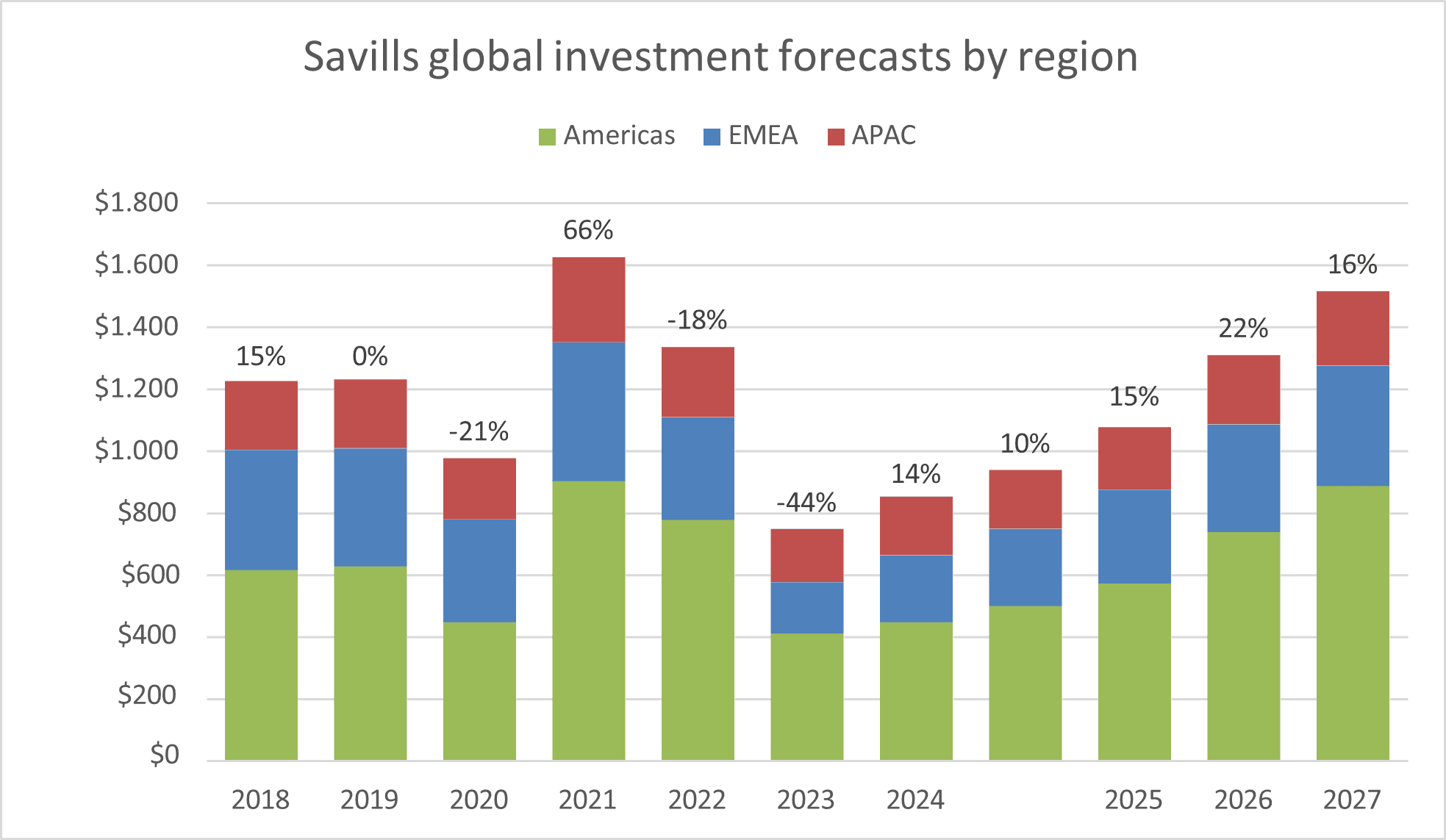

Global real estate investment volume is expected to surpass $1 trillion in 2026, up 15% from 2025 and the first time since 2022 that threshold has been exceeded, according to Savills World Research.

