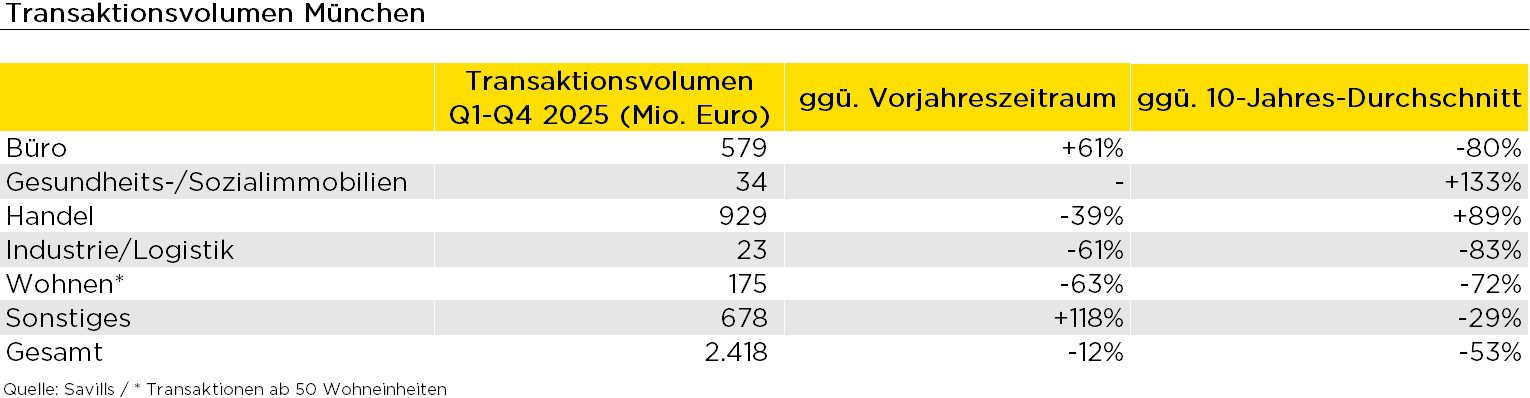

According to Savills, around 2.4 billion euros were turned over in the Munich real estate investment market in 2025. Compared to the previous year, this corresponds to a decrease of 12%. Compared to the 10-year average, sales were even 53% lower. In the last twelve months, Savills has registered about 40 transactions, an increase of 6% compared to the same period last year. The prime yield for offices stood at 4.0% at the end of December, 10 basis points lower than in the previous quarter and 20 basis points below the previous year’s figure. The prime yield for commercial buildings was 3.9% at the end of December, unchanged from the previous year’s figure.

Philipp Traumann, Associate Director Investment at Savills in Munich, comments on the market as follows:

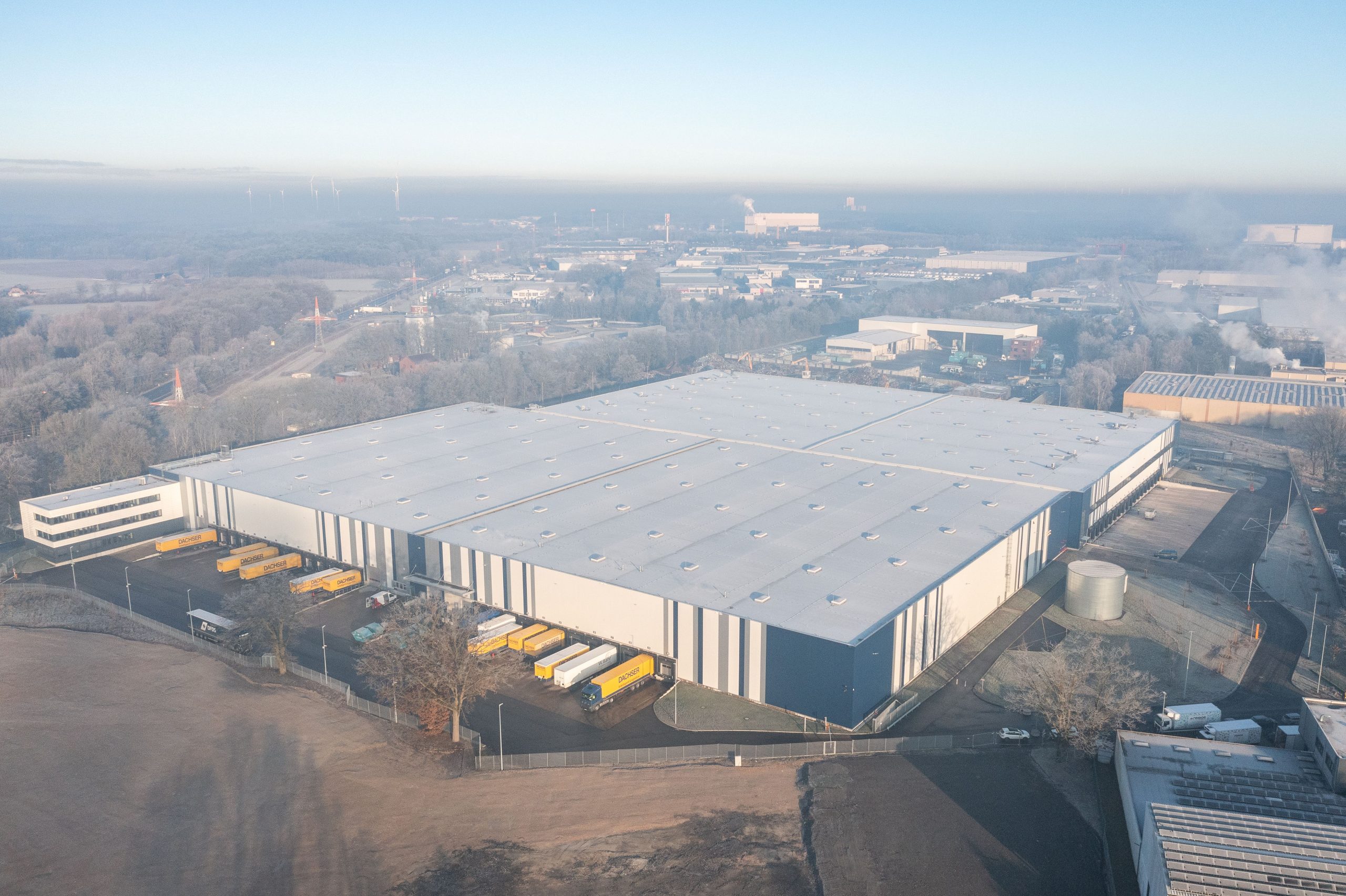

“In 2025, Munich’s commercial real estate investment market was dominated by transactions that took place predominantly within the Altstadtring and often with the participation of private capital. These took place in particular in the medium and higher volume segments. We also observe that in insolvency sales, the banks have often taken over the decision-making authority and are now moving away from the book values or the full repayment of the loan amounts. Overall, more realistic price expectations from many sellers increase the chance of successful transactions, although many sales processes still drag on. Last year, a number of retail properties in prime locations changed hands again, which meant that offices were only in second place among the highest-volume uses, as in the previous year. In 2025, a disproportionately high volume share of hotels was striking, reflecting the revival of this asset class among investors.”

With a transaction volume of EUR 930 million, retail properties have contributed the most to investment turnover in the last twelve months, followed by office properties (approx. EUR 580 million) and residential properties* (approx. EUR 170 million).

* Only properties with at least 50 residential units

Additional graphics and data can be found in our online dashboard on the real estate investment market.