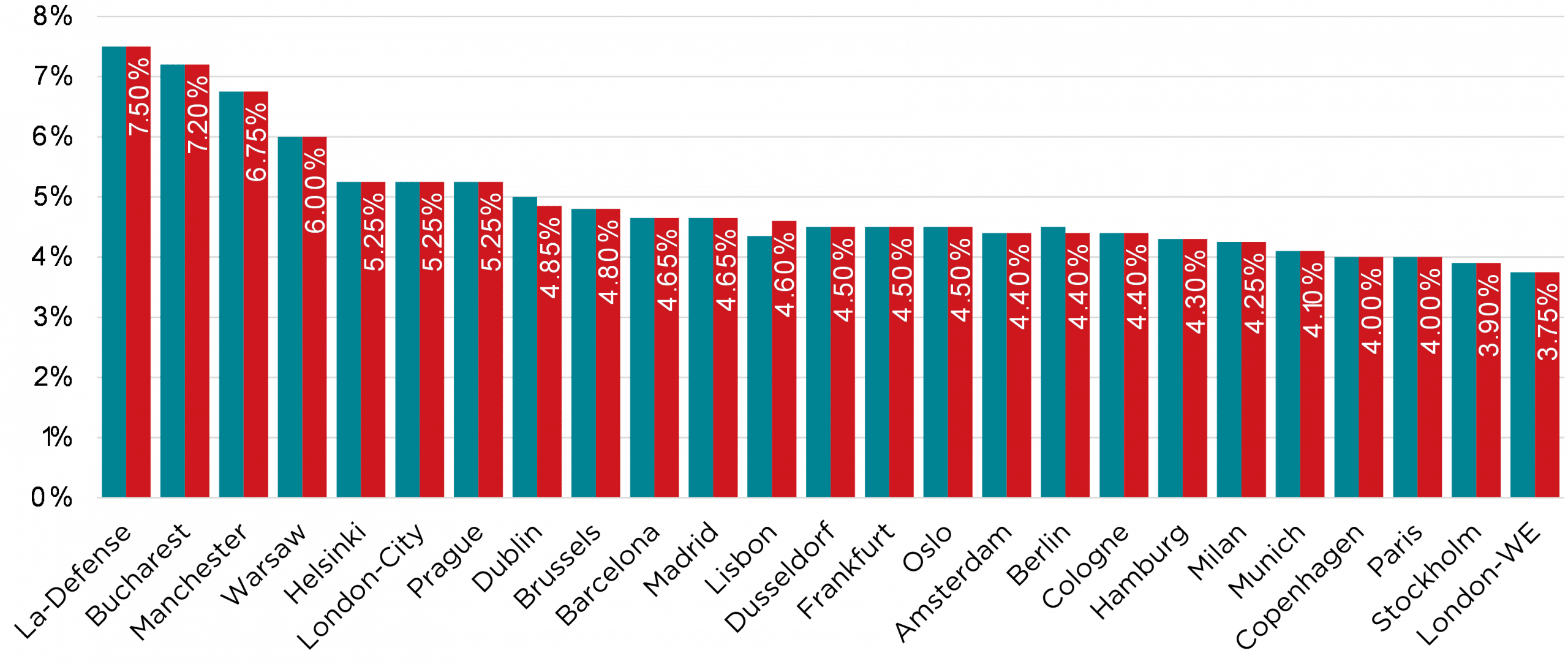

An analysis by Savills based on preliminary RCA data shows that the average transaction size for office properties in Europe rose to €30 million in Q3 2025, the highest level in three years. The number of office investments over 50 million euros has increased by 43% compared to the previous year as investors are increasingly willing to make larger transactions, according to the international real estate consultant. Yields on prime office properties in Europe remained stable at an average of 4.87%, according to Savills.

Karsten Nemecek, Deputy CEO Germany and responsible for Capital Markets at Savills Germany, classifies the developments in Germany in the European context as follows: “In the meantime, there have also been one or two major deals on the German office investment market and other large properties are in the process of being sold. Overall, however, liquidity in the office segment in Germany is still limited and a real turnaround is unlikely in the short term.”

Data from RCA shows that cross-border investment from the EMEA region in European office properties has increased by 46% compared to the previous twelve months, with buyers from Norway, Switzerland, the United Arab Emirates and Spain leading the way so far in 2025. Despite their concentration on the London office market, established US investors are also showing increasing activity on the continent. For example, Blackstone acquired the Trocadero in Paris for around 700 million euros in the 3rd quarter of 2025.

James Burke, Director Global Cross Border Investment at Savills, says: “The number and range of buyers for European office properties has increased again and we are seeing an increase in the number of bidders for prime properties. Signs of yield compression for this asset class in selected markets are also driving a larger number of sellers.”

Mike Barnes, Director in Savills’ European Commercial Research team, adds: “Income yields will continue to be the main driver of total returns over the next twelve months. In view of the lack of new office buildings, users willing to move have few options. Interest rates remain high, and users are reluctant to invest in new premises. As a result, we are seeing a higher proportion of lease renewals, which offers landlords the opportunity to benefit from an increase in prime rents.”