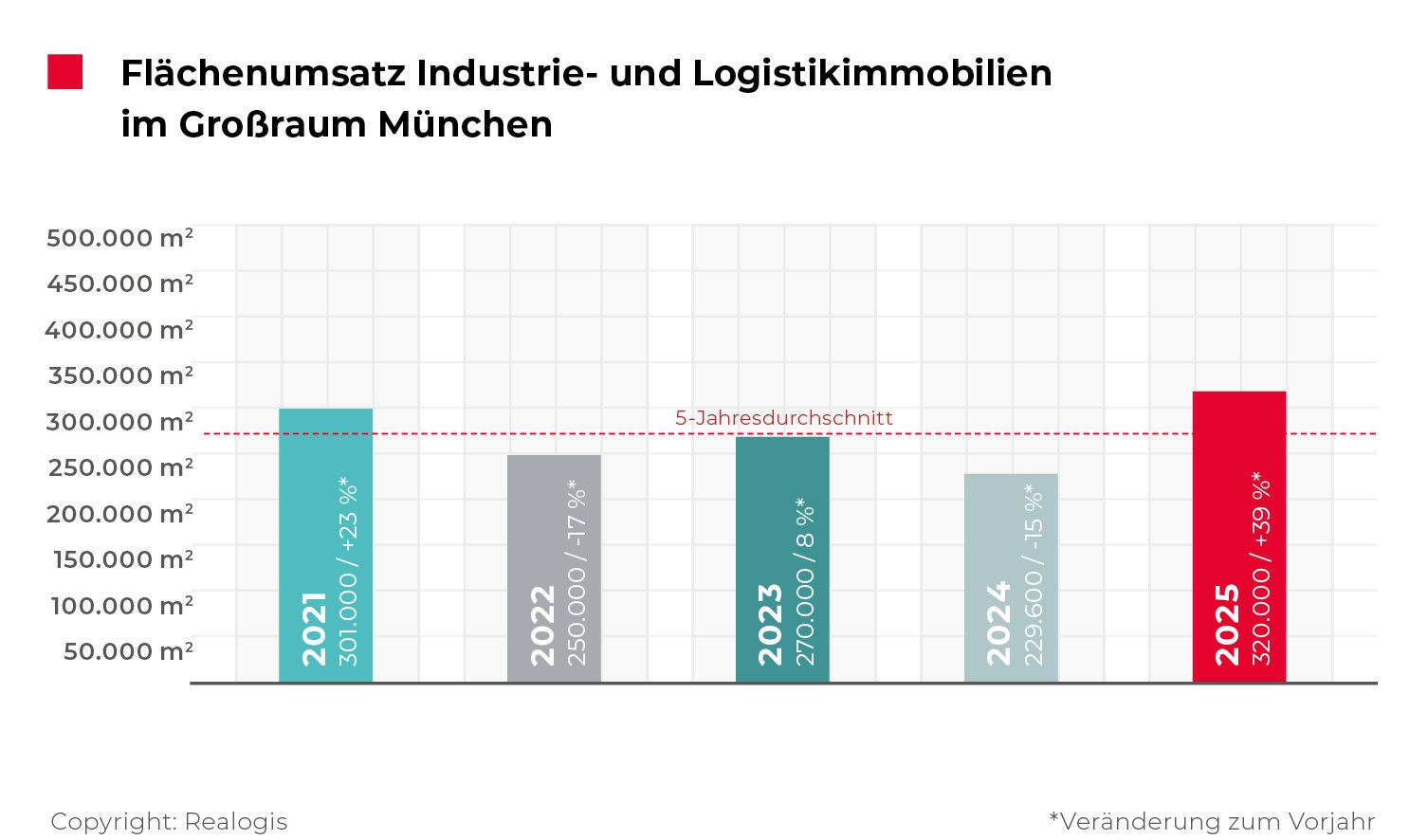

The REALOGIS Group, Germany’s leading consulting firm for industrial and logistics real estate as well as commercial properties, registered take-up of 320,000 m² in the logistics and industrial real estate tenant market in Munich as a whole in 2025. Compared to the previous year, this corresponds to an increase of 90,400 m² or 39% (2024: 229,600 m²). The 5-year average was exceeded by 17%. The main revenue drivers were TTI, REPA, Sonima, Rohlik and Agile Robots. Together, they contributed 108,300 m² or 34% of total take-up.

