REALOGIS: Major deals kept take-up stable in Cologne’s industrial and logistics real estate market in 2025, rents stagnating

* Take-up of 244,800 m² just below the 5-year average

* Prime rent at €8.00/m², average rent at €6.85/m²

* Lettings in existing space reached 109,900 m²

* New buildings on greenfield sites fell to 62,400 m²

* Logistics and freight forwarding is the largest user industry with 101,100 m²

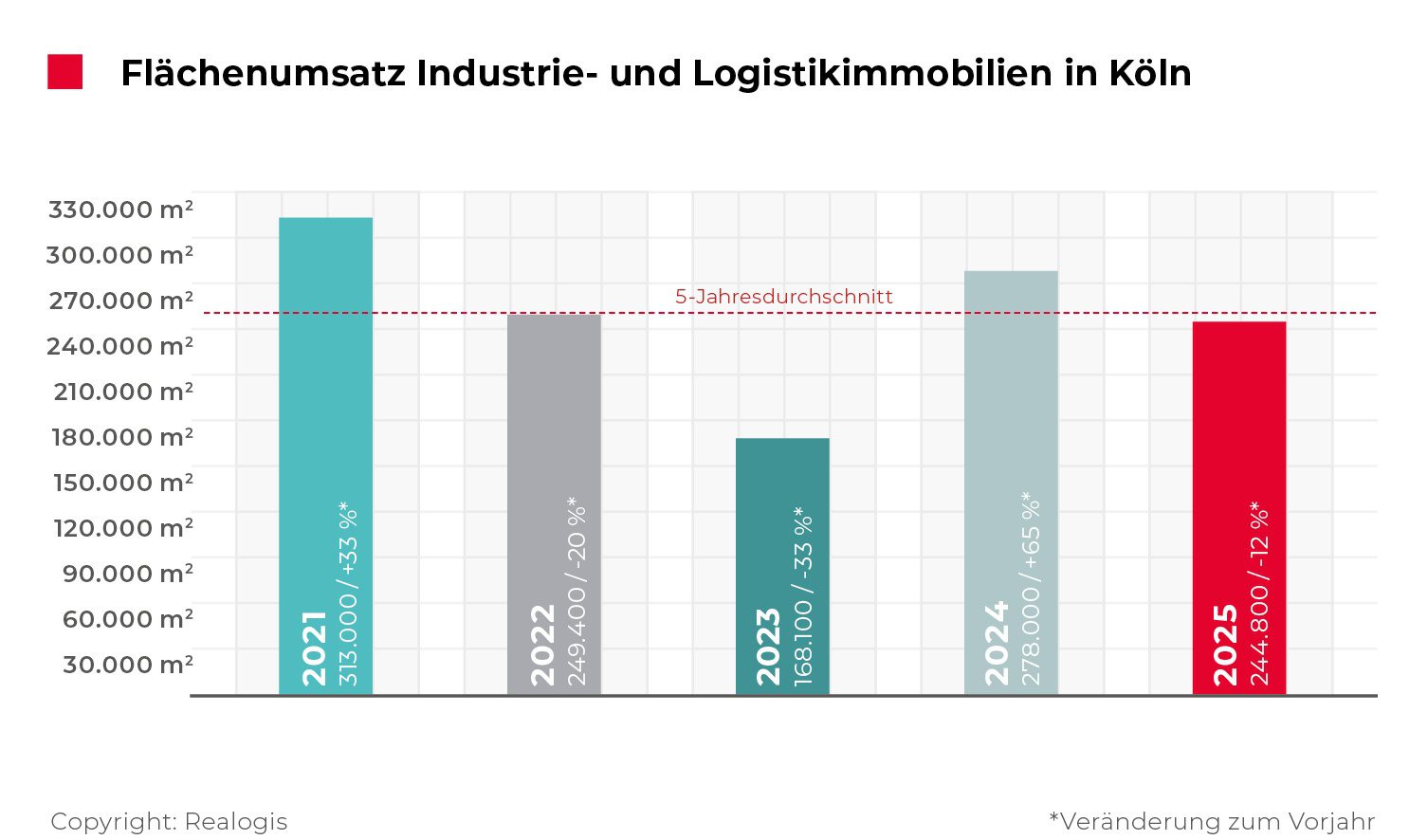

The REALOGIS Group, Germany’s leading consulting firm for industrial and logistics real estate as well as commercial