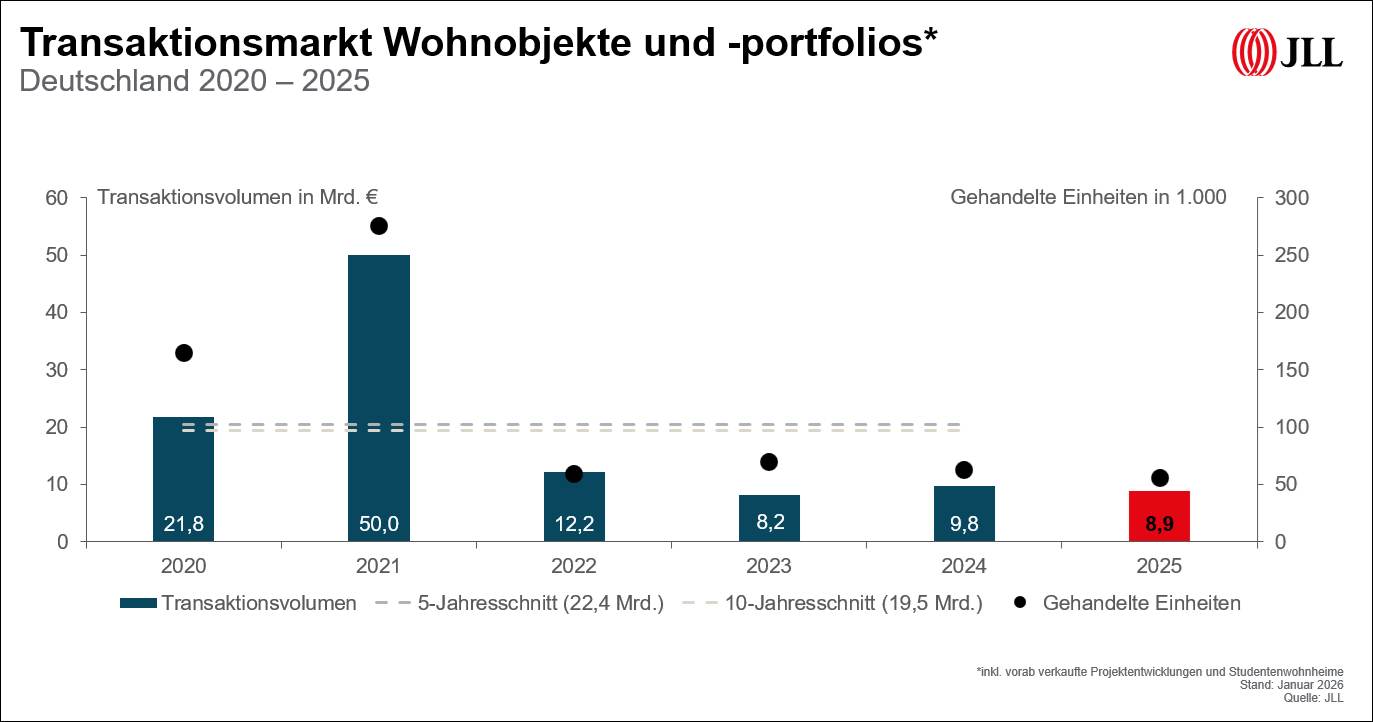

Dynamic end of the year ensures sales of almost 2.5 billion euros in the final quarter

Despite higher market activity, the investment volume in the institutional housing market in 2025 will be lower than in the previous year. The completed transactions total 8.89 billion euros, around one billion euros less than in 2024 (9.84 billion euros). A total of 259 transactions were registered last year, seven percent more than in the previous year (242). However, the number of traded residential units fell from 63,000 to around 55,700.

The final quarter was the strongest with a transaction volume of 2.46 billion euros. Compared to the previous quarter, sales increased by just over a fifth, but at the same time remained almost a third below the value of the fourth quarter of 2024. However, an above-average number of apartment purchases were also completed in the final quarter of 2025. With 75 transactions, market activity was around seven percent higher than in the same quarter of the previous year and three percent above the five-year average.

“The year 2025 was characterised by different quarterly dynamics, but also by stabilisation in the German residential investment market overall. After the turbulent previous years, we observed a gradual return of institutional investors, which can also be seen as a sign of the attractiveness of the asset class,” comments Michael Bender, Head of Residential JLL Germany.

