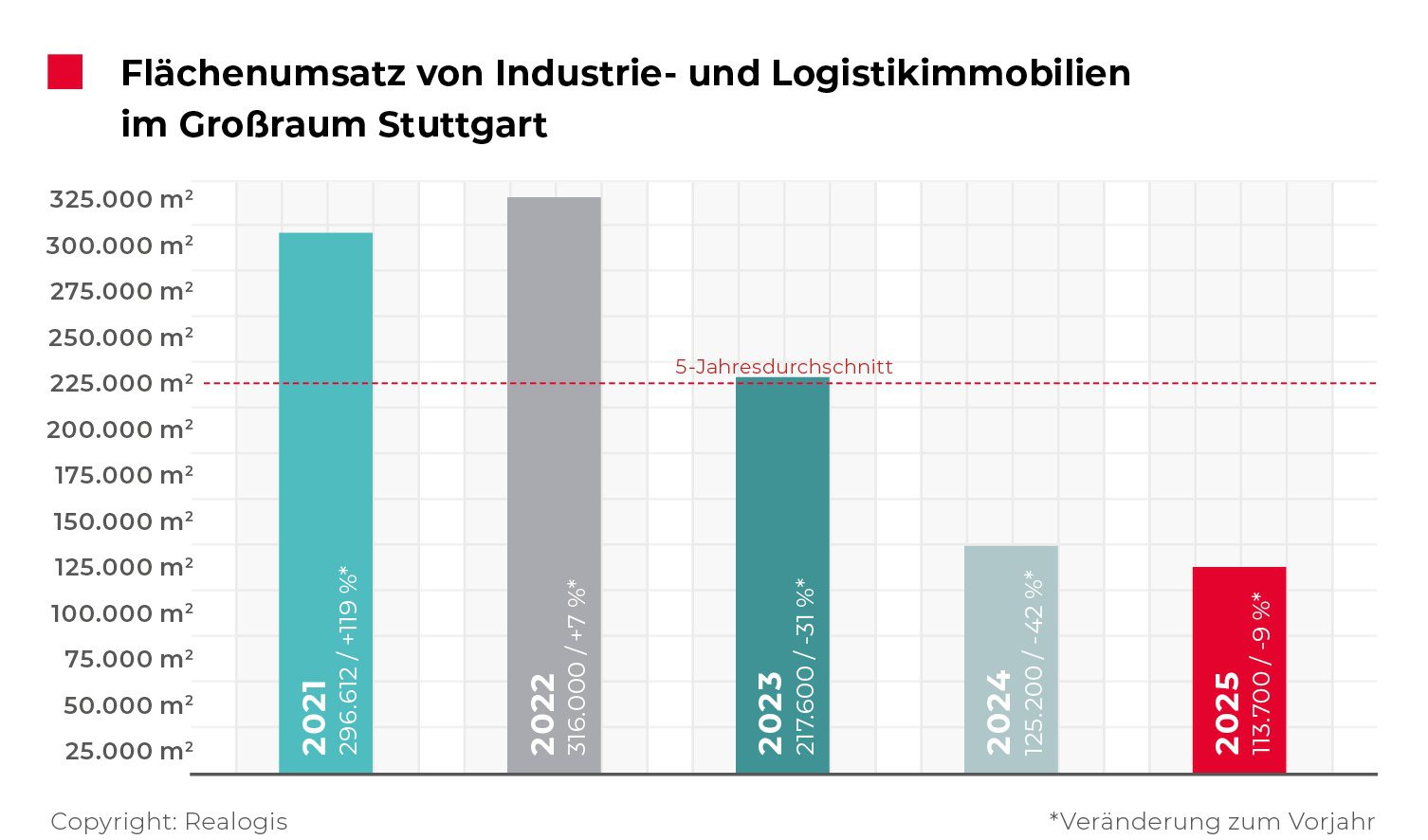

The logistics and industrial real estate market in the Stuttgart Region recorded take-up of 113,700 m² in 2025 as a whole. REALOGIS Immobilien Deutschland GmbH (REALOGIS), Germany’s leading consulting firm for industrial and logistics real estate as well as commercial properties, is thus observing a continuation of the decline of recent years, which, however, is much more moderate than in previous years. Starting from 125,200 m² in the previous year, total take-up fell by 11,500 m² or 9%. While 2022 was the strongest year since records began in 2011 at 316,000 m², 2025 marks the weakest year as a whole. The 5-year average was missed by 47%. The three largest deals by LIDL, Klauss GmbH and a logistics service provider totalled 21,000 m² or 18% of total earnings.

Joel Adam, Managing Director of Realogis Immobilien Stuttgart GmbH, comments: “Demand for space remains selective against the backdrop of the overall economic situation and structural challenges, especially in the automotive industry. But the Stuttgart Region has a high level of industrial competence, distinctive technological know-how and strong innovation structures. These will have a stabilising effect and form the basis for a moderate revival of take-up in the course of 2026.”