properties, registered take-up of 244,800 m² on the Cologne industrial and logistics real estate market in 2025 as a whole. Compared to the previous year, this corresponds to a decline of 33,200 m² or 12% (2024: 278,000 m²). The 5-year average of 250,660 m² was missed by 2%. The five largest deals by Sellvin AG (26,026 m²), Dachser (23,300 m²), Barnet Europe (21,000 m²), ParcelJet (20,000 m²) and DSV (19,560 m²) contributed 45% to the total take-up.

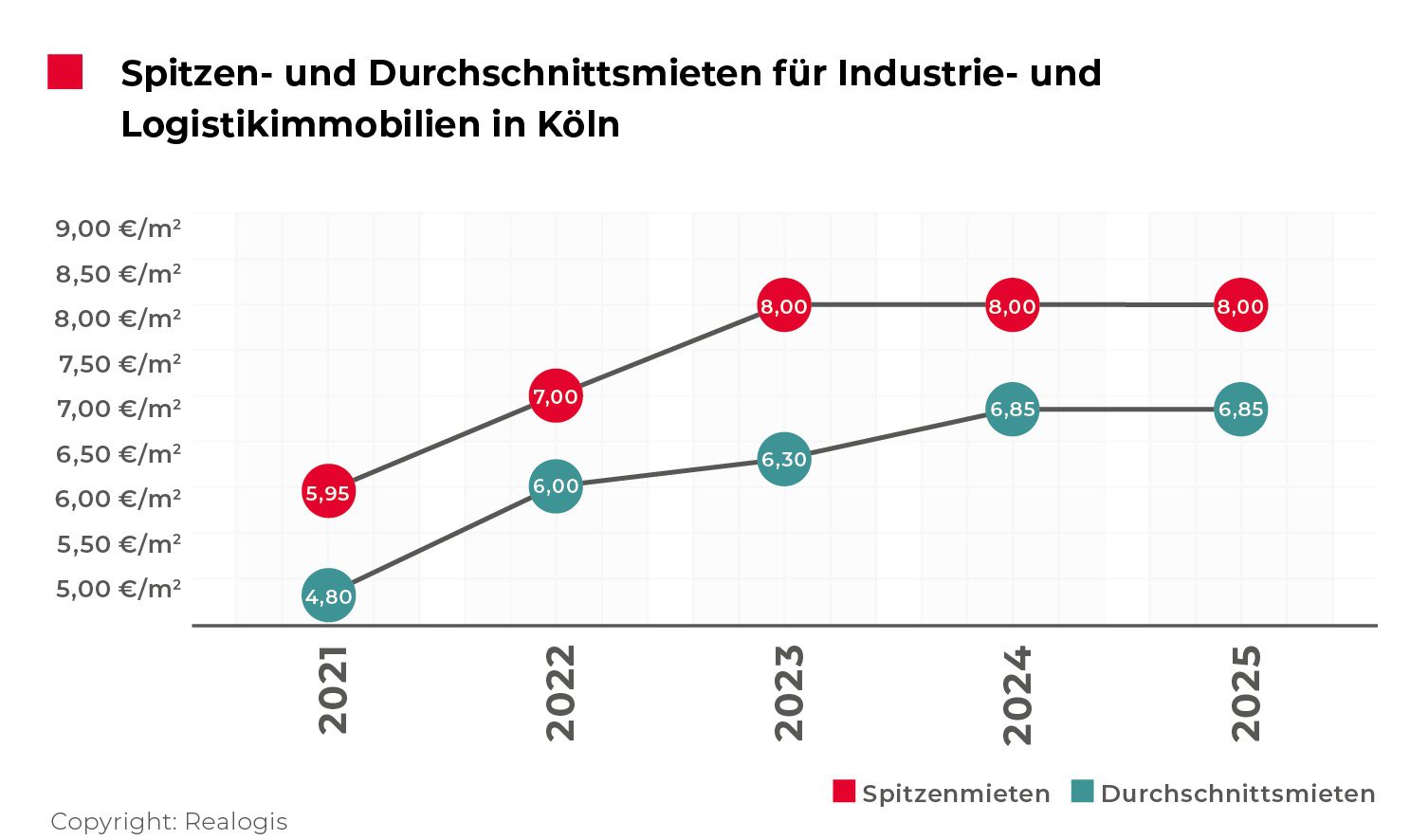

Rents: Prime rent stagnates for the second year in a row, average rent also unchanged