The market was dominated by smaller and medium-sized transactions in the range of ten to 50 million euros. Portfolio transactions of more than 100 million euros are rare and accounted for only a third of the annual volume, compared to twice as high in the previous year. One reason for this development is the focus on core real estate, which is traditionally traded in the form of individual transactions. While their share of the total volume was still 21 percent in 2024, it has risen to around 54 percent in 2025. As core transactions have a lower volume, the average deal size has also decreased as a result. “The high marketability of core assets is therefore also an expression of the fact that the market is determined by the buyer side,” says Helge Scheunemann, Head of Research at JLL Germany.

Family offices and private investors are increasingly using the current market cycle to acquire core properties, especially in the metropolises of Berlin and Munich. Listed housing companies are also active again. At the end of the year, Vonovia made another major acquisition. Vonovia acquired around 750 residential units from Quantum for more than EUR 100 million. “This fuels the hope that the listed housing companies will again have a greater presence on the buyer side in the future,” says Scheunemann.

Two investment strategies shape the housing market

Despite the high proportion of core transactions, value-add investments are stable at a market share of ten percent. “This supports our observation that we are currently observing two dominant investment strategies in the German residential investment market. On the one hand, there is a large group of investors focused on younger portfolios and thus on the core segment. On the other hand, we see buyers who prefer properties with significant value-add potential and attractive yield premiums. The spread between core and value-add investments is greater than ever,” explains Scheunemann.

As in the first half of 2025, the yield delta between good and medium-quality properties in good micro-locations in each of the seven Class A cities remained unchanged at around 50 basis points. For top products, the average yield remains at 3.51 percent. “The expected compression of prime yields has thus not been fulfilled in 2025, as interest rates have also risen more sharply than expected,” says Scheunemann.

Focus on forward deals with short completion times

The increasing interest in forward deals is striking. In 2025, their share has doubled to 20 percent compared to the previous year. One in two forward deals had a subsidized share in the projects, significantly more than the five-year average (30 percent). “It is also noteworthy that municipal and state-owned housing companies act disproportionately as buyers, especially in subsidized, price-regulated and/or socially bound housing projects,” emphasizes Dr. Sören Gröbel, Director of Living Research JLL Germany.

The forward transactions also show a focus on advanced and already ongoing project developments. On average, the transactions in the fourth quarter had a planned completion date of the end of 2026, with corresponding deals taking place throughout Germany, with a focus on the metropolises of Berlin, Cologne and Leipzig as well as increasingly in the surrounding areas and in B-cities such as Hanover, Heilbronn, Konstanz or Göttingen.

Overall, transaction activity has shifted to locations outside the major metropolises. Around 39 percent of transactions were carried out in the seven real estate strongholds, significantly less than the five-year average (55 percent). “Supply-side limitations on young stock in the seven metropolises have increasingly driven capital into strong B cities in 2025, because strong fundamental factors and stable and sustainable cash flows can also be found here,” explains Gröbel.

Recovery in housing construction will not eliminate supply shortages

The supply of new construction has recently fallen sharply, but in the meantime the low point in residential construction seems to have been passed. At least more building permits were issued again in 2025. Between January and September 2025, the construction of 175,600 apartments in new and existing buildings was approved. This is around twelve percent or 18,400 apartments more than in the same period last year. However, the increase was mainly due to the approval for single-family homes.

In order to boost housing construction, the Construction Turbo Act was passed in October 2025 and came into force at the end of that month. With the construction turbo, the legislator is pursuing the goal of significantly accelerating the planning procedures in residential construction, which have often been lengthy up to now, and at the same time expanding the scope for action for municipalities and developers. This should open up the possibility of creating new living space quickly and flexibly. The construction turbo is to be used primarily for inner-city areas. “New residential construction is likely to continue to recover in 2026, but it will not be enough for the knot to burst. The shortage of supply in younger housing stocks will continue for the time being,” predicts Gröbel.

No major impetus for the residential investment market is expected from the financing side this year. Interest rates rose towards four percent at the end of 2025 and are expected to increase moderately in 2026. “The interest rate level can basically be planned for the real estate industry, but no one should expect lower interest rates. So there will be no ‘interest rate boost’ for the market as a whole,” Helge Scheunemann clarifies.

Nevertheless, the residential investment market is starting 2026 with some tailwind. For example, the overhang of deals from the fourth quarter of 2025 led to a dynamic start to the year and an increased transaction volume in the first few months, as numerous trades were postponed until the new year. In addition, several large-volume portfolios are likely to come onto the market. “We know of three portfolios with a total volume of around 1.3 billion that will be put on the market in the first few months,” says Michael Bender. Product availability remains correspondingly high. However, not all properties offered will find a buyer in the near future, which will lead to extended marketing times for sellers.

Bender expects the market development from the previous year to continue in 2026: “The focus is on sustainable core products and forward deals with a short completion horizon. We expect further market stabilization and a transaction volume of between nine and ten billion euros.”