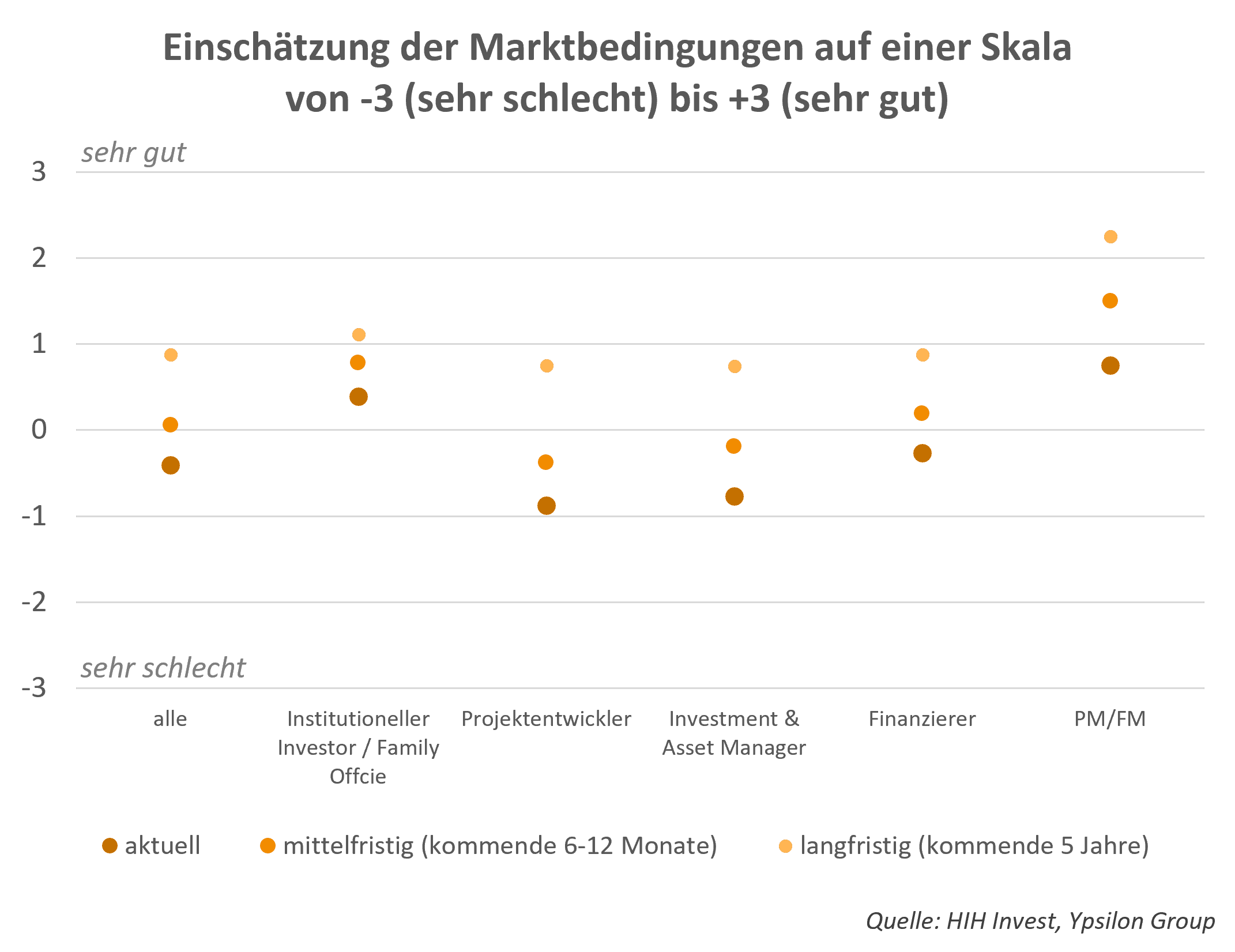

According to the latest sentiment survey by HIH Invest Real Estate and the Ypsilon Group, the mood in the real estate industry has given way to a clearer realism after a temporary recovery in the previous year. The current sentiment index is again in negative territory at -0.41 (2024: -0.06) and is thus at the level of 2023. Last year, the industry had even more optimistic expectations of market developments.