Nicolas Werner, Managing Director of REALOGIS Immobilien München GmbH, explains: “2025 was one of the strongest years because companies in Munich and the surrounding area continue to be very robustly positioned. Demand for space remains correspondingly high, while supply is not keeping pace. There is no short-term relief in sight.”

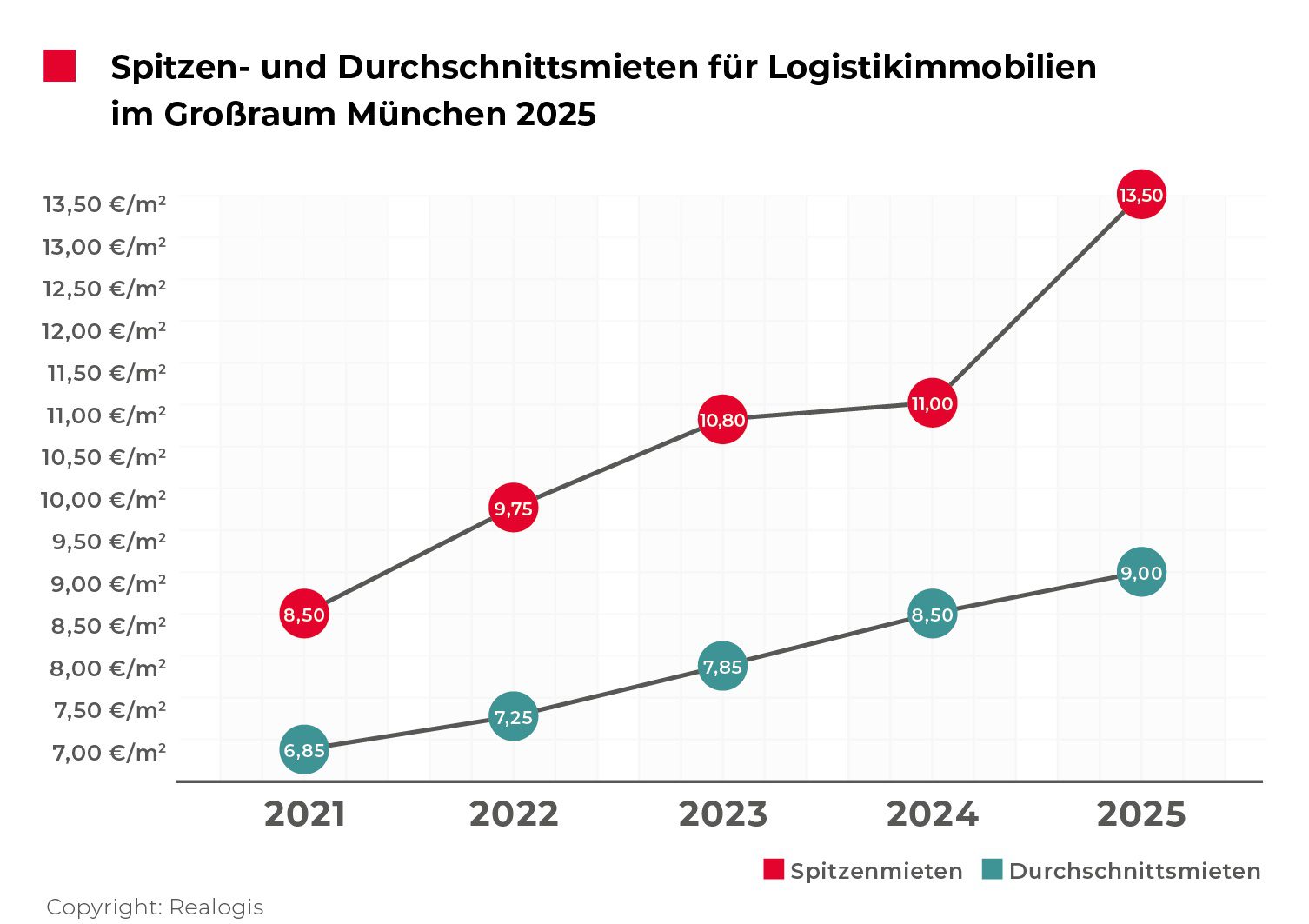

Rents: Peak value rises significantly, average rent rises moderately

Prime rents rose by 23% year-on-year to a new high of €13.50/m² (2024: €11.00/m²), continuing the upward trend since 2022. The average rent rose by 6% to currently €9.00/m² (2024: €8.50/m²). Prime and average rents reached their current peak at the end of the 1st half of 2025 and have been stable since then.