The prime rent in the cathedral city remained unchanged after 2024 at €8.00/m² last year. However, this exceeded the 5-year average of €7.39/m² by 8%. The average rent was calculated at €6.85/m² for the end of 2025. This also corresponded exactly to the value of the previous year. The 5-year average of €6.16/m² was exceeded by 11%.

Take-up: Stock is the largest type of space, brownfields gained in importance

Lettings in existing space reached 109,900 m² or 45% market share (2024: 172,400 m² / 62%). Compared to the previous year, this is a decrease of 62,500 m² or 36%. The deals with Sellvin AG (26,026 m²) and ParcelJet (20,000 m²) together accounted for 42% of the take-up of existing space.

New buildings on former brownfields followed with 72,500 m² or 30% of take-up, after this category had not played a role in recent years. Two of the five largest revenue drivers, Dachser and DSV, were responsible for 59% of the leasing activities here.

New-build properties on greenfield sites reached 62,400 m², which corresponds to 25% of total take-up (2024: 105,600 m² / 38%). The segment recorded a decline of 43,200 m² or 41%. The closing of the transaction by Barnet Europe (21,000 m²) accounted for around 34% of the segment’s take-up.

Market structure: Cologne largely tenant-driven

Lease deals totalled 238,300 m² or 97% (2024: 278,000 m²). Owner-occupiers accounted for 6,500 m² or 3%, after no deals were registered in the previous year.

Types of buildings: Big box areas peak, other properties increase significantly

Big box space accounted for 147,900 m² or 60% market share (2024: 234,200 m² / 84%). Compared with the previous year, take-up in this segment fell by 86,300 m² or 37%.

Other properties that cannot be assigned to either big-box spaces or classic business parks accounted for 60,100 m² or 25% (2024: 25,400 m² / 9%), a significant increase.

Lettings in business parks doubled compared to 2024 to 36,800 m² or 15% (2024: 18,400 m² / 7%).

Industries: Logistics / freight forwarding in the lead, trade lost sales shares

Despite a decline of 16,000 m² or 14%, the most sought-after user sector was the logistics / freight forwarding sector. It generated a letting volume of 101,100 m², which corresponded to 41% of take-up (2024: 117,100 m² / 42%). The deals of Dachser, ParcelJet and DSV contributed 62% to this result.

At 80,100 m² or a share of 33%, retail companies rented significantly less than in the previous year (2024: 121,300 m² / 44%). Within retail, e-commerce was just ahead of traditional retail with 40,800 m² or 51% (2024: 42,500 m² / 35%). The largest deal by Sellvin AG (26,026 m²) contributed 64% to the e-commerce result. Traditional retail reached 39,300 m² or 49% (2024: 78,800 m² / 65%).

The industry / production sector accounted for 41,000 m² or 17% of take-up (2024: 38,100 m² / 13%). The deal by Barnet Europe (21,000 m²) accounted for 51% of the industry’s volume. Other industries concluded leases for a total of 22,600 m², a share of take-up of 9% (2024: 1,500 m² / 1%).

Size classes: Areas from 10,001 m² continue to dominate the market

The size class from 10,001 m² accounted for 175,700 m² or 72% (2024: 234,200 m² / 84%). The five largest deals were made in this area. They accounted for 63% of take-up. Compared to 2024, this still corresponds to a decrease of 25%.

Areas between 5,001 m² and 10,000 m² accounted for 31,400 m² or 13% (2024: 19,200 m² / 7%). Average space between 3,001 m² and 5,000 m² was 10,200 m² or 4% (2024: 16,400 m² / 6%).

Contracts in the range of 1,000 m² to 3,000 m² added up to 23,400 m² or 9% (2024: 8,000 m² / 3%). Very small areas of less than 1,000 m² totalled 4,100 m² or 2% (2024: 200 m² / 0%).