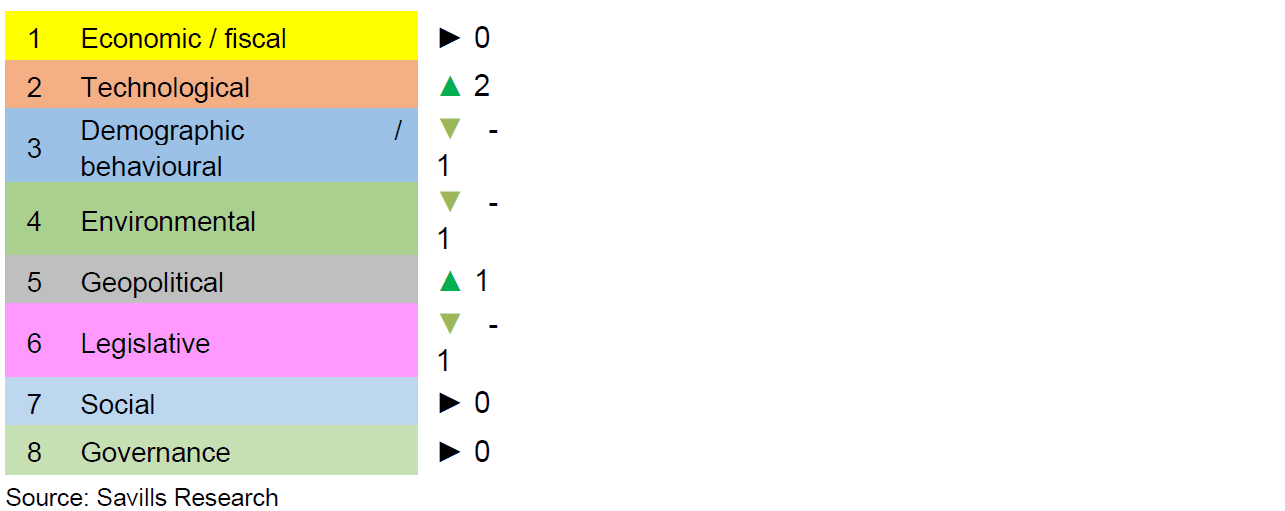

In the thought leadership program “Impacts”, the international real estate consultant predicts that the EMEA region will see the strongest relative investment growth next year, rising by 22% to $300 billion, while America will continue to be the largest real estate investment market with a projected revenue of $570 billion – up 15% – driven by the US, where it will reach $530 billion. About a quarter of this is expected to be in the office real estate sector. While some economic and fiscal headwinds remain a concern – and are identified by Savills researchers as the central theme that will shape investment and rental markets of all uses next year – overall investor optimism is returning, driven by the return of institutional capital, robust demand from occupiers and the release of pent-up activity after several years, according to Savills below-average market activity.

89% of Savills researchers globally expect rents for prime office space in their regions to rise by 2026, with two-thirds expecting an increase of 2% or more as demand increases due to companies’ continued search for high-quality office space. As a result, 82% of Savills researchers predict that capital values for premium/grade A office space in their region will increase next year. Investor demand is also likely to remain robust in the residential, industrial and logistics sectors, with the retail sector also offering opportunities. While the picture in retail differs by sub-sector and region, a total of two-thirds of Savills researchers expect retail rents to rise in 2026, while a further 26% expect rents to remain stable.

Rasheed Hassan, Head of the Savills Global Cross Border Investment Team, says: “2025 marked a turning point in real estate capital markets, with investment turnover increasing by 10% in the first three quarters compared to the same period in 2024. More importantly, the data underpins the narrative of stability and recovery: capital values have bottomed out, average transaction volumes are rising, and there is positive leverage again. We expect these trends to intensify further in 2026.”

Although the impact is not yet fully foreseeable, Savills researchers have also identified technology as a key theme that will shape the global real estate market in 2026: it has risen two places in their rankings since last year and is now seen by researchers as the second most important market driver, driven by the rapid adoption of AI, Savills expects, that the impact on global labor markets will vary by sector, affect office occupancy and reshape utilization strategies. Even though the residential real estate sector could provide a hedge, AI-driven disruption will affect all asset classes. Nevertheless, it will also bring opportunities in the form of data centers and the transformative potential of PropTech.

The main themes that will shape the global real estate market in 2026

(Change compared to 2025)

Paul Tostevin, Head of Savills World Research, comments: “The year 2026 offers new optimism and, overall, we expect growth in both investment and user activity in most sectors next year in most regions, although there are still many challenges to overcome. Economic development remains crucial: falling interest rates and available sources of capital are meeting robust user demand and supporting a recovery in investment activity. Technological change, driven by the increasing adoption of AI, is a fast-growing market driver, but investors and users should not ignore demographic changes and behavioral changes. Real estate ultimately serves people – where they live, work, shop and spend their free time. As these behaviors evolve and demographic profiles change, operational expertise becomes a key differentiator.”