Take-up: Stock dominates, brownfields are back

Leases in existing properties dominated the market in 2025, reaching 199,000 m² or 62% of total take-up (2024: 111,400 m² / 49%). Two major deals by Rohlik and Agile Robots contributed 12% to the result. New greenfield buildings ranked second with 77,500 m² or 24% (2024: 118,200 m² / 51%). The major deals by TTI (35,700 m²) and Sonima (17,000 m²) account for 68% of the segment’s turnover.

After no deals were registered on former brownfields in the past three reporting periods, they played a role again in 2025 and reached 43,500 m² or 14%. The major deal by REPA contributed around 75% to the segment result at 32,600 m².

Types of buildings: “Other” are growing strongly, big-box space is losing market share

With regard to the type of building, in 2025 there were in particular deals in properties that could not be assigned to the category of big-box space or a business park structure. This collective category accounted for 184,400 m² or 57% of the space leased.

Big box space remained in second place with 82,400 m² or 26% of the share of space taken up (2024: 95,400 m² / 43%). They are the only type of building to miss their previous year’s value. Business park leases once again occupy third place with 53,200 m² or 17% (2024: 34,300 m² / 15%).

Regions: North remains in the lead, west with strongest growth

The North region further expanded its leading position, reaching 168,200 m² or 53% share of take-up (2024: 108,200 m² / 47%). The 5-year average of 140,020 m² was exceeded by 20%. The major deals by REPA (32,600 m²) and Sonima (17,000 m²) contributed 29% to the region’s take-up.

The West region, which had previously been in third place, followed in second place with 81,600 m² or 26% (2024: 24,200 m² / 11%). This is where the most significant growth was recorded, resulting in a result well above the 5-year average of 55,500 m². The two deals by TTI (35,700 m²) and Agile Robots (10,200 m²) accounted for 56% of total take-up here.

The eastern region was the only one to suffer losses in take-up in third place. 52,700 m² or 16% of take-up was registered here (2024: 83,800 m² / 36%). The major deal by Rohlik (12,800 m²) was responsible for 24% of sales.

The South region continues to rank in the bottom with 17,500 m² and a share of 5% (2024: 13,400 m² / 6%), although the rented area increased by 4,100 m² or 31%.

Industries: Retail leads, e-commerce collapses

The strongest sector in 2025 as a whole was retail with 115,900 m² or 36% market share (2024: 78,500 m² / 34%), replacing the industry/production sector in the top position. Within retail, traditional retail dominates with 103,100 m² or 89% (2024: 30,100 m² / 38%). The two largest deals, TTI (35,700 m²) and REPA (32,600 m²), represent 66% of take-up in traditional retail. E-commerce is collapsing significantly: at 12,800 m², Rohlik’s major deal is the only lease in the industry. Take-up was thus only about a quarter of the previous year’s figure (2024: 48,400 m² / 62%).

Logistics/freight forwarding follows in second place with 104,500 m² or 33% (2024: 48,700 m² / 21%). With an increase of 115%, this corresponds to the most significant growth of all industries. Industry/production ranks third with 88,500 m² or 28% (2024: 81,100 m² / 36%) and recorded moderate growth of 7,400 m².

Size classes: Large areas remain in the lead, areas between 5,001 and 10,000 m² are catching up

Large spaces of 10,001 m² or more remained the frontrunners with 133,400 m² or 42% market share (2024: 128,900 m² / 56%). The 5-year average of 104,020 m² is exceeded by 28%. Spaces between 5,001 m² and 10,000 m² rank second with 66,400 m² or 21% (2024: 23,900 m² / 10%). They exceed their 5-year average of 53,120 m² by a quarter (25%).

Key figures at a glance • Take-up: 320,000 m² • Prime rent: €13.50/m² • Average rent: €9.00/m² • Existing space: 199,000 m² | New building on a greenfield site: 77,500 m² | New building on brownfield: 43,500 m²