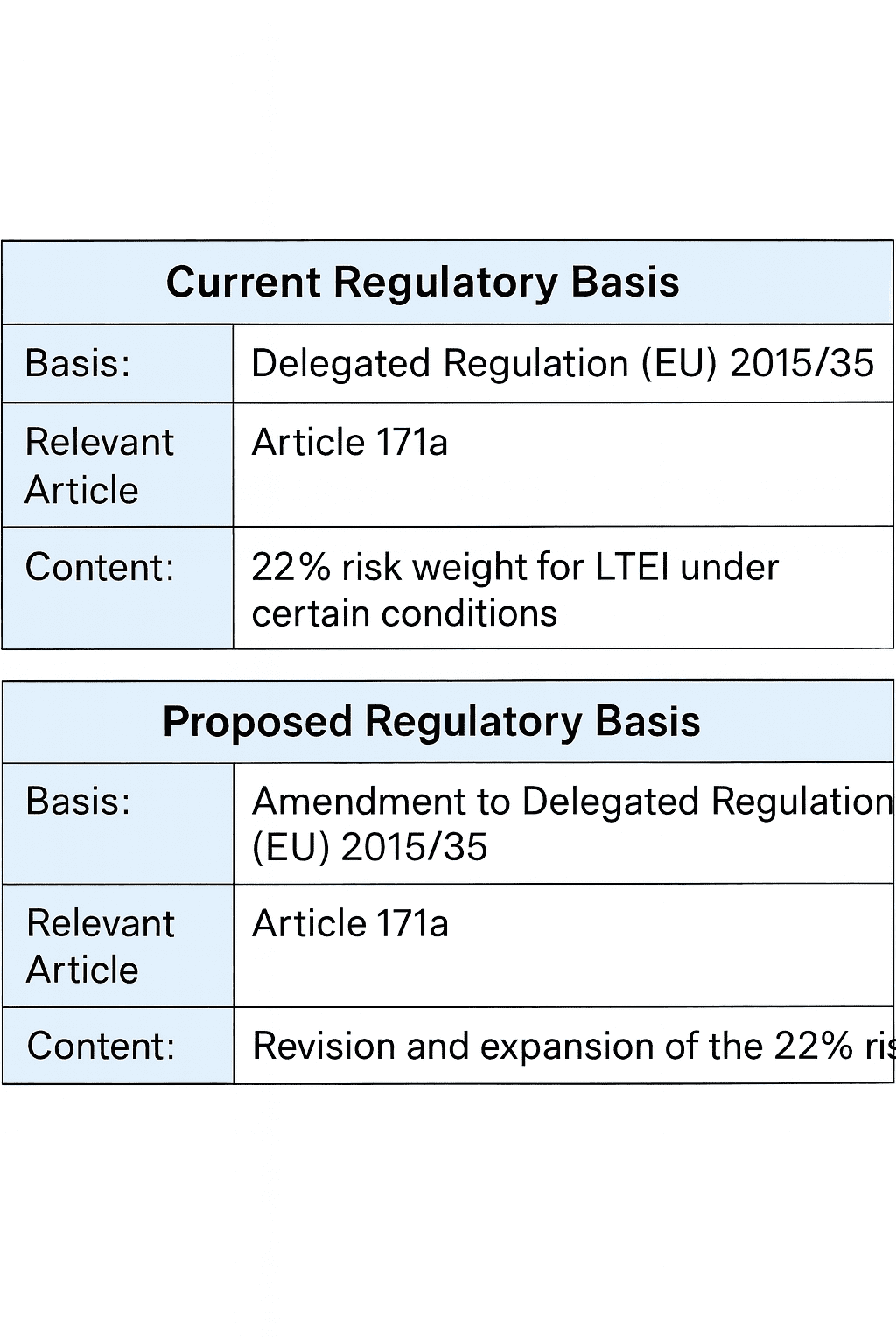

In Article 171d (New) of the Implementing Rules, the proposal assigns ELTIFs and lower-risk funds to Long-Term Equity Investments (LTEI) at Level II.

ELTIFs and lower-risk funds are eligible for regulatory preferential treatment if they meet specific requirements. The background to the adjustment is the necessary reference to Article 105a (2) of the Solvency II Directive at Level I, the provision of which has been newly added. This reference in Level I makes it possible for the application of the LTEI module to be related not to the level of the assets of the fund, but to the level of the fund itself. In practice, this is associated with significant simplifications for the purpose of using the LTEI module. Art. 171d (new) of the implementing rules at Level II explicitly clarifies that the ELTIFs and other so-called lower-risk funds benefit from the improved application of Art. 105a(2) of the Solvency Directive at Level I. This all sounds quite technical, and it is. Therefore, it is best to start with the understanding of the term simply from the beginning, see below.

What do LTEI do anyway?

An LTEI is a strategic, long-term investment held by the insurer that, if it meets certain requirements, is favoured by regulation. Therein lies all the charm!

What is such a regulatory favor for LTEI?

Such a regulatory advantage may result in the significantly reduced capital deposit . The equity deposit is what is tied up as the insurer’s capital available under regulatory law. The less equity capital the insurer is tied up for its investments, the less its freedom is restricted, see below.

And in concrete terms, what does this mean for the insurer?

LTEI’s capital adequacy is 22% of the market value of LTEI. In the case of a preferential investment covered by this, the insurer would only have to commit 2,200,000 euros as own funds for the investment period for an example investment with a market value of 10,000,000 euros instead of – for example – 3,900,000 euros (standard 39% equity deposit as a so-called market risk module). Incidentally, own funds are not “gone” or otherwise “disappeared” during their commitment period anyway, but they are simply “tied”. In practice, this means that these own funds may not either cover other risks or be distributed as profits to the insurer’s owners during the commitment period. This is the reason for the advantage for the insurer that it simply has more regulatory equity available for further investments. Of course, a lower equity commitment has a beneficial effect on the return on investment earned by the insurer. That LTEI module under Solvency II is therefore the regulatory door opener for long-term investments, especially in infrastructure, investments and private equity! And the reference to Article 105a(2) of the Solvency Directive at Level I results in relief for ELTIFs and lower-risk funds, because the application of the LTEI module may relate to the level of the fund (rather than assets).

And this brings us to infrastructure, for example

The statements in the preamble confirm that equity infrastructure investments can also be eligible for the benefit of the LTEI module. This is logical, because the use of the LTEI module has always been a sore point for the European Insurance and Occupational Pensions Authority (EIOPA), for example. At the time in 2021, as part of the “Review of Solvency II” process, EIOPA had found that only 17 insurers (less than 4% of regulated insurers) were using LTEI (“Background document on the opinion on the 2020 Review of Solvency II”). And infrastructure assets in particular were already highlighted by the EU Commission at that time as an area in which insurance capital should be promoted.

Results:

- The draft of the implementing provisions at Level II, which has been submitted by the EU Commission after revision, is intended to be adapted to the amended Solvency II Directive at Level I.

- The overarching goals of the EU Commission are less regulatory burden and more competitiveness; the industry representatives are not yet completely satisfied in this respect.

- In concrete terms, however, for ELTIFs and for so-called lower-risk funds, there is a clarification by referring to the relevant reference of the Solvency II Directive at Level I that the LTEI module can be applied to ELTIFs and to lower-risk funds at fund level; this makes it easier to apply.

- This means that the regulatory door is even better open for ELTIFs and lower-risk funds for infrastructure investments to benefit from the privileged capital deposit of 22%. For ELTIFs, this could also be interesting in terms of how these insurers invest directly in the context of shell products.