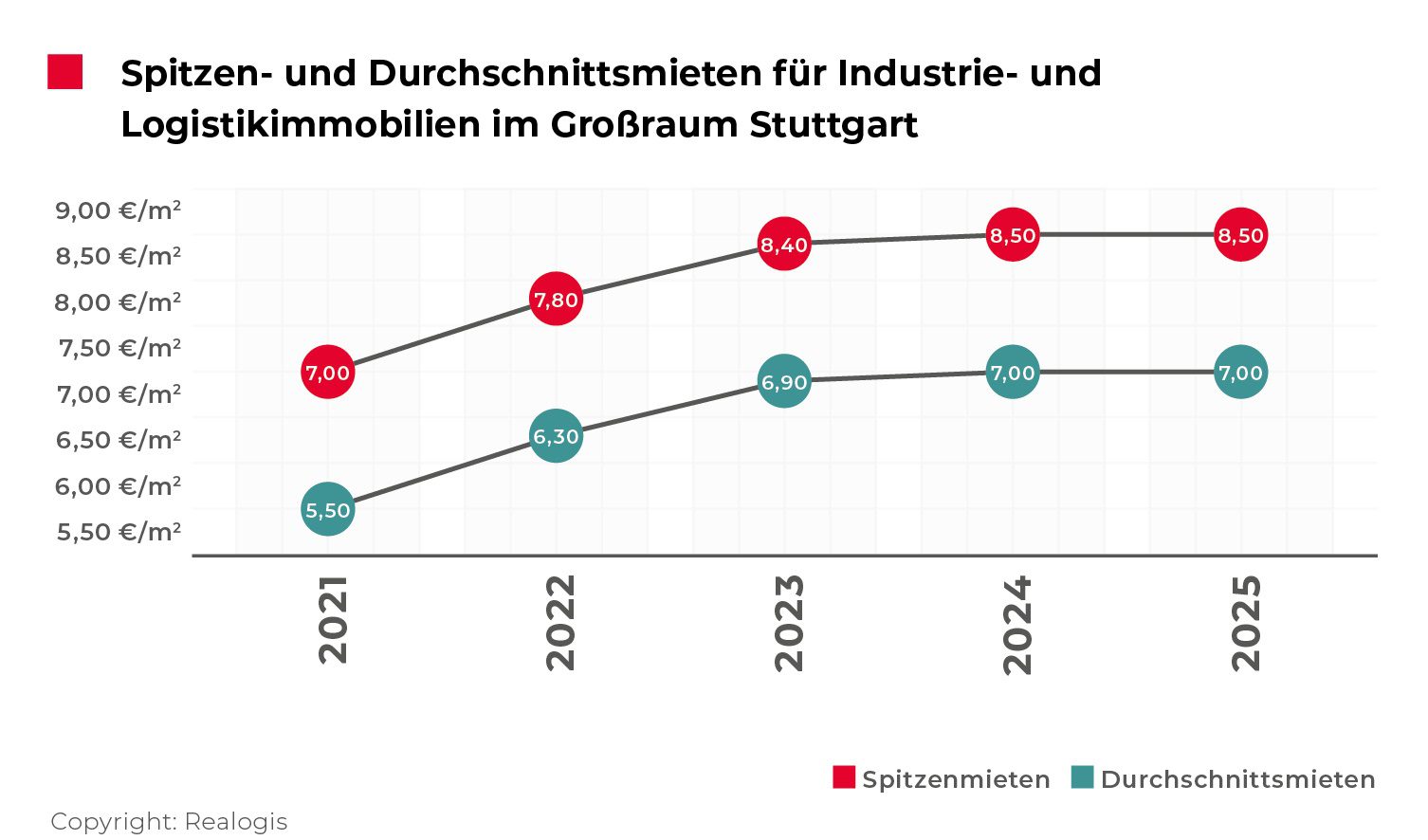

Rents break upward trend

The prime rent remains stable at €8.50/m², halting the upward trend that has been ongoing since 2020. The average rent is stagnating at €7.00/m². Both figures are 6% and 7% above their respective 5-year averages, respectively. The gap between prime and average rents has remained stable at €1.50/m² for five reporting periods. While the supply of modern space in sought-after locations remains limited, increased construction and financing costs are driving up prices, but restrained demand is preventing further price increases.

Existing areas dominate, new buildings of little importance

At 98,200 m², or 87% of total take-up, deals in existing space remained pace-setting. In 2025, new buildings reached a total of 15,500 m², or 13% of take-up, with the vast majority (12,900 m² or 83%) being former brownfield space. The 9,000 m² deal by LIDL in the Esslingen district accounted for around 70% of the brownfield volume. At 2,600 m² (17%), greenfield contracts played a subordinate role in lettings in new buildings.

Esslingen takes top position in take-up for the first time

With 44,300 m² or 39% of total take-up, the district of Esslingen replaces last year’s leader Ludwigsburg. The district of Böblingen follows in second place with 23,500 m² and recorded the highest growth of all regions with an increase in take-up of 17,100 m². Take-up increased by more than 3.5 times compared to the previous year. Ludwigsburg slips to third place with 20,600 m². Due to the lack of major deals, take-up halved again. The fourth-placed district of Göppingen remained unchanged in rank with 13,000 m² or 11%. With 8,700 m², the city of Stuttgart contributes only 8% of total take-up.

