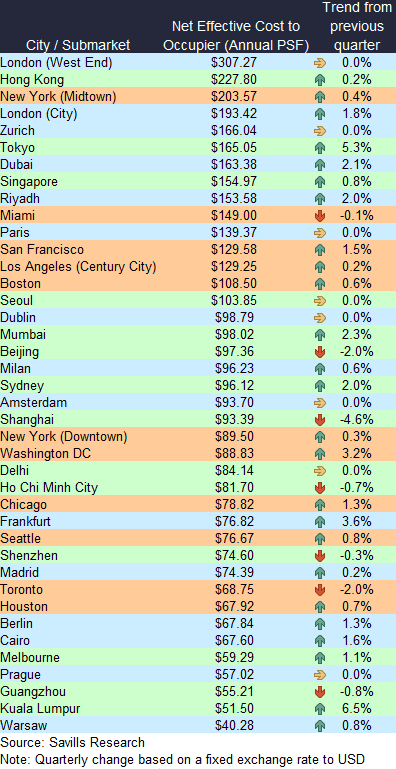

In the third quarter of 2025, according to Savills’ latest Prime Office Costs Report, the cost of prime office space* rose by 0.8% globally, bringing the average cost increase over the past twelve months to 3.3% overall. 25 of the 40 markets tracked by Savills saw an increase in average effective net costs to tenants (rent plus fit-out costs) in the third quarter (compared to 24 markets in the previous quarter). This increase is due to an average increase in gross rents of 0.9% globally during the quarter, while fit-out costs and related costs remained almost stable, increasing by only 0.03% on average.

In Asia-Pacific, the average effective net cost of prime office space increased by 1% in the third quarter, with Savills pointing to significant regional differences: In Chinese cities, costs fell by -1.9% on average, due to a significant oversupply of space and fragile economic sentiment. At the same time, Kuala Lumpur saw a further 6.5% increase in the cost of prime office space in the third quarter, following a 4.4% increase in the previous quarter. This is because tech companies and multinationals are competing for a very limited supply of prime space.

After an average increase in costs of 1.4% in the second quarter, costs in North American cities grew by 0.6% in the third quarter, with the majority of this increase driven by rent increases. Again, Savills reports regional disparities: San Francisco saw a 1.5% increase this quarter, driven by AI companies looking for the best space. Toronto, on the other hand, experienced a decline of 2% due to increased vacancy rates and a greater supply of sublet space. However, Savills stresses that this offers tenants the opportunity to move to higher-quality space on better terms, supporting long-term market resilience.

In Europe and the Middle East, the differences are somewhat smaller, according to Savills. In none of the markets analysed did the costs for top offices fall in the third quarter. On average, they rose by 0.9%, with Frankfurt recording the highest regional increase with an increase of 3.6%. The lack of large contiguous spaces in prime buildings drove up rents for available space in the city. In the Middle East, multinational tenants continued to compete fiercely for prime space in the third quarter, according to Savills, keeping the vacancy rate very low and driving costs up 2.1% in Dubai, 2% in Riyadh and 1.6% in Cairo.

Rick Schuham, CEO of Global Occupier Services at Savills, comments: “In recent years, an increase in the cost of prime office space in many markets has been largely driven by rising fit-out costs, as inflation in labour and building materials has driven up prices. As the expansion costs are now stabilizing, the cost increases in the third quarter were mainly caused by rising rents. Worldwide, the picture is largely characterised by a very limited supply of first-class space in combination with increased and growing demand from users. This gives landlords the opportunity to raise rents.”

Sarah Brooks, Associate Director in the Savills World Research Team, adds: “While rental growth for prime office space slowed in 2024 due to economic uncertainty, continued space adjustments and higher interest rates, it has accelerated again this year. Currently, rents in the EMEA region are rising faster than in North America, while the markets for prime office space in the Asia-Pacific region show a significant divergence in gross rental price developments. Including mainland China and Hong Kong, regional rents for prime office space have fallen by -5.9% since the first quarter of 2020. However, excluding these markets, the rest of APAC’s cities have seen an average increase in prime rents of 8.6% over the past five years.”