The battery-electric drive will very likely be the leading and key technology in the passenger car segment in the coming years. This development path is interesting for the players in the “infrastructure industry” because the “ramp-up” must be accompanied by an efficient charging infrastructure.

Actors include project developers and operators of charging parks, manufacturers of technical equipment, grid operators, but also equity investors from the institutional investor environment.

Development of the number of registrations of Battery Electric Vehicles (BEVs)

There has been a trend towards fewer new passenger cars (passenger cars) being registered in Germany in recent years. This has complex backgrounds, in which, among other things, corona-related supply bottlenecks and economic dips play a role. While there were still approx. 3.61 million new registrations in 2019, the figure was approx. 2.82 million in 2024. The number of fully electric passenger cars (BEVs) has risen steadily and, with around 440,000 new registrations in the period from the beginning to the end of October 2025, represents a share of 18.4% of all new registrations. The dominant class in the same period are hybrid drives with a share of approx. 39%. The proportion of plug-in hydrides is very low and thus also the importance for demand in the public charging network.

The share of BEVs is expected to increase in the future. The automotive industry is developing more powerful automobiles that are more suitable for everyday use, which have made up a lot of ground in terms of the critical success factors a) charging time, b) range and c) acquisition costs compared to earlier products.

Among the technological advancements of many manufacturers is the switch from 400 volts to 800 volts technology, which implies advantages in terms of efficiency and charging power. Manufacturers are already researching 1,200 volt architectures with SiC power electronics (silicon carbide) for even higher charging capacities and efficiency. Here, the target is charging capacities of 350-500 kW and charging times of 5-10 minutes for 80% State of Charge (SoC).

Further optimization potential lies in the use of other battery-cell chemistries. Currently, lithium iron phosphate (LFP) batteries are mainly used. The technology is cheap, highly scaled, safe, durable, and cobalt and nickel-free. The disadvantage is the low energy density (130–190 Wh/kg), which leads to high weight with a limited range. Various manufacturers are working on the introduction of solid-state batteries, for example, which have significantly higher energy densities (up to 400–500 Wh/kg).

In short, the advancing technological progress is foreseeable and also has implications for the charging infrastructure: In the future, there will be a need to have very powerful HPC chargers (High Power Chargers, defined from 150 kW) in public spaces. Below is a theoretical example of the power differences: An 800-volt electric car with an 80 kWh battery charges from SoC 10% to 80% at a 150 kW station in about 22 minutes and a 300 kW in about 11 minutes.

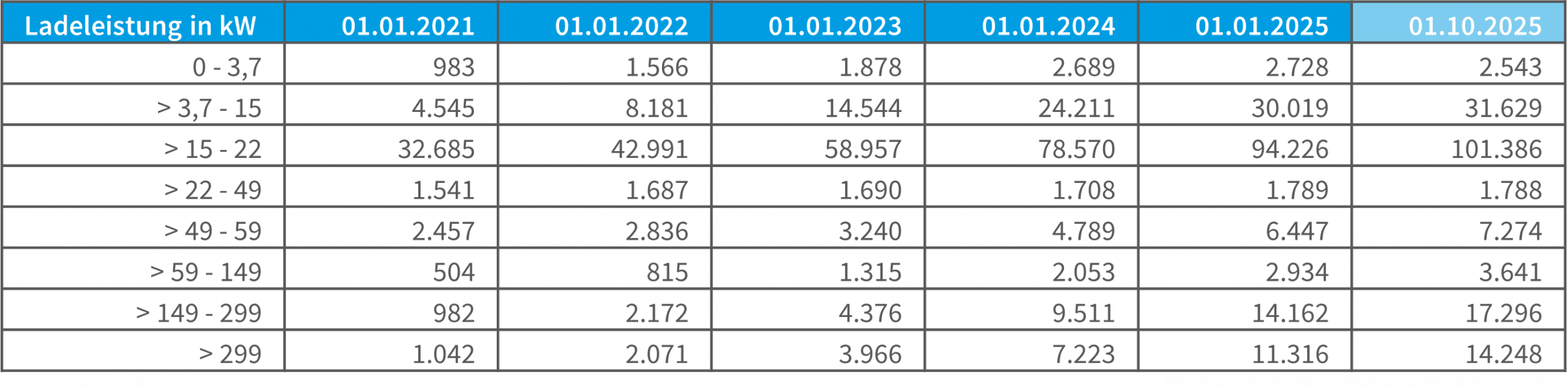

The development of the charging infrastructure in Germany

A look at the current charging point expansion status shows that the expansion of HPC chargers has only gained momentum in the last three years. The number of charging points with charging capacities > of 149 kW has increased sharply, with the most important thing against the background of technological progress being that the 299 kW power class > is being significantly expanded.

Despite the dynamics that can be observed, the following questions about the future arise – depending on the actor’s perspective:

From the user’s point of view:

- How is competition developing in the supply of charging infrastructure and, above all, the price of charging electricity (currently a wide spread of approx. €0.39/kWh to approx. €0.90/kWh depending on the location and subscription model)?

From the point of view of project developers, financiers and operators:

- How quickly can charging parks be built (grid connection, permits, etc.)?

- Is it guaranteed that the charging stations will deliver the promised power output through the grid connection or corresponding buffer storage tanks?

- What is the expected utilization of the charging stations and the achievable return?

- How fast is the technical progress in BEV, which indirectly implies investments in the charging park?

- Bidirectional charging (vehicle-to-grid): To what extent does this key technology change the business plan of charging parks if vehicles can feed energy back into the grid as a storage medium (e.g. offering grid services)?

Singular impulses with a signal effect, such as the following, can also be drivers of BEV acceptance: From 2026, employees of the software company SAP will only be allowed to order BEVs as company cars. The previous transitional regulation for plug-in hybrids expires at the end of 2025. With around 19,000 vehicles, the company is one of the largest fleet operators in Germany.

In addition, the German government presents 41 measures in the recently published “Master Plan for Charging Infrastructure 2030” to accompany the ramp-up of electric mobility in Germany.

Therefore, the development path of the ramp-up of e-mobility for passenger cars in connection with the corresponding charging structure seems to “stand” in principle, although the speed and scope are variables that are somewhat more difficult to predict.