While property and facility managers continue to assess their current situation positively (0.75), there is a significant change in sentiment among investment and asset managers: in 2024 still slightly positive (+0.07), the index now stands at -0.77. Project developers also remain at a very low level, but were able to record slight improvements to -0.88 for the second year in a row.

Mood and prospects

At 0.06 points, the respondents’ medium-term expectations for the next six to twelve months signal only a slight recovery, while the long-term outlook (0.88) is assessed much more optimistically – albeit noticeably more cautiously than in the previous year (1.59).

“The results of the survey show that after the challenges of recent years, the industry is increasingly stabilizing in a complex environment. It is not short-term economic fluctuations that are decisive, but the structural framework conditions – and this is where new opportunities open up. Those who use this phase to invest strategically and countercyclically can benefit in the long term from the strong fundamentals of the real estate markets,” says Alexander Eggert, Managing Director of HIH Invest.

Ulrich Creydt, Managing Director of the Ypsilon Group, also emphasizes the long-term perspective: “We see a mood that seems depressed in the short term, but promises stabilization in the medium term. The market is working through the consequences of the crisis – but more slowly than many would like. In particular, the financing situation will remain a decisive factor for development in the coming quarters.”

Focus on types of use

Dwell

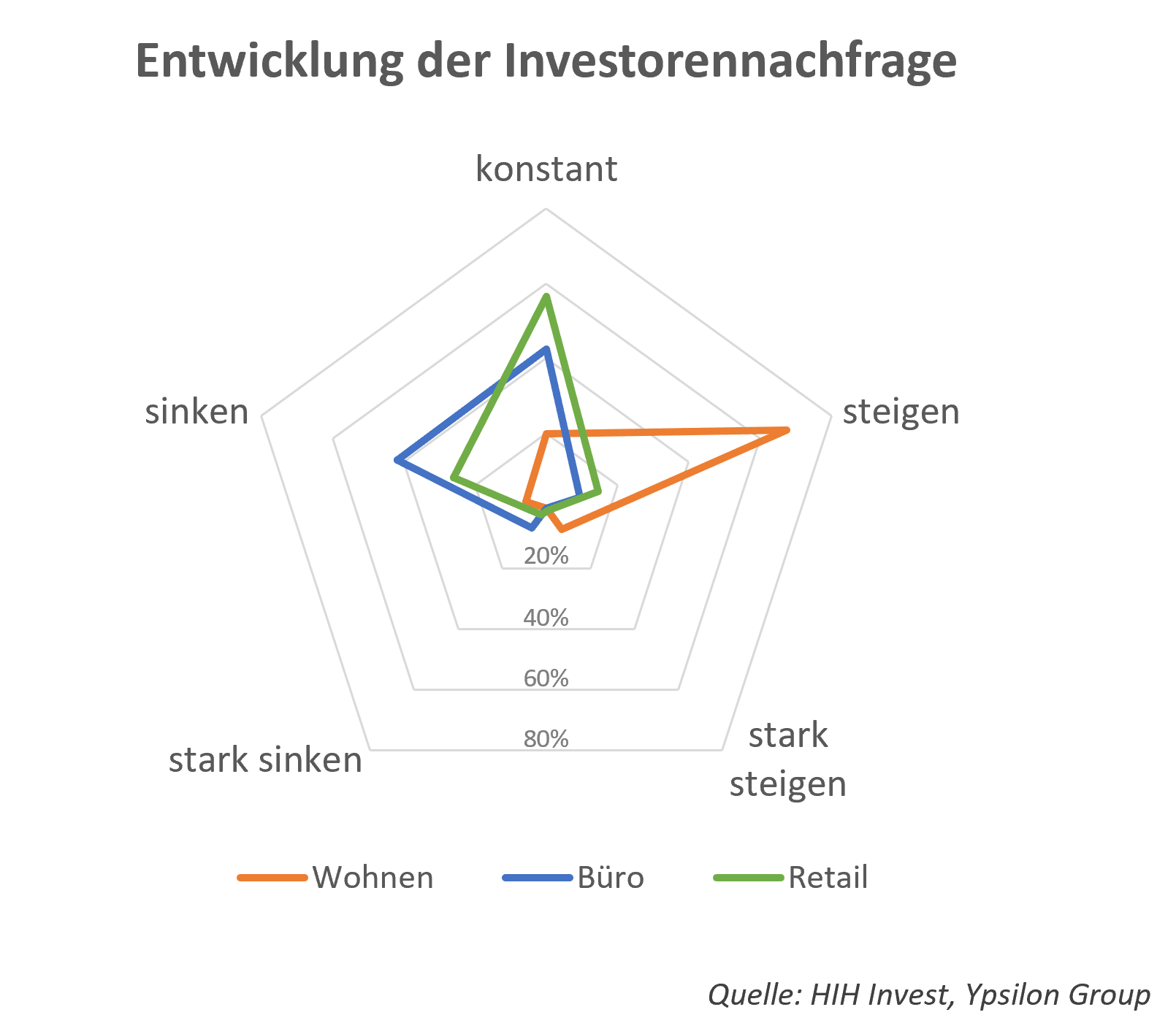

The demand for rental apartments remains high: 63 percent of those surveyed expect demand to increase, and 23 percent even expect a sharp increase. 91 percent also expect rents to continue to rise, the vast majority of them in the range of five percent.

The picture is mixed for condominiums: 45 percent of those surveyed expect demand to increase, 41 percent expect stable markets. 65 percent expect higher prices.

Logistics real estate

44 percent of those surveyed expect growing demand, 40 percent rising rents, and a third rising prices. Compared to 2024, however, expectations are more restrained.

“Residential and logistics real estate is one of the most reliable and dynamic segments of the market. In the residential sector, the ongoing excess demand ensures stable growth prospects, while logistics space continues to gain in importance due to the transformation of global supply chains and the focus on ESG. Both asset classes remain firm anchors in the portfolios of institutional investors and offer long-term security as well as attractive return opportunities,” says Felix Meyen, Managing Director of HIH Invest.

Office properties