Logistics and freight forwarding with high growth; Traditional retail beats e-commerce again

The industry and production sector maintained its top position with 39,500 m² or 35% of total take-up, but recorded a decline of 26% compared to the previous year. The main reason for the decline in take-up was the lack of major take-up, which accounted for around half of the sector’s take-up in the previous year.

Retail follows in second place with 27,900 m² or 24% of total take-up. Within retail, traditional brick-and-mortar retail companies clearly dominated with 82% of retail space take-up, compared to e-commerce companies with 18%. While the percentage share ratio of e-commerce to brick-and-mortar retail was still 75% to 25% in 2023 as a whole, the ratio tipped to 61% to 39% as early as 2024.

Third place went to the logistics and freight forwarding sector with 23,900 m² or 21% of total take-up. It was the only industry to record a significant increase of 546%, compensating for around two-thirds of the declines in the other sectors.

Smaller areas characterise the market

In the size class from 10,001 m², no deal was recorded in 2025. This means that this size class remains without a qualification for the second year in a row. Spaces between 1,000 m² and 3,000 m² took the lead with 45,100 m² or 40% of total take-up, recording an increase of 47% compared to the previous year. The 3,001 m² to 5,000 m² size class follows in second place with 34,000 m² or 30% of total take-up. Together, space under 5,001 m² accounts for a total of 86% of total take-up. In the previous year, it was only 56%.