The office sector remains the problem child: 61 percent of respondents expect user demand to fall, 54 percent expect rents to fall, and two-thirds expect prices to fall.

Retail real estate

Assessments of retail real estate remain cautious: 53 percent expect demand for space to remain constant, 38 percent expect rents to fall and 41 percent prices to fall.

“The results of the survey show a clearly differentiated picture between the individual asset classes. While demand for residential and logistics properties continues to be stable, office space in particular is coming under pressure. Retail is at a consistently low level,” says Peter Lenz, Partner at the Ypsilon Group.

Industrial and corporate real estate

The majority of respondents (53%) see constant demand, a third expect rents to fall, while 36% expect prices to fall.

Investment opportunities

The respondents see the greatest opportunities in the residential segment, especially in A (38%) and B cities (47%). When it comes to logistics real estate, B cities are in the lead with 46 percent, followed by A (31%) and C cities (20%). At 78 percent, A-cities are considered to be almost without alternative for office investments – an indication of the polarization of the market.

“The real estate industry remains a central engine of the German economy,” says Carsten Demmler, Managing Director of HIH Invest. “Even though investors are sensitive to interest rates and geopolitical developments, structural demand remains unabated – from housing to modern logistics to sustainable office space. If politics and the industry work together to create stable framework conditions, this potential can be fully exploited.”

Alternative investment opportunities

In addition to classic real estate uses, alternative investments are increasingly coming into focus. The respondents rate data centers, data networks and energy infrastructure and storage in particular as interesting investment options. Around a fifth of market participants consider these segments to be “very attractive”, while renewable energies are assessed more mixed: 37 percent rate them as attractive, 36 percent are still undecided.

“Alternative investments are gaining in importance in a market environment characterized by uncertainty because they combine stable cash flows with long-term growth drivers such as digitization or the energy transition,” explains Ulrich Creydt, Managing Director of the Ypsilon Group. “Institutional investors in particular are increasingly using these asset classes as a diversification tool to make their portfolios more resilient.”

About the survey

The Sentiment Survey 2025 was conducted from July 29 to September 15, 2025 by RUECKERCONSULT on behalf of HIH Invest Real Estate and Ypsilon Steuerberatungsgesellschaft among 153 market players. Institutional investors, project developers, asset and investment managers, family offices and property and facility managers were surveyed.